The US Dollar has displayed a mixed tone across G8 currencies since the Wednesday 21st September FOMC meeting, but lacklustre recovery activity versus the Japanese Yen and the Australian Dollar leaves risk for USDJPY losses and AUDUSD gains into late September and potentially through into early October.

For USDJPY, the key support levels to watch are 100.07/00 and critically 99.51 stop.

For AUDUSD, the key resistance to overcome for a more bullish tone is at .7760.

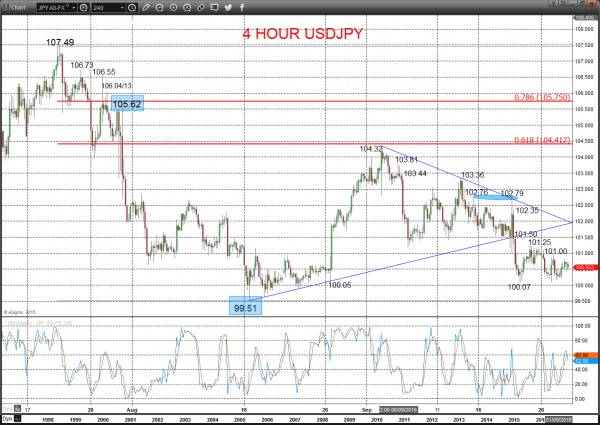

USDJPY

A low-level negative consolidation theme so far this week, after the setback Monday from 101.25 resistance.

This price action continues to reject the Thursday-Friday rebound last week from just above 100.05 support (off of 100.07), to leave a negative bias into Thursday.

Moreover, the plunge lower last Wednesday (post the Bank of Japan Meeting), leaves the intermediate-term risk for a shift from neutral to bearish, only signalled below 99.51.

For Today:

- We see a downside bias for 100.07/05/00; break here aims for key 99.51.

- But above 101.00 opens risk up to 101.25 and aims for 101.50.

Short/ Intermediate-term Range Parameters: We see the range defined by 105.62 and 99.51.

Range Breakout Challenge

- Upside: Above 105.62 aims higher for 107.49 and 109.26.

- Downside: Below 99.51 sees risk lower for 99.00 and 96.57.

4 Hour USDJPY Chart

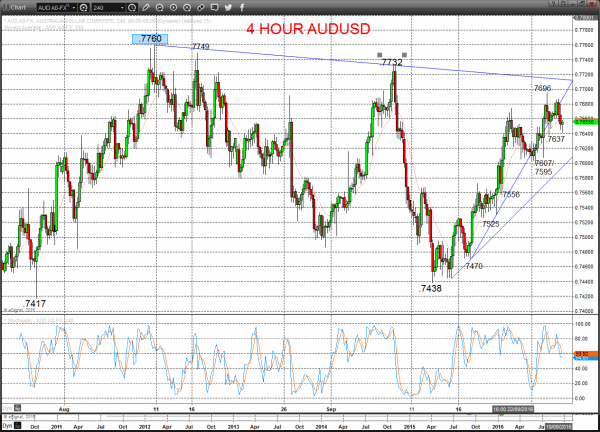

AUDUSD

A resilient consolidation tone on Wednesday, with a dip and rebound from ahead of minor support at .7637, ahead of better support down at .7607/7595, to maintain upside pressures from the recent push above the prior recovery peak at .7675, maintaining upside pressures into Thursday.

For Today:

- We see an upside bias for .7696; break here aims through .7700 for .7732, maybe .7749 and even the key .7760 level.

- But below .7637 quickly targets .7607/7595 and opens risk down to 7595.

The early September plunge below the .7489/86/84 support area produced a shift in the intermediate-term view from bullish to neutral.

Short/ Intermediate-term Range Parameters: We see the range defined by .7403 and .7760.

Range Breakout Challenge

- Upside: Above .7760 aims higher for .7835/50/78, .8000 and .8164/66.

- Downside: Below .7403 sees risk lower for .7284 and .7141.

4 Hour AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.