- The US Dollar bullish tone has been resurrected against most major currencies in late February, driven by a renewed perception of a more hawkish Fed (after Chairman Powell’s recent testimony) which has pushed yields higher, alongside a renewal of equity market weakness.

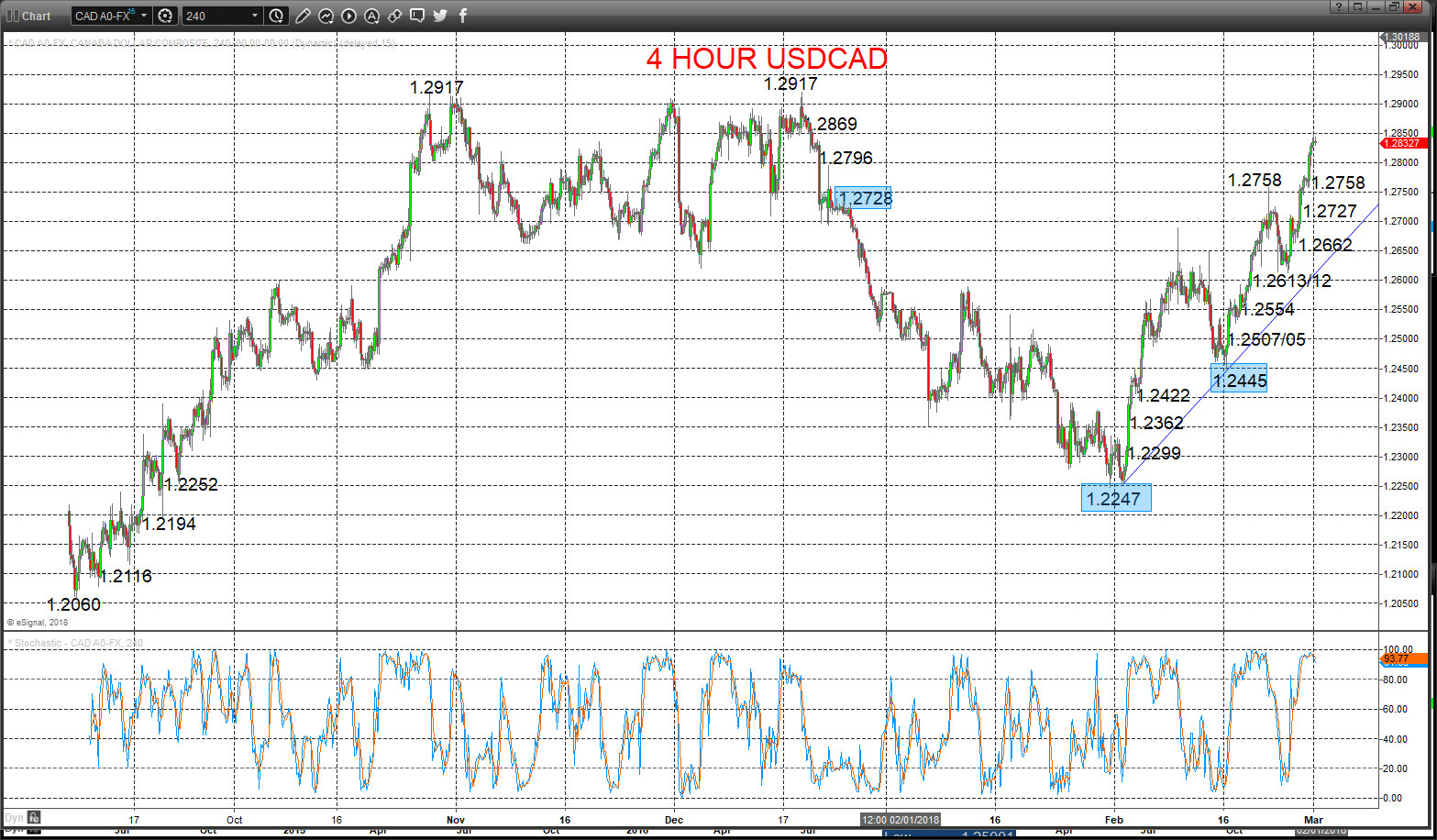

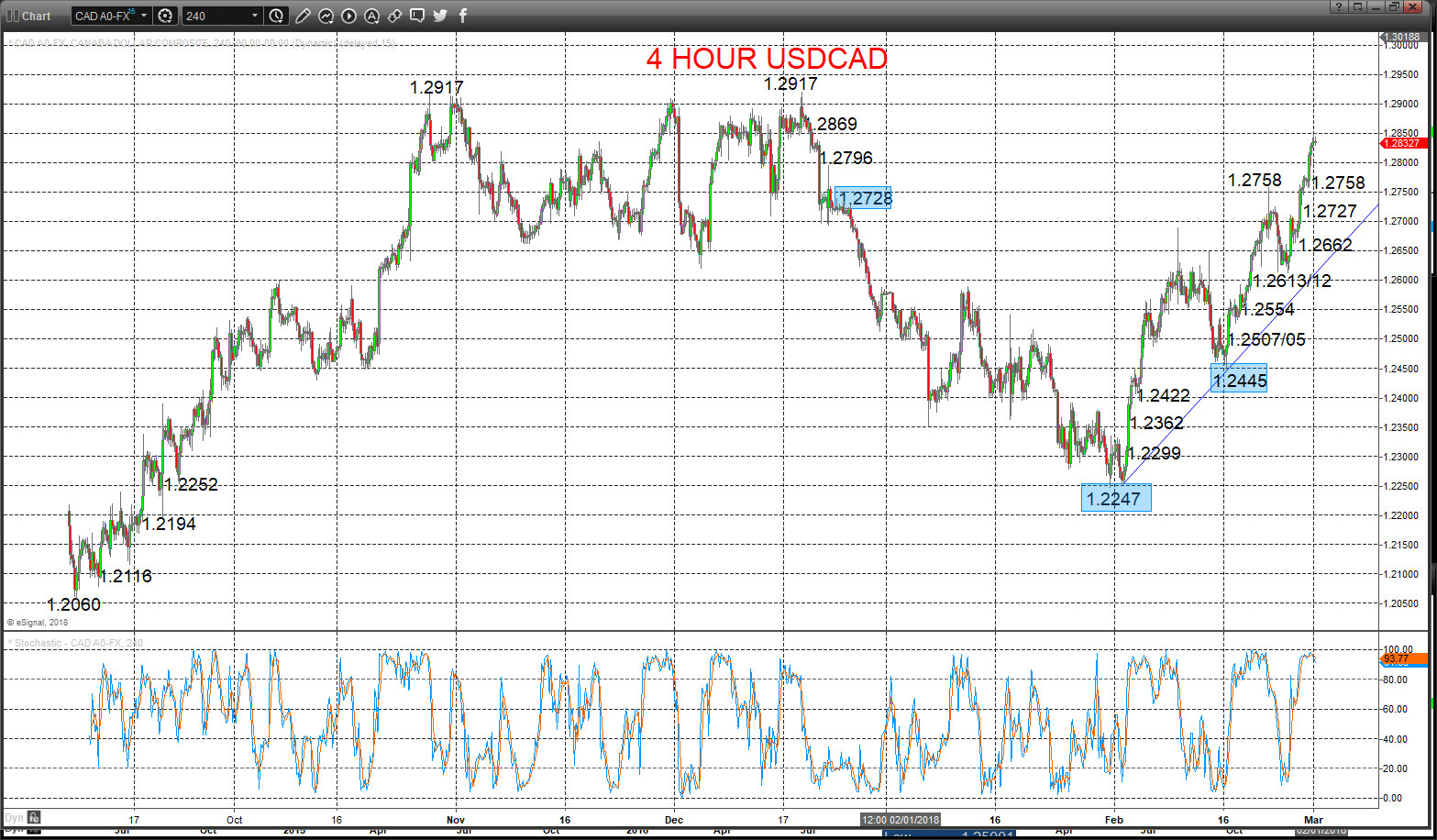

- USDCAD has pushed above a key resistance at 1.2728 which has seen the intermediate-term outlook shift to bullish.

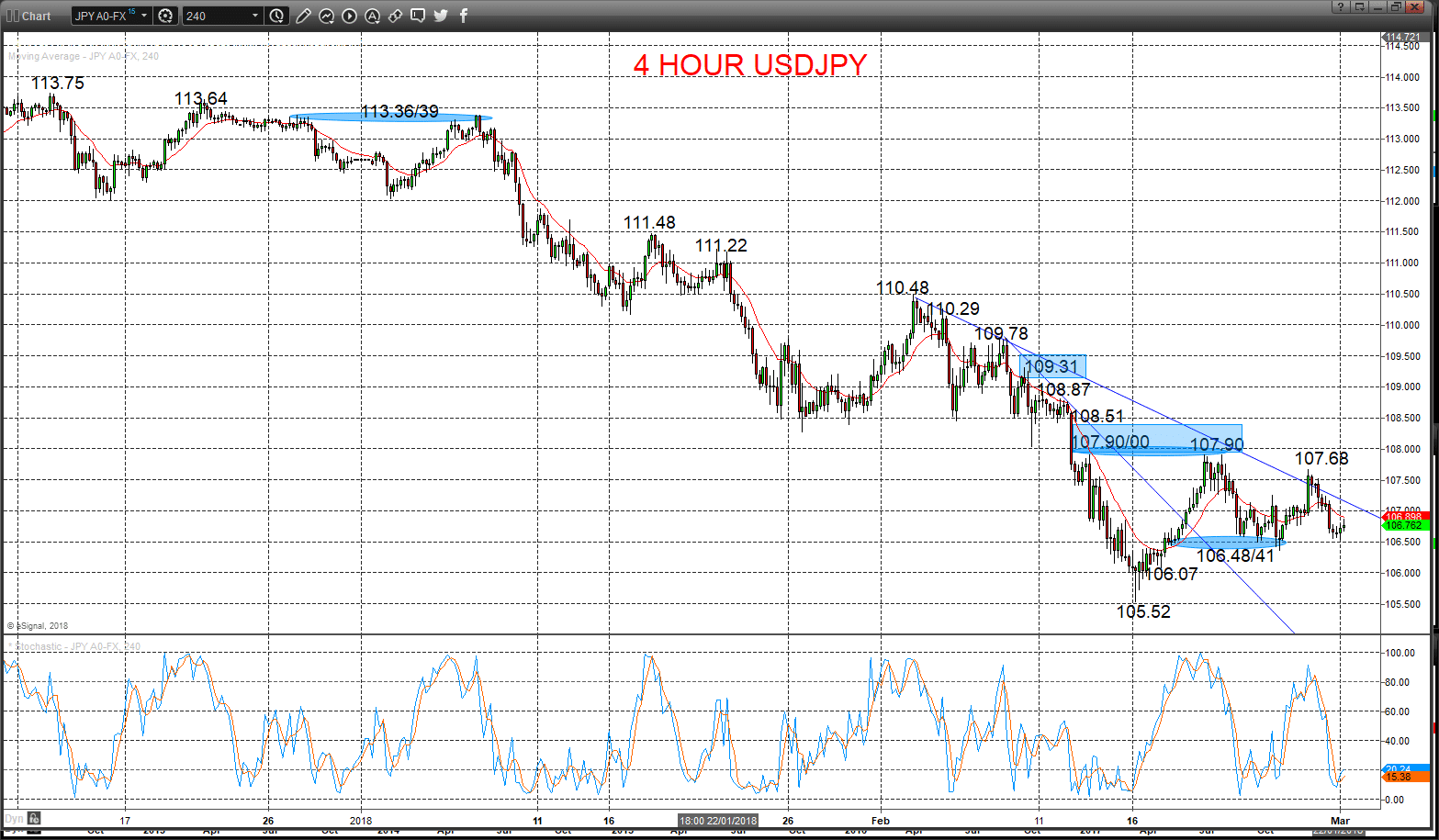

- Whilst the US$ has rallied against most major currencies from late February, USDJPY has stayed bearish throughout the entire erratic “risk on/ risk off” activity from early February, with the bias for renewed losses into March.

USDCAD

Bull bias reinforced

Another strong advance Wednesday to another new recovery high through 1.2796 resistance, sustaining the bullish tone since Monday’s firm rebound just below our 1.2613 support (from 1.2612), to keep the bias higher Thursday.

The latter February break above 1.2728 set a bullish intermediate-term view.

For Today:

- We see an upside bias for 1.2869; break here maybe aims towards the cycle peaks at 1.2917.

- But below 1.2758 opens risk down to 1. 2727, maybe towards 1.2662.

Intermediate-term Outlook – Upside Risks:

- Whilst above 1.2445 we see a positive tone with the bullish threat back up the cycle high at 1.2917, 1.3000/15 and 1.3347.

What Changes This? Below 1.2445 signals a neutral tone, only shifting negative below 1.2247.

Resistance and Support:

| 1.2869* | 1.2917*** | 1.2955 | 1.3000/15** | 1.3051 |

| 1.2758 | 1.2727 | 1.2662* | 1.2613/12** | 1.2554* |

4 Hour Chart

USDJPY

Upside correction fading

A Wednesday prod higher and then a failure back from our 107.68 resistance level, to ease the positive correction tone, to prod 106.91 support and shift the bias back lower for Thursday .

The mid-January selloff below 112.01 produced an intermediate-term bearish shift, BUT risk is growing for a push above 107.90/108.00, to see a neutral intermediate-term theme.

For Today:

- We see a downside bias for 106.76; break here aims for the 106.48/41 area, maybe 106.07.

- But above 107.68 opens risk up to the key 107.90/108.00 area, which we would look to try to cap.

Intermediate-term Outlook – Downside Risks:

- Whilst below 107.90/108.00 we see a bear theme with the downside threat to 104.93,104.06 and 101.15.

What Changes This? Above 107.90/108.00 signals a neutral tone, shifting bullish below 109.31.

Resistance and Support:

| 107.68* | 107.90/108.00*** | 108.51* | 108.87* | 109.31*** |

| 106.76 | 106.48/42* | 106.07* | 105.52** | 105.16 |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.