The Australian Dollar/United States Dollar currency pair (also referred to as AUDUSD and AUD/USD) is one of the most actively traded in the world. In this article, we will examine how AUDUSD is performing.

AUDUSD Key Stats

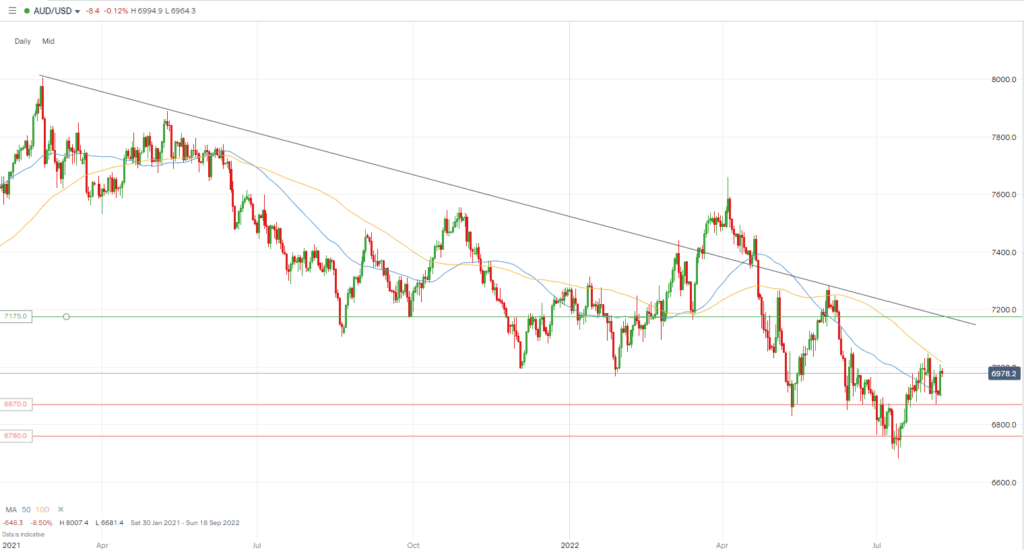

- 2021 high: 0.8007

- 2021 low: 0.6993

- YTD high: 0.7661

- YTD low: 0.6681

- YTD % change: -3.65%

AUDUSD Forecast Summary

The recent strength of “king” dollar, the US dollar that is, has seen the AUDUSD decline in 2022. However, there has been a slight reprieve for the Australian dollar in recent weeks. Even so, the current macroeconomic and geopolitical climate means we see another leg lower for the pair over the near to medium term. Of course, the current rally in equities suggests markets are in risk-off mode, but we believe there are still headwinds that will impact risk currencies and see the dollar gain once more. The initial level we are looking to is 0.6870.

AUDUSD Fundamental Analysis

Fundamental analysis is the backbone of the major swings in the forex market. A clear directional bias can be established through fundamental analysis, and major changes in monetary policy or economic activity can impact a currency pair. Technical analysis is also important, but a country’s economic health must also must be watched carefully.

The Australian Dollar is one of the most frequently traded currencies in the world. A significant driver of the AUD price comes from its wealth of natural resources and its trading with Asian countries. India and China are large importers of Australia’s commodities, and Australia imports heavy machinery and goods produced in those countries. Furthermore, when the Chinese economy is hit, it impacts Australian exporters, hurting the supply chain and resulting in a weakening Australian dollar. Therefore, AUD traders must analyse impacts from both Australia and its trading partners.

As mentioned, the USD is the go-to currency for most, especially during times of economic instability. This is due to the strength of the USA’s economy and the fact the USD is the reserve currency for international trade. As a result, it has earned the title of “King Dollar.”

There are several key economic data releases each month in the US. These include payroll data, GDP, retail sales, non-farm payrolls, and much more. These releases help central bankers, the government, traders, investors, economists, and others understand the current health of the US economy. These data releases can also cause major price swings in the USD and other related assets. As of now, inflation is spiraling, and the Fed recently announced an additional rate increase. The Fed raised interest rates by three-quarters of a percentage point. Given the global economic uncertainty and the Fed raising rates, it’s obvious why the dollar has recently had a major bull run.

Related Articles

- AUDJPY Forecast and Live Chart

- GBPNZD Forecast and Live Chart

- What Are Commodity Forex Pairs?

- Forex Charts

AUDUSD Technical Analysis

Support Levels:

- 0.6870

- 0.6851

- 0.6760

Resistance Levels:

- 0.7065

- 0.7175

- 0.7265

When assessing the technical levels of the current AUDUSD price, we see 0.6870 as an interesting support level. It is also our initial downside target. The level has been tested as support and resistance on various occasions and will be one to watch. Further lower, we also see 0.6851 as an area to watch out for, with the price bouncing from there twice in June before it finally broke lower. Finally, level 0.6760 looks excellent on both the daily and weekly charts for traders with a bearish stance on AUDUSD.

To the upside, we see an initial potential resistance level at 0.7065, which may present an opportunity for price to turn back lower. Furthermore, 0.7175 is also one to watch, as is 0.7265. However, with the price currently in a downtrend, we are looking for a move higher to signal a potential entry lower.

Trade AUDUSD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.