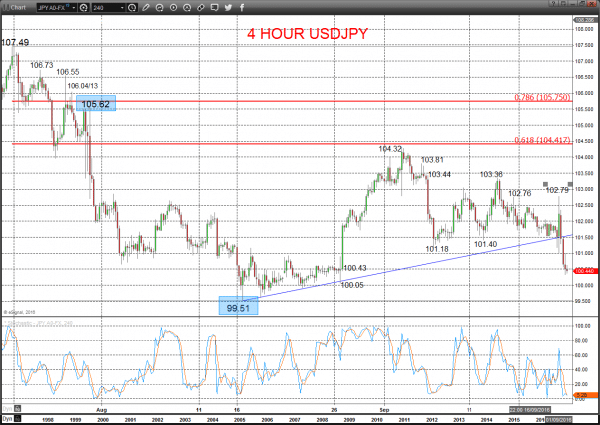

A USDJPY plunge after the Bank of Japan Meeting on Wednesday 21st September, as extra measures were added, with longer term yields now targeted. This has indicated a more negative tone for USDJPY within a broader range, BUT with risk of a more bearish shift through 99.51.

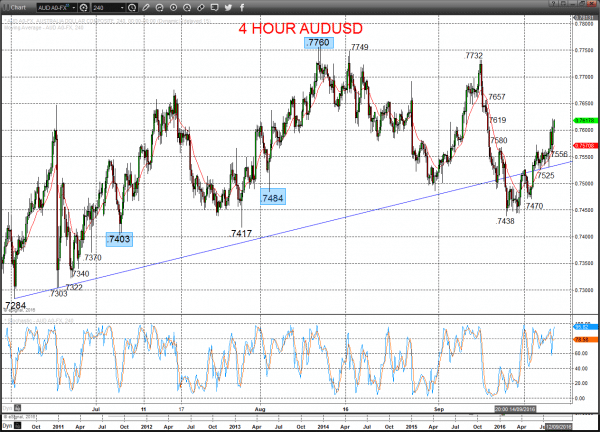

Despite significant losses for AUDUSD in the early September, a rebound through mid-month has fir now rejected the threat of a more bearish shift below .7403.

USDJPY

A plunge lower after the BoJ Meeting Wednesday, back from a prod at 102.76 resistance (from 102.79) through 101.40, 101.18 and 100.43 supports, to leave the bias lower for Thursday.

For Thursday/ Friday:

- We see a downside bias for 100.05; break here aims for key 99.51.

- But above 101.00 opens risk up to 101.50, maybe 102.35.

The latter August push above 102.66/86 resistances created an intermediate-term base to shift the intermediate-term outlook to a broader range theme.

Short/ Intermediate-term Range Parameters: We see the range defined by 105.62 and 99.51.

Range Breakout Challenge

- Upside: Above 105.62 aims higher for 107.49 and 109.26.

- Downside: Below 99.51 sees risk lower for 99.00 and 96.57.

4 Hour USDJPY Chart

AUDUSD

A still better rebound Wednesday building on the Tuesday recovery and firm Monday bounce, to overcome .7573/80 and prod at .7619 resistances, to leave an upside bias into Thursday.

For Thursday/ Friday:

- We see an upside bias for .7657; break here aims for .7700.

- But below .7556 opens risk down to .7525.

The early September plunge below the .7489/86/84 support area produced a shift in the intermediate-term view from bullish to neutral.

Short/ Intermediate-term Range Parameters: We see the range defined by .7403 and .7760.

Range Breakout Challenge

- Upside: Above .7760 aims higher for .7835/50/78, .8000 and .8164/66.

- Downside: Below .7403 sees risk lower for .7284 and .7141.

4 Hour AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.