- Although the US Dollar has seen some modest corrective recovery activity into the end of January, we expected this to be short-lived.

- We see the broader US$ weakness that has dominated since around the last Fed rate hike in December 2017, extending into at least the first half of February.

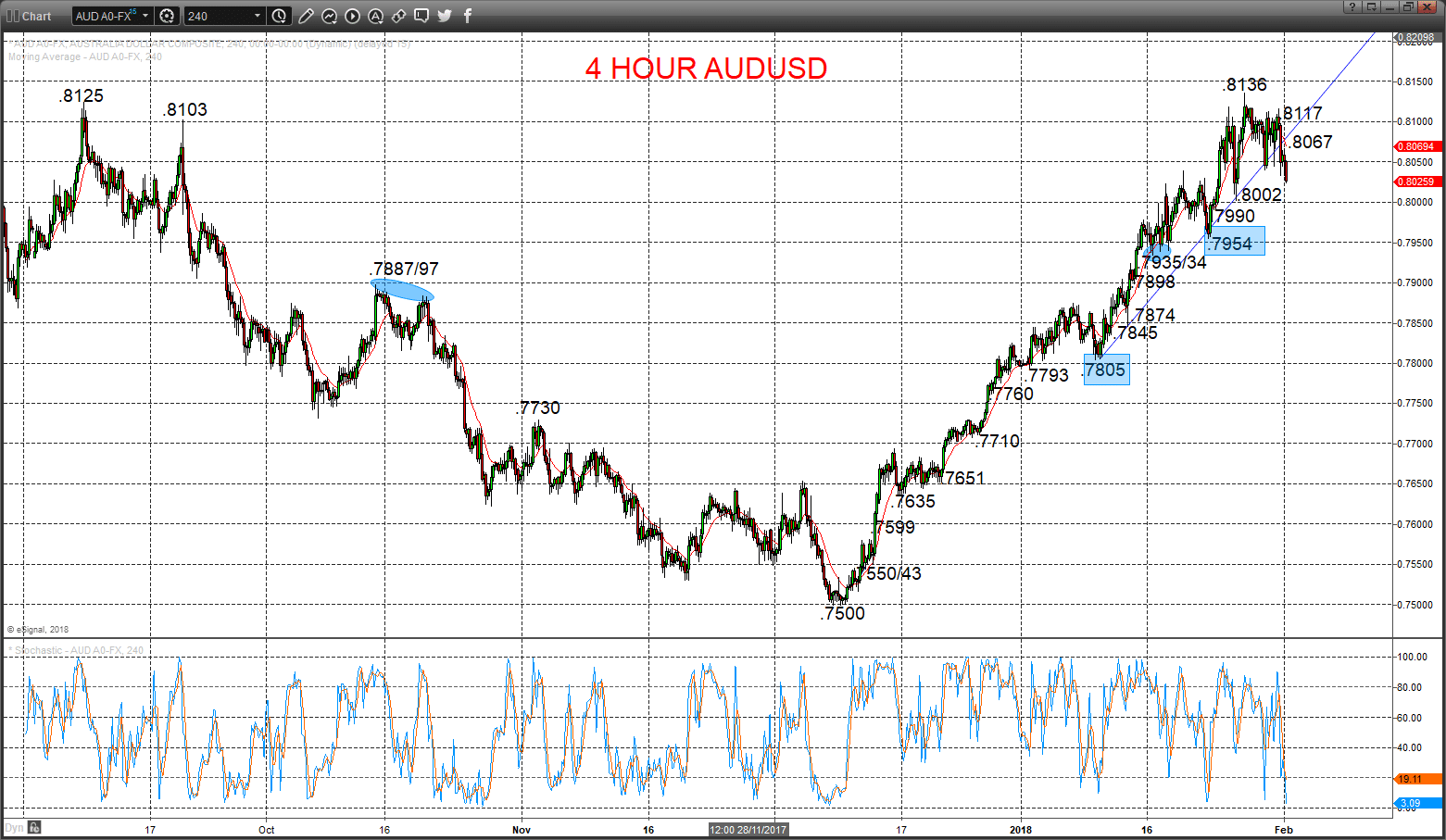

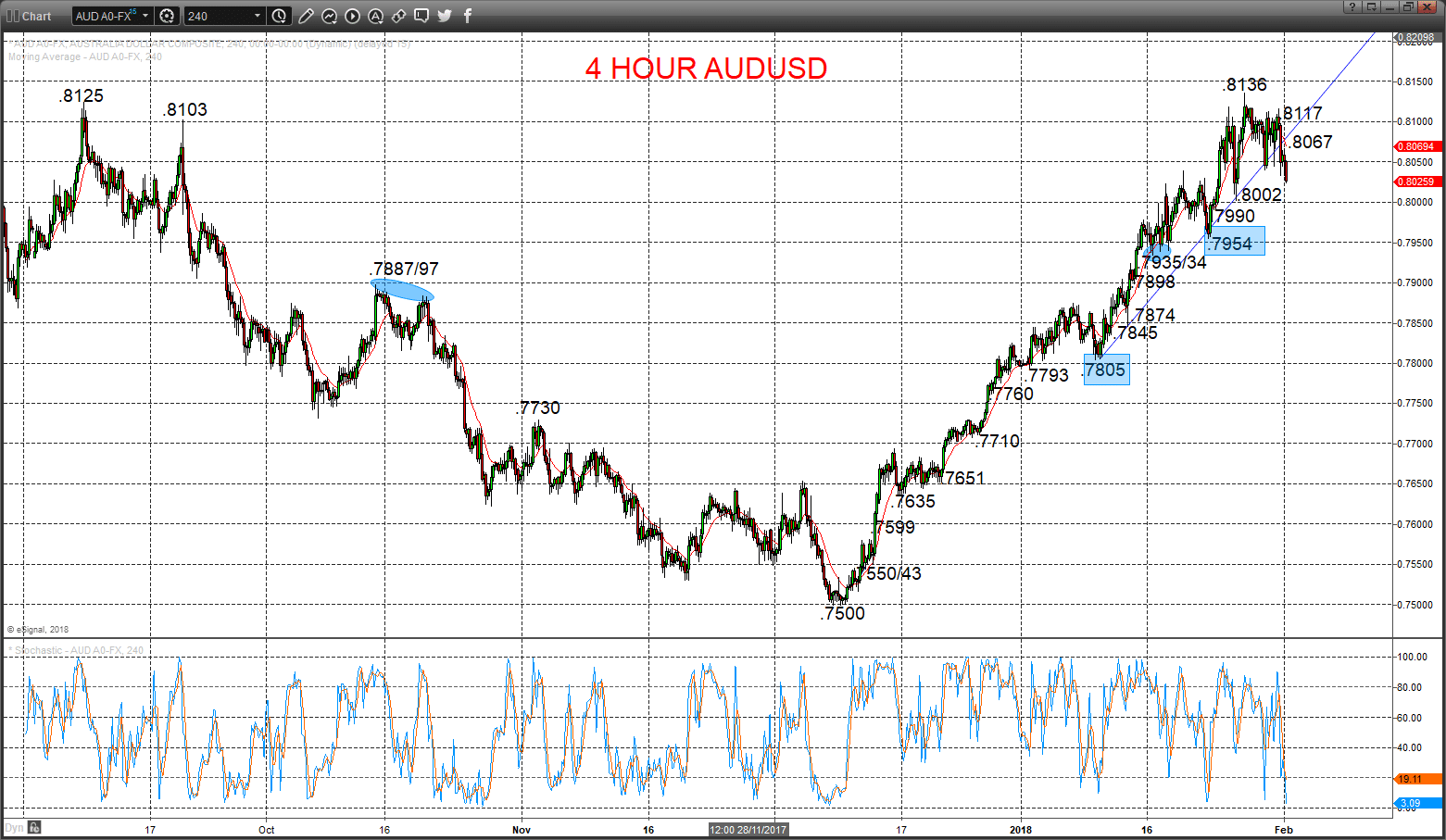

- The AUDUSD currency rate probed above a key multi-year peak from September at .8125 at the end of January. This activity has reinforced the December 2017 bottoming formation and bull trend from here, to look to extend the intermediate-term bullish view into mid-Q1 and potentially beyond.

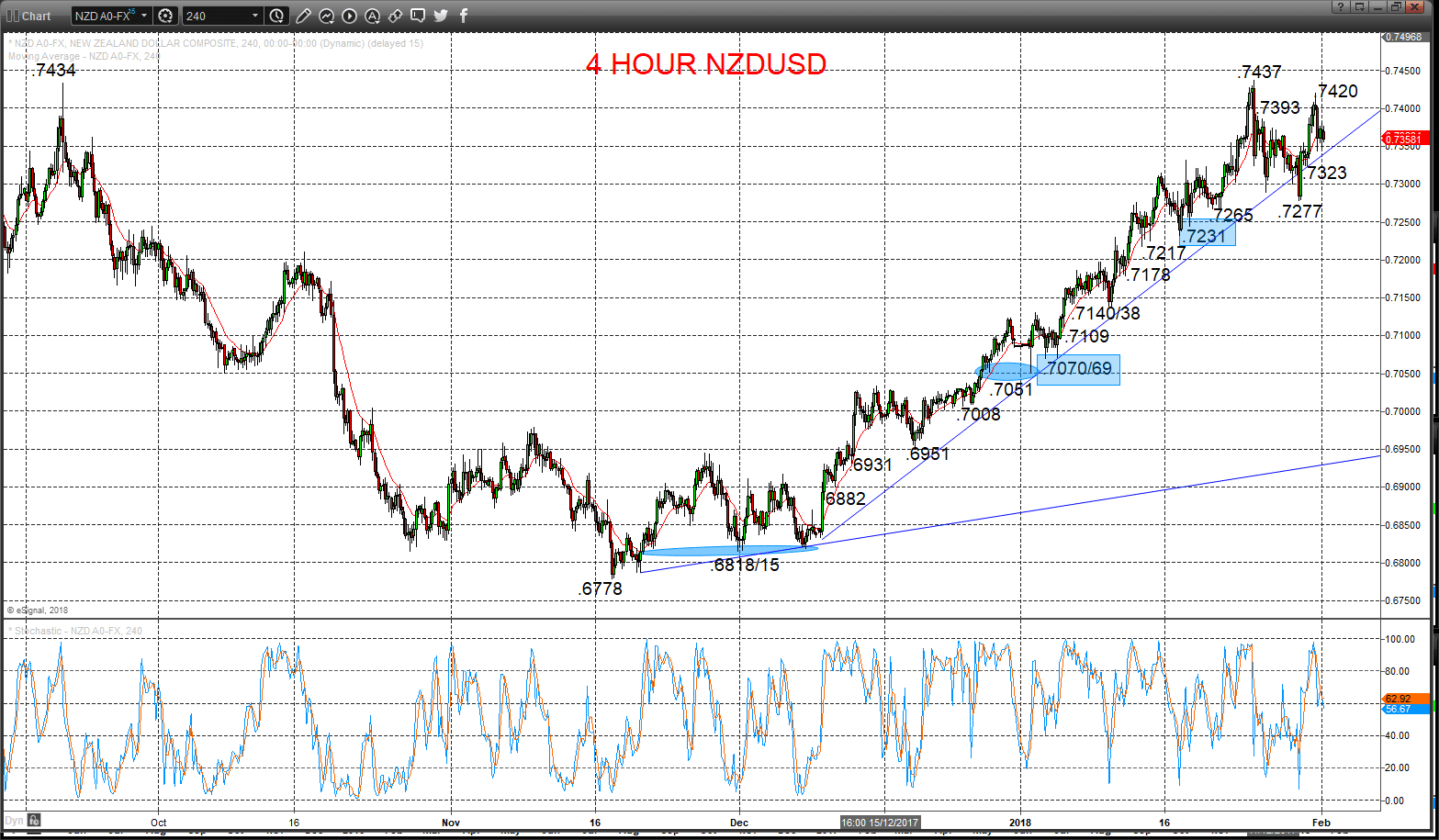

- For the NZDUSD forex rate, late January produced a probe above the September 2017 cyclical swing high at .7434 (up to .7437), and despite a setback into month-end, the end of month rebound sets the trend higher for early and into mid- February.

AUDUSD Upside risks

An erratic consolidation tone Wednesday/Thursday, but despite the dip lower we still see upside pressures from last Friday’s recovery off of .8002 to another new cycle high at .8136 (above a key multi-year peak from September at .8125), to aims higher into Thursday/ Friday.

The December break above the .7730 level shifted the intermediate-term view to bullish.

For Today:

- We see an upside bias for .8067 and then .8117, maybe back to the new cycle peak at .8136.

- But below .8002 quickly targets .7990 and maybe key .7954, which we would look to try to hold.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to targets ..8164/66, .8295 and the .8452/82 key retracement target area.

- What Changes This? Below .7954 signals a neutral tone, only shifting bearish below .7805.

Resistance and Support:

| .8067 | .81117 | .8136* | .8164/66*** | .8200* |

| .8020 | .8002** | .7990* | .7954*** | .7935/34** |

4 Hour AUDUSD Chart

NZDUSD Bull threat

A strong advance Wednesday to push above modest resistance at .7393, just stalling ahead of key peaks at .7434/37, but building on Tuesday’s intraday rebound from above strong supports at .7265 and .7231 (off of .7277), to move back above bull trend line from mid-December, keeps the risk higher into the Fed Meeting and for Thursday.

The mid-December push above .6980 produced an intermediate-term shift to a bullish theme, reinforced by the early 2018 extension rally.

For Today:

- We see an upside bias to .7420 then for the key peaks at .7434/37; above here targets .7455.

- But below .7323 aims quickly at .7377/65, which we would look to try to hold. Below targets .7231.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to targets .7558 and .7744.

- What Changes This? Below .7231 signals a neutral tone, quickly shifting bearish below .7069.

Resistance and Support:

| .7420 | .7434/37** | .7455* | .7500** | .7526 |

| .7323 | .7277/65** | .7231*** | .7217* | .7200 |

4 Hour NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.