- A US Dollar selloff on Wednesday in the wake of both Federal Reserve (Fed) Chairman Jerome Powell’s testimony for the US Congress and after the release of the FOMC Minutes from their last meeting.

- This has been in reaction to a perception of a still very dovish tone from the Fed, which in turn sees a weaker US Dollar.

- For the EURUSD and GBPUSD Forex rates, the broad US Dollar selloff has seen these currency pairs move notably higher, to ease previous bearish forces and shift risks in the very short-term, into mid-July, to the upside.

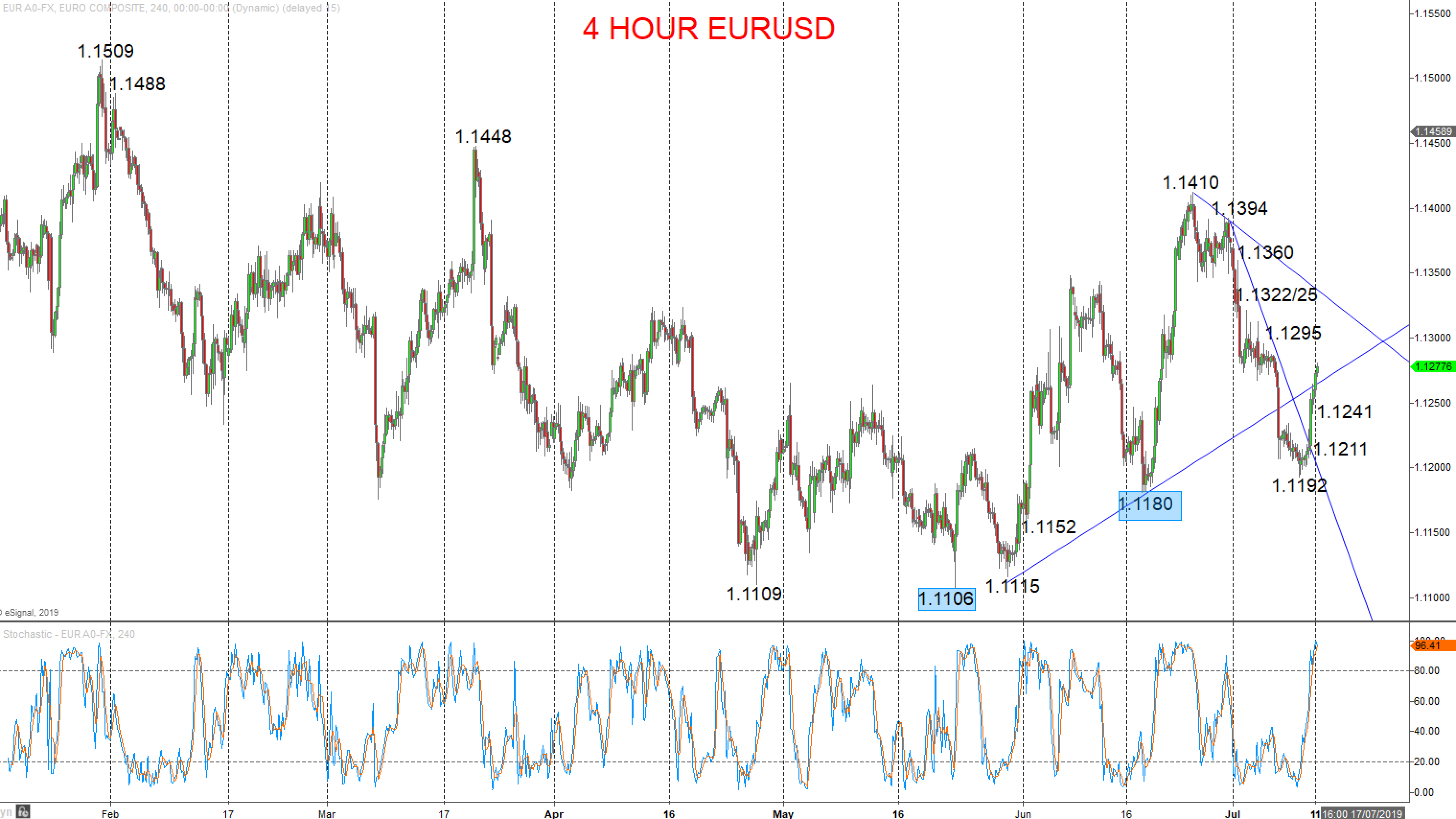

EURUSD risks switch back higher

A surge higher Wednesday above 1.1234 and 1.1264 resistances and to reverse the July down trend line, to reject negative forces from the very aggressive selloff through various supports at the start of July, to switch risks higher for Thursday.

We see an intermediate-term bull trend since the push above 1.1348

For Today:

- We see an upside bias for 1.1295; break here aims for 1.1322/25, maybe 1.1360.

- But below 1.1241 opens risk down to 1.1211, then maybe 1.1192 and even key 1.1180.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 1.1448.

- Higher targets would be 1.1509 and 1.1570.

- What Changes This? Below 1.1180 shifts the intermediate-term outlook back to neutral; through 1106is needed for an intermediate-term bear theme.

4 Hour EURUSD Chart

GBPUSD small base and upside bias

A solid rebound Wednesday to prod minor resistance at 1.2539 (after Tuesday’s push to another a new cycle low at 1.2438), to ease immediate bear threats and hint at a very small base pattern, to switch the bias higher into Thursday.

The latter April probe below 1.2947 signalled an intermediate-term Double Top pattern and set an intermediate-term bear trend.

For Today:

- We see an upside bias for 1.2581/88; break here aims for 1.2617.

- But below 1.2483 opens risk down to 1.2438/37, possibly 1.2403/01.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2437.

- Lower targets would be 1.2366 and 1.2109

- What Changes This? Above 1.2814 shifts the outlook back to neutral; above 1.2916 is needed for a bull theme.

4 Hour GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.