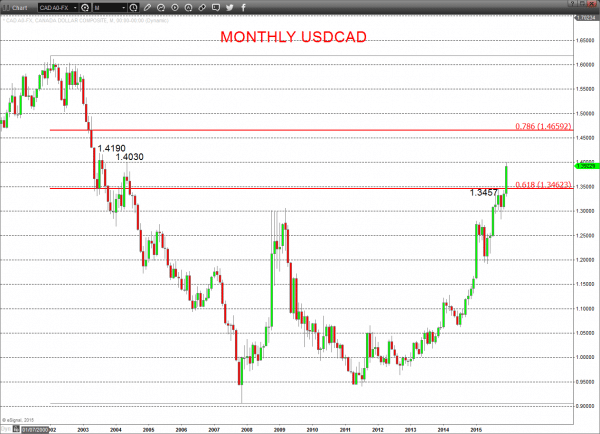

USDCAD hit another new cycle high last week after pushing above the secular peak from September and a long term retracement resistance earlier in December. This has allowed for an approach to further key resistance targets into and through the holiday season and into early 2016.

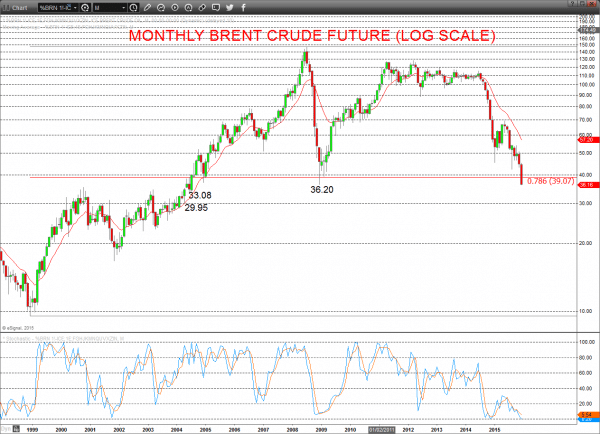

The Brent Crude Future plunge below $40/ barrel, to multi-year lows and more recently through a critical $36.20 level leaves the risk lower for year-end and for 2016.

This Oil price weakness will likely continue to support USDCAD gains.

USDCAD

The strong push through the key 1.3457/62 resistance area set a more bullish tone into 2016.

Another bull break last week above a long term monthly target high from 2004 at 1.3819, maintains upside pressures into the holiday season.

For Year-end:

- We see an upside bias through for 1.4000/4030; break here aims for maybe 1.4190.

Monthly USDCAD Chart

Brent Crude Oil (January 2015 Future)

Another new cycle and secular low having already broken the psychological/option level at 40.00, to now probe below key 36.20 multi-year low.

This has reinforced the larger bearish view into December from the 2015 bear trend and leaves bear pressures for year-end and into January and 2016.

For Year-end:

- We see a more negative tone with the bearish threat to targets 33.08 and maybe even 30.00/29.95.

Monthly Brent Crude Oil Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.