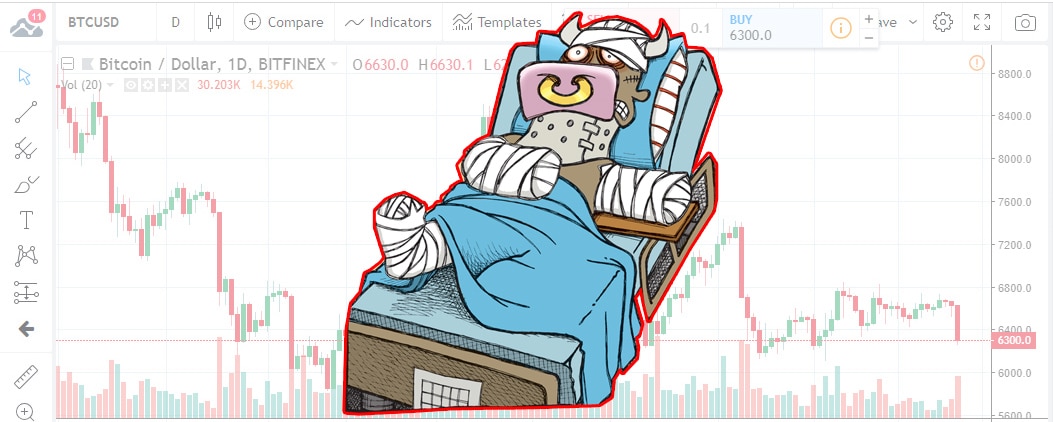

Bitcoin’s price took yet another major hit earlier today, as the bull-bear deadlock of the last few weeks was broken in favor of the bears, in spectacular fashion no less. The price shed around 5% in just 30 minutes of trading, almost hitting the $6k mark, before it rebounded to just over $6.2k.

The losses registered by other cryptos over the same period were even more spectacular. XRP for instance lost some 12.34% of its value.

To say that the bears finally had their way today would be an understatement in several ways. The $6.4k price-point, which had more or less turned into a solid support level over the last few weeks, was obliterated. The whole crypto market was sent into a tailspin and the bears took over the reins of price action with the sort of authority not seen for about a month.

Talking about the crypto vert as a whole: the losses generated by today’s across-the-board price drop have thus far amounted to $13.1 billion.

The sudden price meltdown put an end to the sideways trading which had been going on since September 17, and which had the notoriously volatile asset-price trapped within a $300 band.

What happens now though? With bulls cheering the end of the bear market, it looks like the bears are in fact back in the driver’s seat, even more firmly entrenched than before…

Even just a day ago, some technical analysis specialists were predicting a massive bullish breakout. Can this drop really be explained in technical terms or do we rather need to look into the fundamentals to understand the forces driving it?

Looking at the 1-Day chart it is obvious that the pattern of ever-higher lows, registered over the last few months, has not been broken by this drop yet. If the price does indeed find support above $6.2k, then that bullishly promising pattern will not yet have been invalidated.

The RSI still shows oversold conditions, so we may yet end up seeing an upward correction.

The $6.4k level – which acted as a strong support until earlier today – has now turned into just as sturdy a resistance, so it will probably cap any short-term recovery efforts.

The problem is however that the crypto dip was accompanied by a dip in global markets too. Everything just seems to be extremely bearish today, and that may indeed explain why BTC thusly defied technical analysis. Nasdaq fell around 4% yesterday, and the short positions on BitFinex had simply piled up before the drop. In fact, they reached their highest level since September 22, and this number is still rather menacing right now.

That considered, the bears may not yet be done with their rampage, and the price may indeed dip below $6k.

Besides the global market woes, are there any other fundamentals involved here?

The news-stream is filled with the drops various major cryptos registered. Indeed, ETH as well as BCH were hit hard, so hard in fact that by comparison, BTC’s 4.77% seems light.

In the meantime, the South Korean government is apparently pondering whether to allow ICO’s back into the country or not. A verdict in the matter will likely be handed down in November.

Korean regulators have apparently been reviewing a previous decision that banned ICOs, and they are set to publish the results of their investigations at the end of this month.

Whether or not a return of ICOs to South Korea will have a positive impact on BTC/crypto prices, remains to be seen though.

In other news: the Zaif exchange – hacked to the tune of $60 million – has come forth with a compensation plan.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.