- The US Dollar recovery strength has begun to emerge in early September against major G10 currencies.

- However, AUDUSD has retained an underlying bullish theme and aims for further gains into the month.

- NZDUSD, however, retains the negative tone set up after the August push below a key support at .7198.

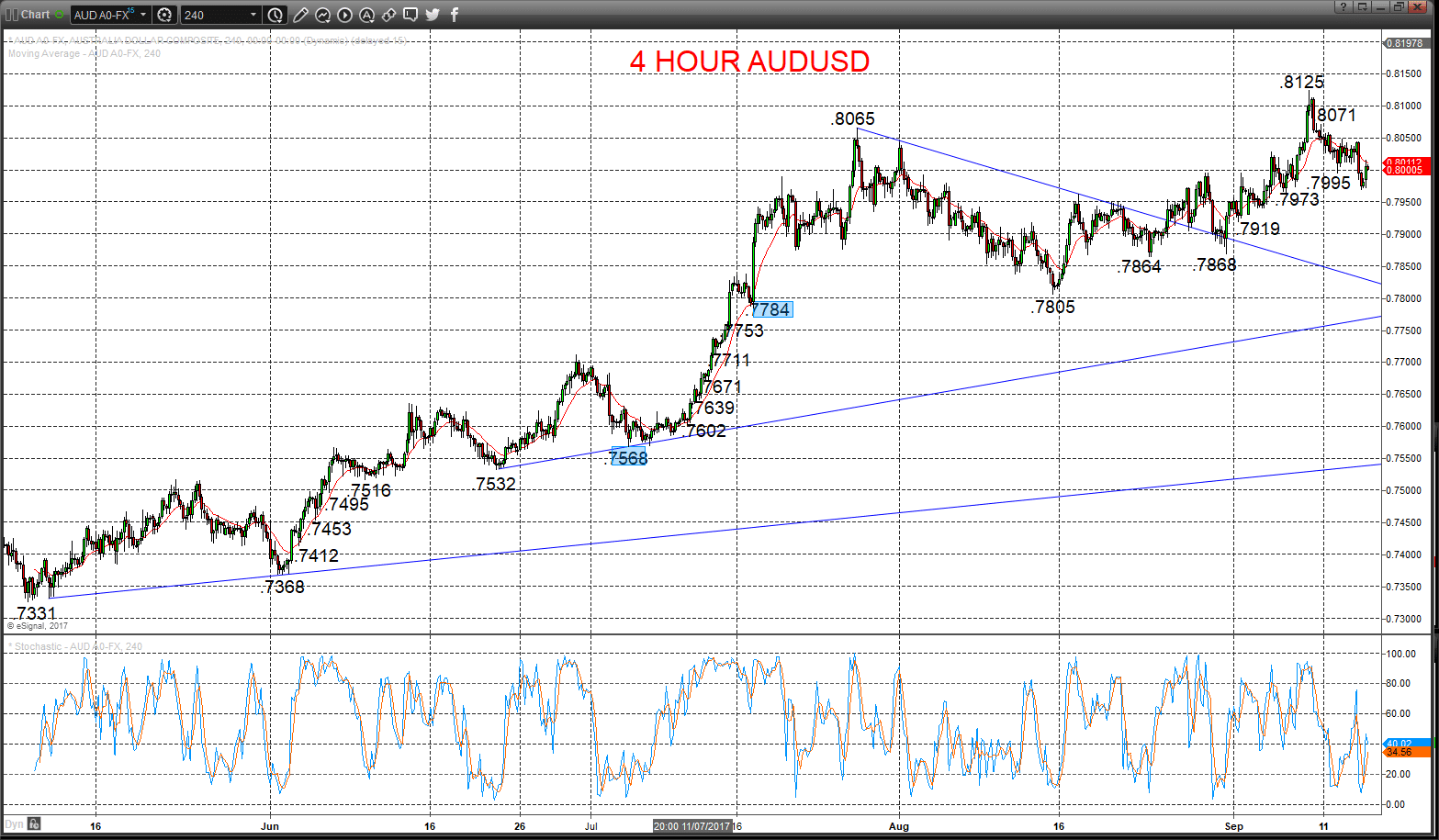

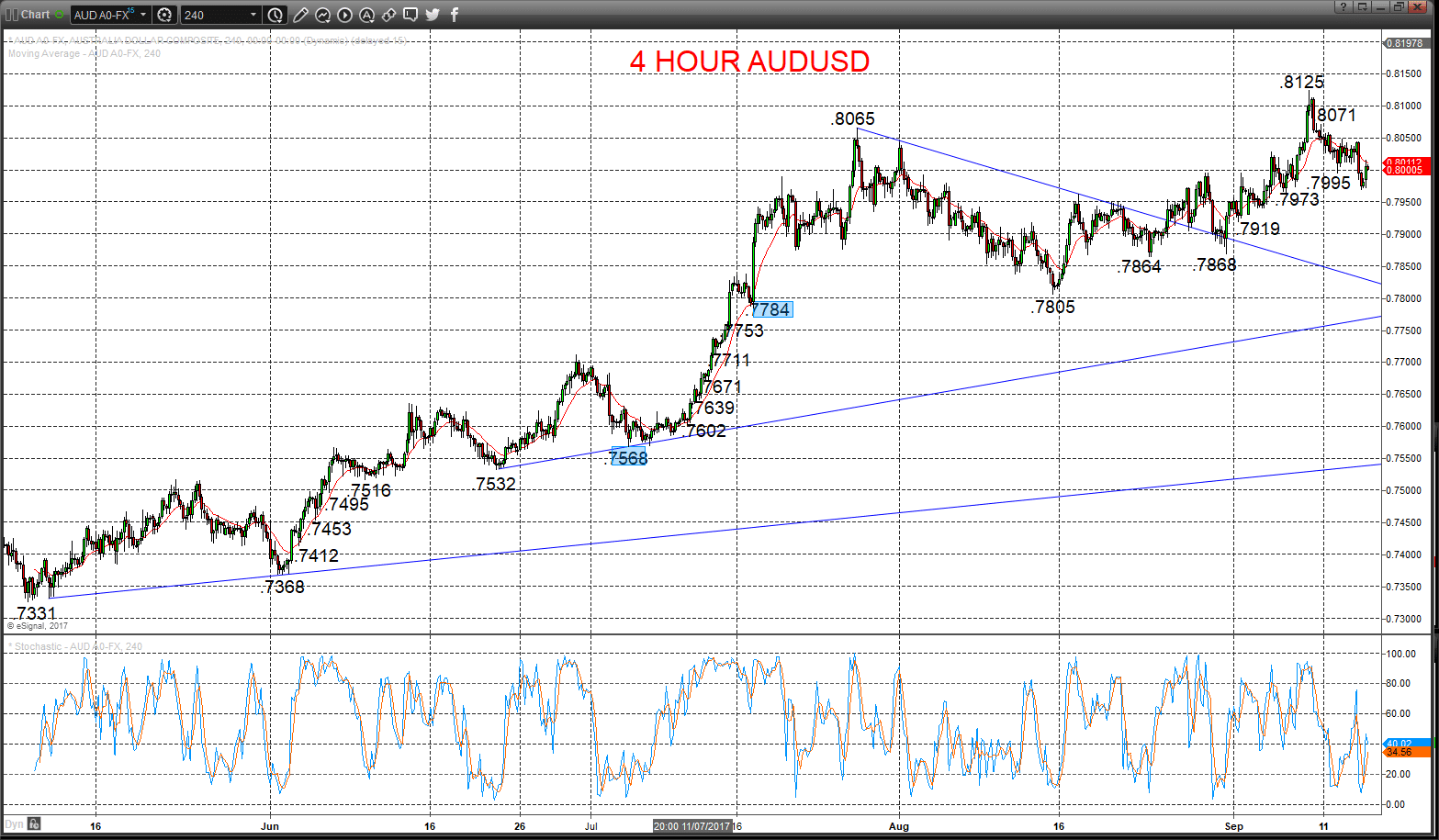

AUDUSD – Downside correction bias

Again a setback Wednesday after Tuesday’s push below support at .8024, sustaining negative pressures evident since last Friday’s correction lower, leaving bias for further corrective activity Thursday.

The robust July advance through the psychological/option target at .8000 reinforced the intermediate term bullish outlook.

For Today:

l We see a downside bias through .7995; break here quickly aims for .7973, then down towards .7919.

l But above .8071 opens risk up to .8125.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to the 2015 high at .8164.

l Above here targets .8295 and the .8452/82 area.

What Changes This? Below .7784 signals a neutral tone, only shifting negative below .7568.

4 Hour AUDUSD Chart

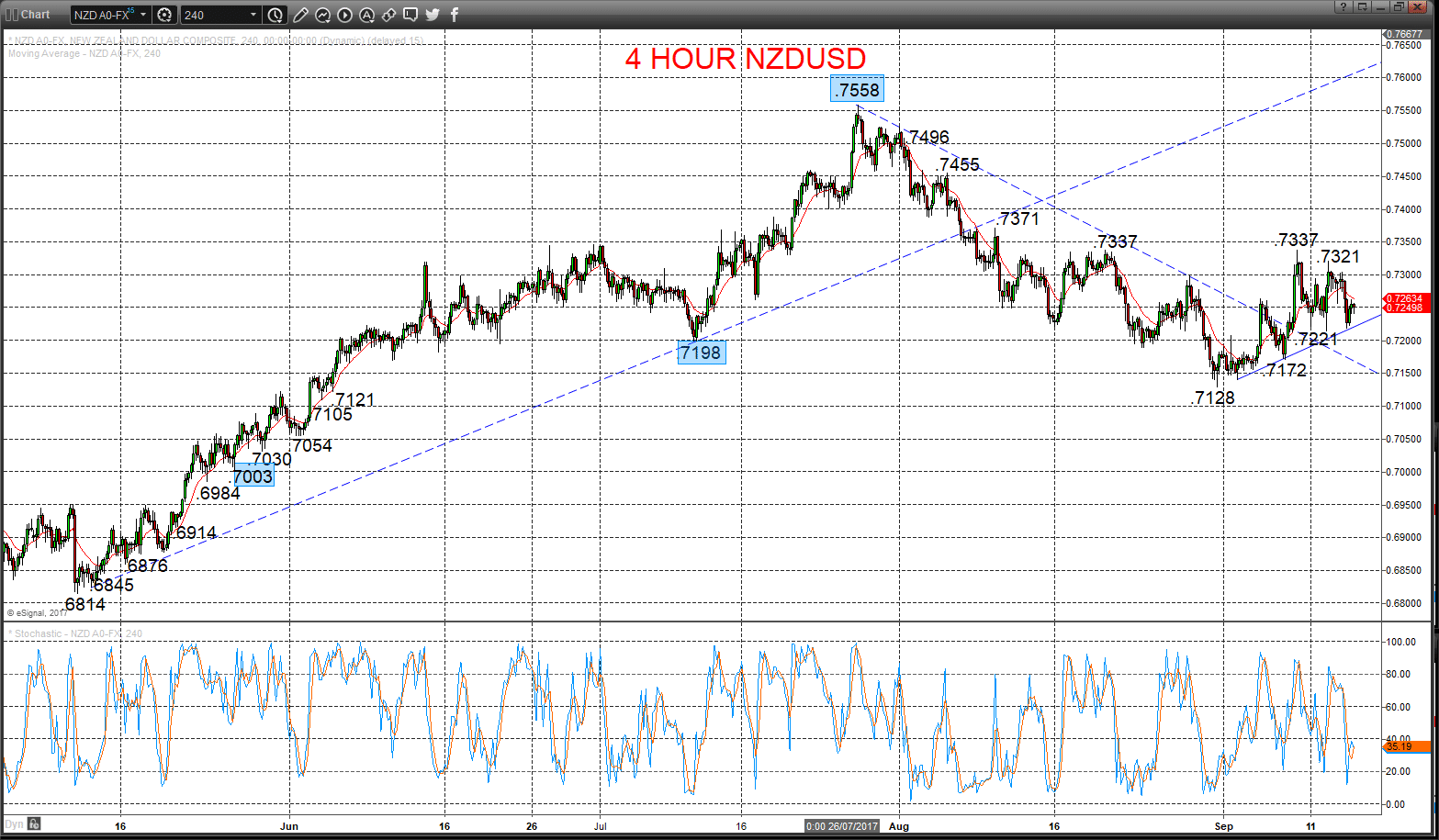

NZDUSD – Downside risk

A setback is anticipated for Wednesday, dismissing Tuesday’s recovery effort, stalling back from ahead of the dual peaks at .7337, sustaining risk for a correction still lower into Thursday.

The recent push down below the July low at .7198 signalled an intermediate shift from bullish to neutral.

For Today:

l We see a downside bias for .7221; break here aims for .7172, which we will look to try to hold.

l But above .7321 quickly opens risk up to .7337, then maybe to .7371.

Intermediate-term Range Parameters: We see the range defined by .7558 and .7003.

Range Breakout Challenge

l Upside: Above .7558 aims higher for. 7744 and .8000/45 area.

l Downside: Below .7003 sees risk lower for .6814.

4 Hour NZDUSD Chart

See all live forex charts

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.