- A resilient consolidation tone for the US Dollar versus both the Canadian Dollar and the Japanese Yen moving into mid-May.

- For USDCAD the underlying intermediate-term bullish theme remains very much intact, with the threat into the second half of May for still further significant gains.

- However, USDJPY has neutralised the intermediate-term bearish theme, for a broader range environment into and through mid-May. Although the immediate risk is for a corrective setback lower, we see the skewed threat for the balance of this month for a potential bullish shift, but only signalled above 115.63.

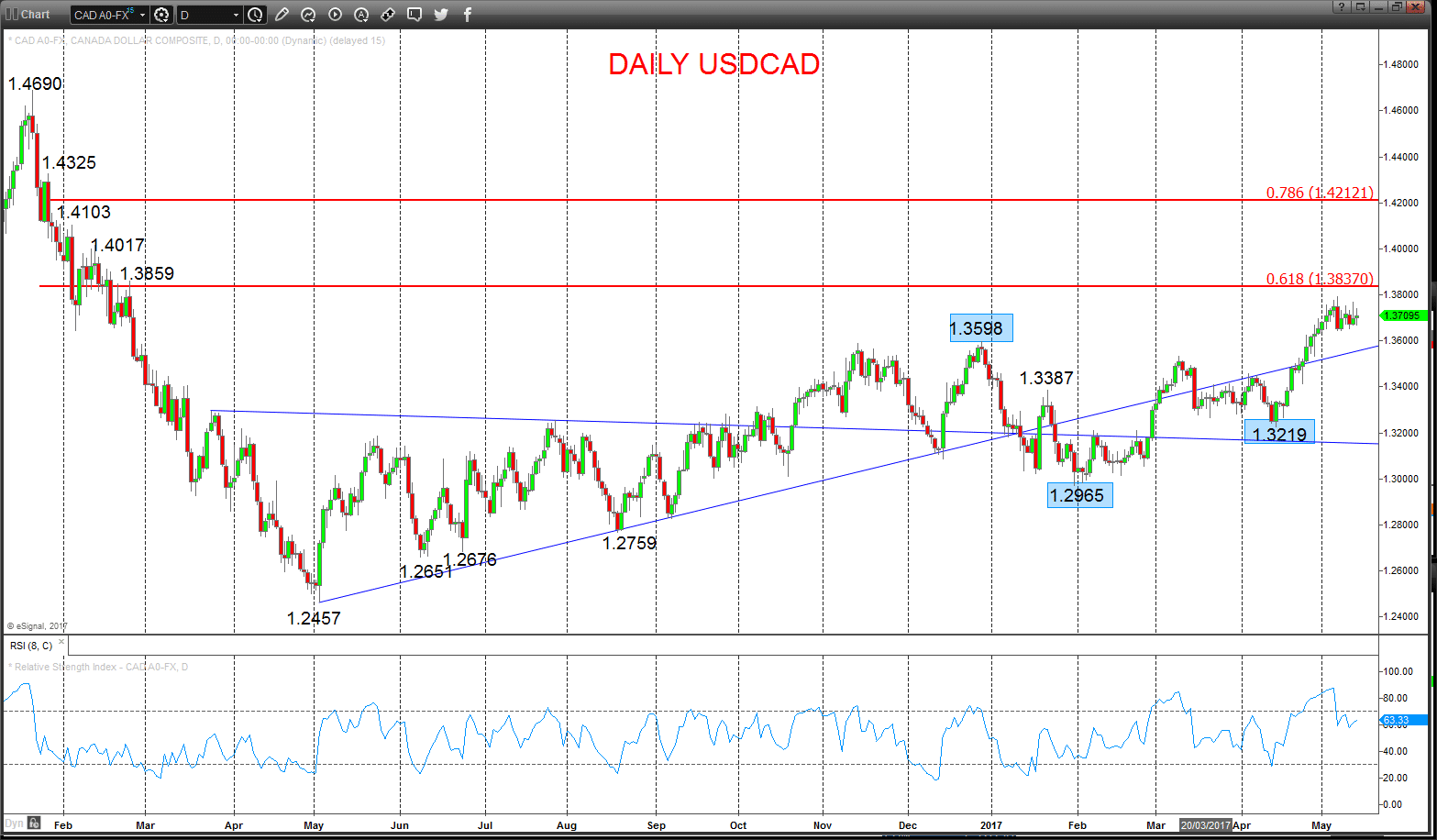

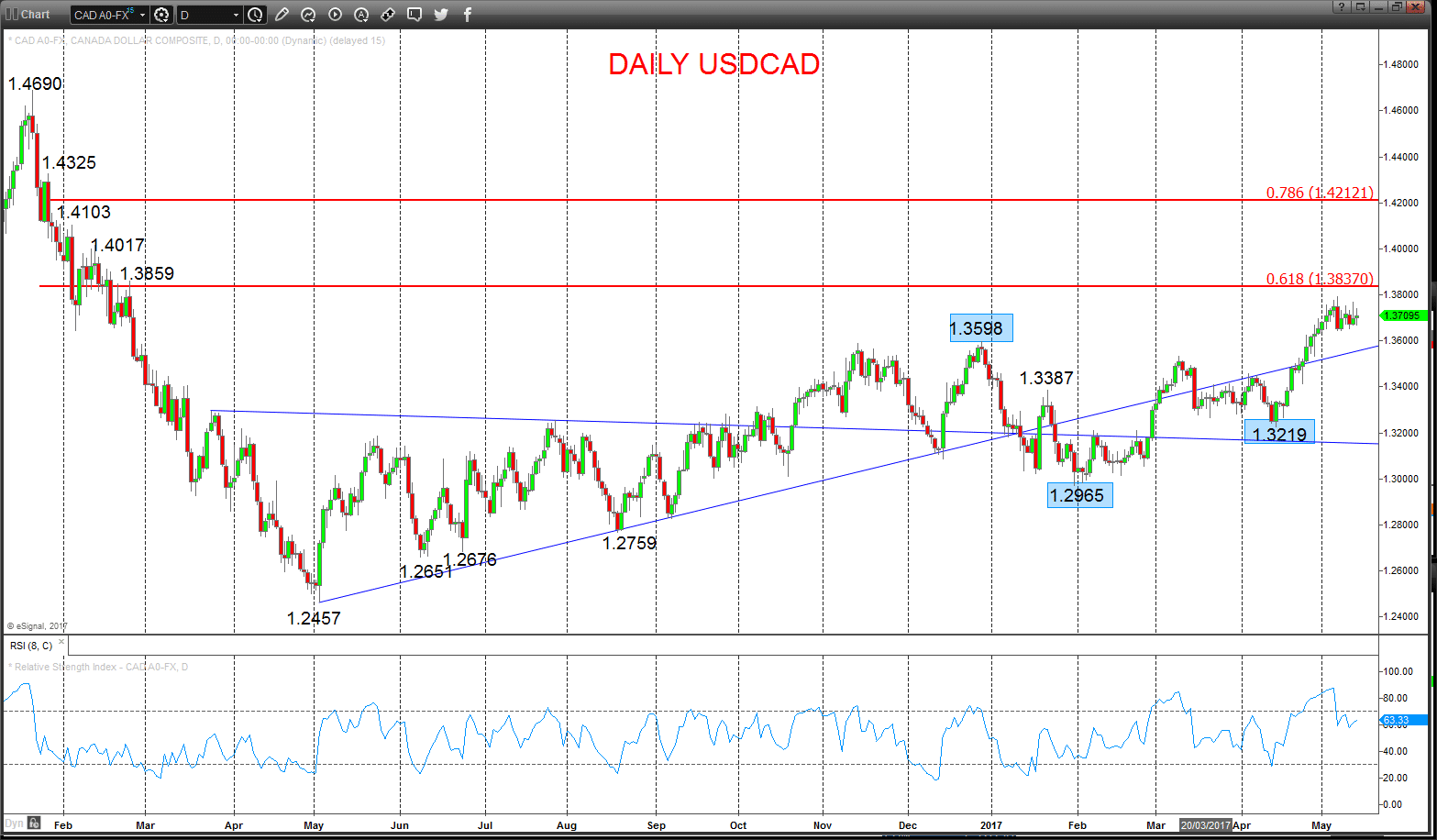

USDCAD – Upside bias

Another erratic consolidation Friday (that dominated all last week), capped below the cycle high at 1.3794, but holding above important support in the 1.3641/35/26 area.

Whilst above this support area, we see the risk skewed towards a rebound, but a break below 1.3626 would quickly see a more significant downside correction.

For Today:

l Whilst holding 1.3641/35/26, we see an upside bias for 1.3750 and 1.3794/95; break here aims for key targets at 1.3837 and maybe 1.3859.

l But below 1.3641/35/26e opens risk down to 1.3606, maybe to 1.3526/10.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to 1.3837/59 and 1.4000/17.

What Changes This? Below 1.3219 signals a neutral tone, only shifting negative below 1.2965.

Daily USDCAD Chart

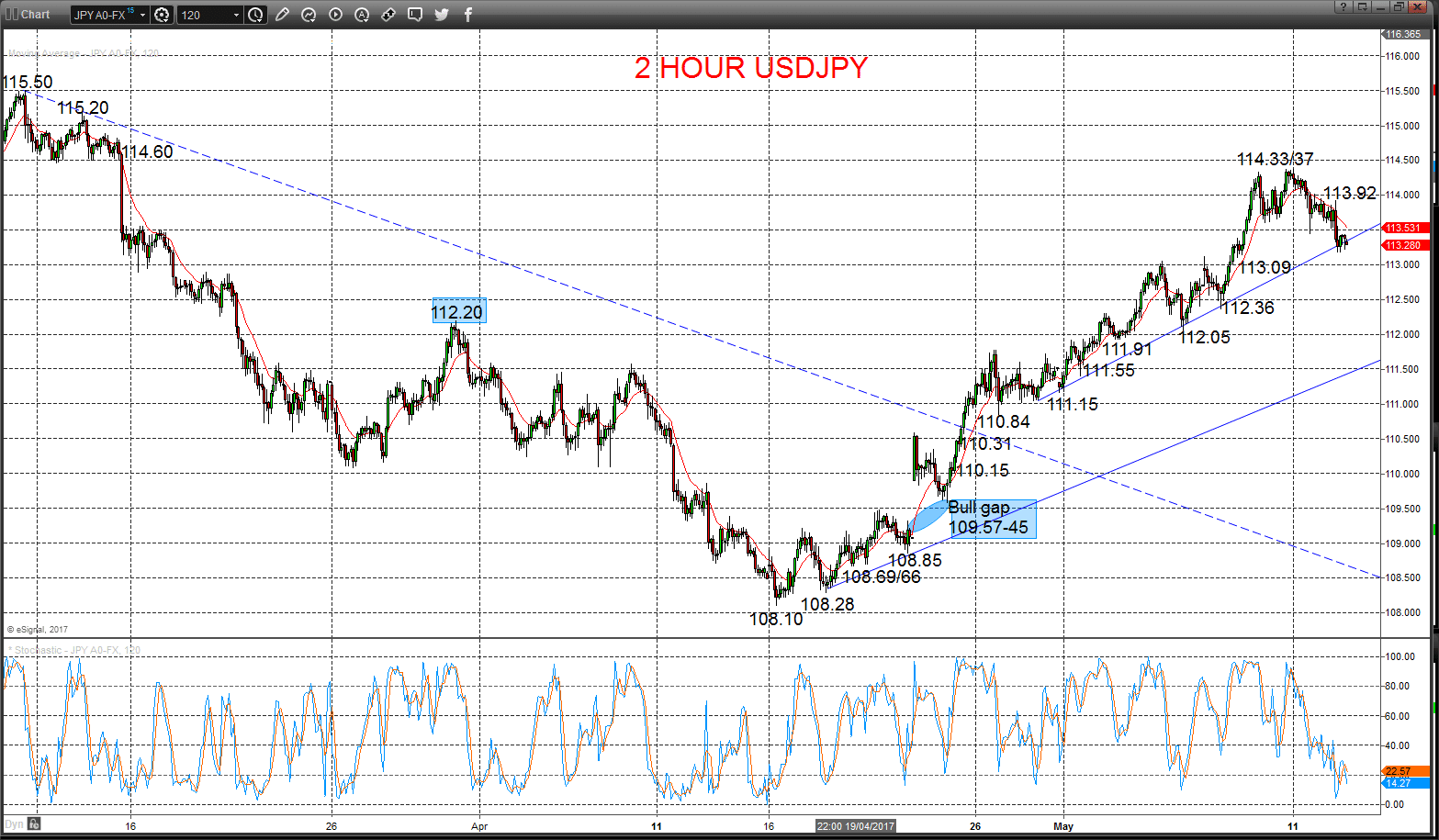

USDJPY – Downside correction bias

Another push lower on Friday as we had anticipated, reinforcing the Thursday setback from just above the recent cycle peak at 114.33 (from 114.37) and plunge through 113.59 support (creating a mini-Double Top pattern), keeping the bias for a further correction lower Monday.

However, the mounting threat into May is for a push above peaks at 115.50/63, which would see an intermediate-term bullish shift.

For Today:

l We see a downside bias for 113.09; break here aims down towards 112.36.

l But above 113.92 opens risk up to 114.33/37, maybe 114.60.

Intermediate-term Range Parameters: We see the range defined by the bottom of the gap at 109.45 and 115.50/63 peaks.

Range Breakout Challenge

l Upside: Above 115.50/63 aims higher for 118.65, 120.00/10 and 121.69.

l Downside: Below 109.45 sees risk lower for 108.10, 107.19, 105.99 and 104.93.

2 Hour USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.