The US Dollar has reinforced its position over the past week as the strong G3 currency (Euro, US Dollar, Japanese Yen), in particularly enhanced by the EURUSD sell-off from mid-October.

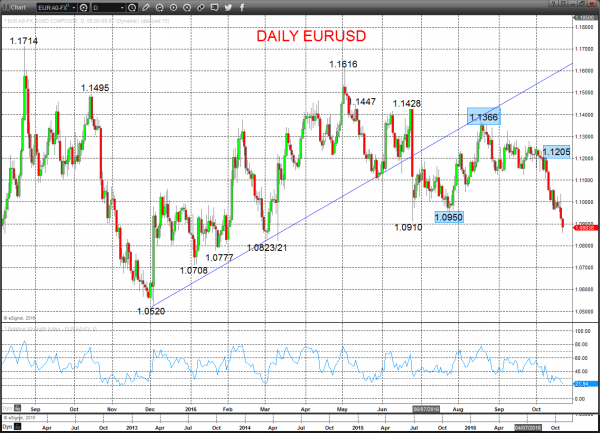

For EURUSD, the significant sell-off over the past week through supports at 1.0950 and 1.0910 (post-Brexit lows) has seen a significant intermediate-term bearish shift.

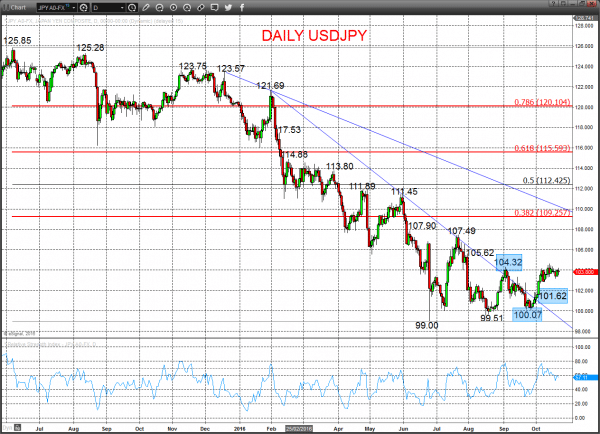

Earlier in October USDJPY secured an intermediate-term Double Bottom pattern, with the probe above resistance at 104.32. The subsequent resilient consolidation maintains the basing structure and favours further upside progress into late October and likely through into mid-Q4.

EURUSD

A push through 1.0910 support Friday, to reinforce Thursday’s post-ECB Meeting plunge through key support at 1.0950 (as we had expected) for an intermediate-term bearish shift.

In addition, the bearish outside pattern Thursday and push below 1.0910 keeps risks still lower into Monday.

For Today:

- We see a downside bias through 1.0855; break here aims for 1.0821, maybe 1.0800.

- But above 1.0945 targets 1.1000 and maybe aims for 1.1039 and 1.1058/61.

The late July push above 1.1189 saw a shift to an intermediate-term, neutral range theme.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

What Changes This? Above 1.1205 signals a neutral tone, only shifting positive above 1.1366.

Daily EURUSD Chart

USDJPY

A mini setback Friday to prod 103.50 support, but quickly rebound from 103.49, after a firm Thursday bounce from the notable 103.14 level, to maintain upside pressures Monday.

Furthermore, the mid-October break above key resistance at 104.32, confirmed a Double Bottom pattern and shifted the intermediate-term outlook to bullish.

For Monday/Tuesday:

- We see an upside bias for 104.20/21 and 104.48; break here aims for the recent high at 104.63, maybe even closer to 105.00.

- But below 103.49 opens risk down to 103.14, which we would look to try to hold.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to 105.62.

- Above here targets 107.49 and 109.26.

What Changes This? Below 101.62 signals a neutral tone, only shifting negative below 100.07.

Daily USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.