The US currency has endured significant losses against the Euro, Japanese Yen and to a lesser extent the GB Pound since the Wednesday release of the FOMC Meeting Minutes for July. This has not only neutralised bullish pressures for the US currency against these currencies, but leaves bias for further gains for EURUSD and GBPUSD and for USDJPY erosion.

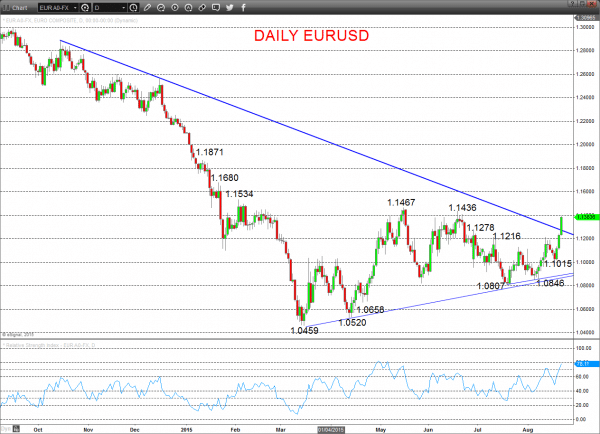

EURUSD

- A still stronger rebound from just ahead of 1.1009 support on Thursday-Friday through 1.1216, for a shift to a broader erratic range theme (but with a positive bias) and risk for latter August (Monday?!) for a bullish shift above 1.1436.

For Monday:

- We see an upside bias for 1.1410 and 1.1436; break here aims for 1.1467, maybe closer to 1.1534.

- But below 1.1360 opens risk down to 1.1309, maybe 1.1269.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.1436 and 1.0807.

- Range Breakout Challenge

- Upside: Above 1.1436 aims higher for 1.1467, 1.1534 and 1.1680.

- Downside: Below 1.0807 sees risk lower for 1.0658, 1.0520 and 1.0459.

Daily EURUSD Chart

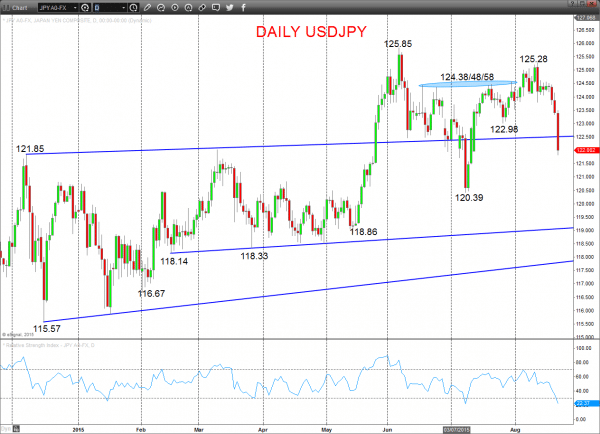

USDJPY

- The Friday plunge through 122.98/90/85 supports saw a shift to a broader range theme for latter August and negative tone for Monday.

For Monday:

- We see a downside bias for 121.79/75/66; break here aims for 121.18/17, maybe 120.39, which we would look to try to hold.

- But above 122.47 aims for 122.75 and opens risk up to 123.08, which we would look to try to cap.

Short/ Intermediate-term Range Parameters: We see the range defined by 125.28 and 120.39.

Range Breakout Challenge

- Upside: Above 125.28 aims higher for 125.85 and 127.50.

- Downside: Below 120.39 sees risk lower for 118.86 and 118.33/14.

Daily USDJPY Chart

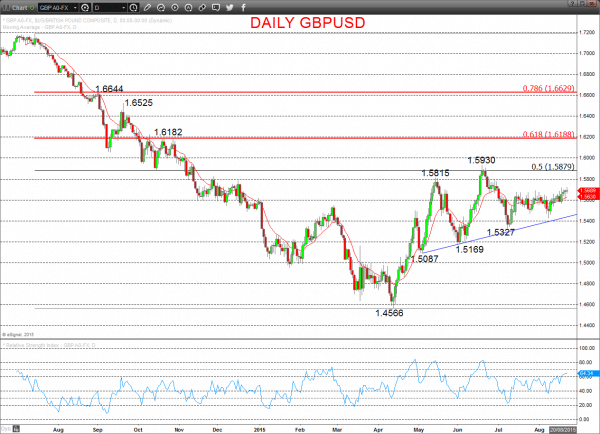

GBPUSD

- A bull breakout above 1.5690 last Tuesday and a firm consolidation of this move ahead of 1.5560 and 1.5603 supports to leave a Monday upside bias and a re-energized bull theme for late August.

- The July push through resistances from June, the rally from our 1.5327 retrace support, and rebound from ahead of the trend line from May all leaves an upside risk into August.

For Monday:

- We see an upside bias for 1.5717/23; break here aims through 1.5734 for 1.5789.

- But below 1.5655 opens risk down to 1.5603, maybe closer to 1.5560/43, which we would look to try to hold.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a bullish rebound bias for 1.5789.

- Threat above is then to 1.5930, 1.6000 and 1.6182/88.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.