- The USDCAD and USDJPY FX rates both remain in intermediate-term bear trends, but in the short-term these currency pairs are displaying differing direction biases, with USDCAD staying bearish in the near-term as well as on a longer time frame, whilst USDJPY has posted a small base and is aiming for a correction higher.

- The USDCAD FX rate has retained a bearish theme both short- and intermediate-term, with the Canadian Dollar strengthening with the rally in Oil.

- The US Dollar generally, however, has seen a modest rebound this week, due to Fed speakers reigning in the market, try to temper the more dovish expectations that have grown throughout June (which had sent the US Dollar broadly weaker). This has helped the USDJPY Forex rate recovery.

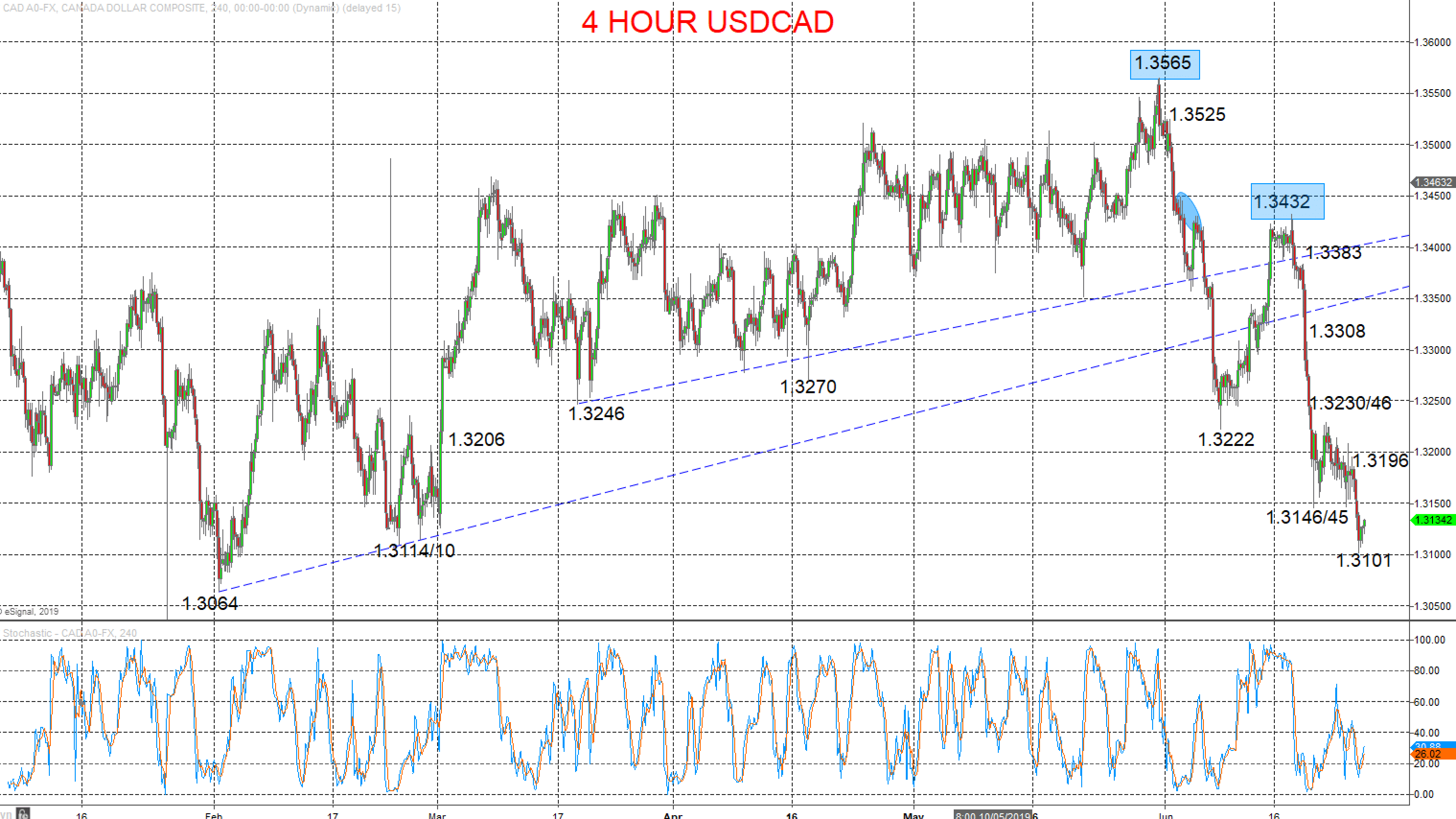

USDCAD bear forces intact

A plunge lower again Wednesday through 1.3146/45 and 1.3114/10 support areas (after a low-level consolidation Friday-Tuesday, resuming bear forces from the aggressive plunge last week after the Fed Meeting to wipe out multiple June support, keeping risks lower for Thursday.

The June plunge through 1.3270 set an intermediate-term bearish trend.

For Today:

- We see a downside bias for 1.310; break here aims for key 3064 and then maybe towards 1.3000.

- But above 1.3153 opens risk up to 1.3196.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.3114/10, 1.3064 and 1.3000.

What Changes This? Above key 1.3430/49 shifts the intermediate-term outlook back to neutral; above 1.3565 is needed for an intermediate-term bull theme.

4 Hour USDCAD Chart

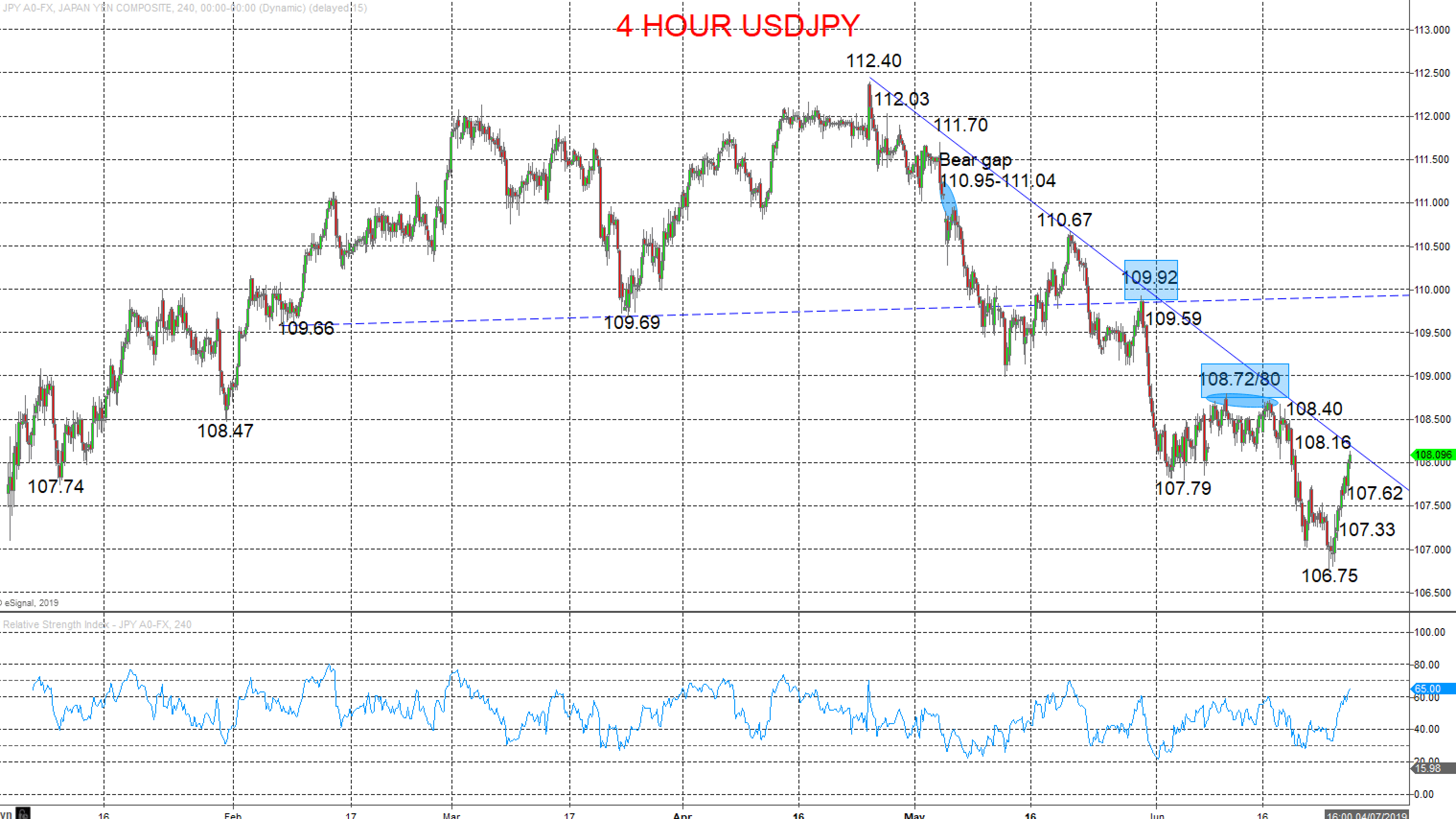

USDJPY correction bias higher

A firm rebound on Wednesday to overcome modest resistance at 107.42 and then prod at the 107.73 level (to 107.76), for now rebutting bear pressures from the post-Fed plunge through 107.79/74 supports, flipping the risks higher into Thursday.

The May surrender of 109.66 set an intermediate-term bear trend

For Today:

- We see an upside bias for 108.16, maybe 108.40.

- But below 107.62 opens risk down to 107.33.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 106.72/55 and 105.00/104.78

- What Changes This? Above the resistance gap at 72/80 shifts the outlook back to neutral; above 109.92 is needed for a bull theme.

4 Hour USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.