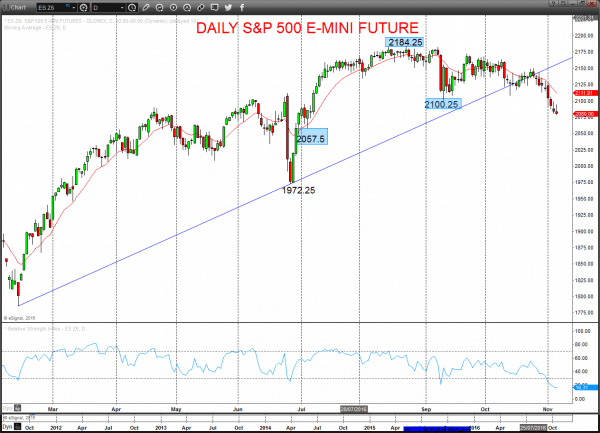

A more bearish shift for US equity indices (and in turn for European and global equity markets) since late October into early November has principally been driven by concerns around the US election result. This has also signalled risk of all potentially deeper equity market correction. In turn, this price action has encouraged a corrective rebound in bond markets, with anticipation of a potentially more dovish FOMC and also seen a more negative US Dollar tone for the start of November.

Daily S&P 500 Future Chart

Both the Euro and GB Pound have continued their upside correction activity versus the US Dollar into early November, and we see this activity likely continuing at least into the US election on Tuesday 8th November and potentially beyond.

However, the intermediate-term outlooks remain negative for both EURUSD and GBPUSD into November and maybe for Q4, from the significant bearish signals in October.

The EURUSD break below 1.0950/1.0910 leaves bigger picture technical threats lower, whilst for GBPUSD, negative pressures from the Brexit and “flash crash” sell offs, leave risks still to the downside for November and potentially year-end.

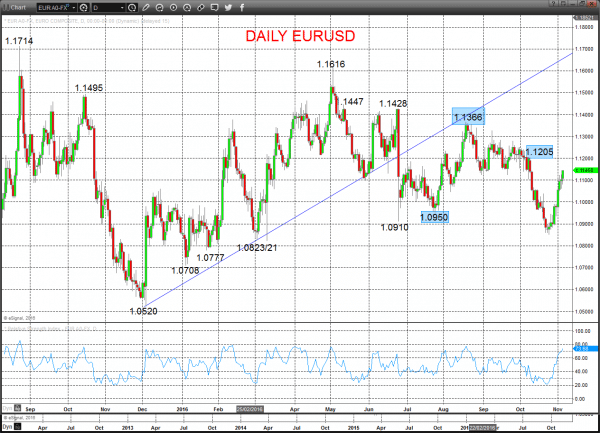

EURUSD

Another probe higher Friday, to reinforce the early November correction rally through resistance at 1.1126 and 1.1142, keeping the bias for a further corrective rally Monday.

The latter October push through 1.0910 and key support at 1.0950 signalled an intermediate-term bearish shift, but risk is growing for a shift back to neutral above 1.1205.

For Monday:

- We see an upside bias for 1.1145 and 1.1205; break here aims for 1.1240/50, maybe key 1.1280/85.

- But below 1.1057/47 opens risk down to 1.1007 and 1.0958.

The October break below 1.0950 signalled an intermediate-term bearish shift.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

What Changes This? Above 1.1205 signals a neutral tone, only shifting positive above 1.1366.

Daily EURUSD Chart

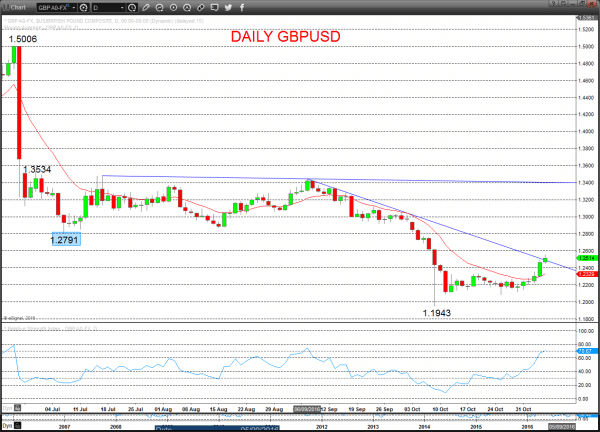

GBPUSD

A push higher to the topside on Friday through resistance at 1.2495, to reinforce the strong rebound Thursday through resistance at 1.2430 and 1.2483 and maintain an upside correction bias into Monday.

However, the 7th October “flash crash” wiped out multi-decade supports, 1.2565 and psychological 1.2000 and reinforced a far more negative intermediate-term outlook.

For Monday:

- We see an upside bias for 1.2557; break here aims for 1.2615, maybe as high as 1.2723.

- But below 1.2447 opens risk down to 1.2349.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.1943.

- Below here targets 1.1880, 1.1000 and even the 1985 low at 1.0520.

What Changes This? Above 1.3279 signals a neutral tone, only shifting positive above 1.3445.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.