- When we last looked at AUDUSD and NZDUSD FX rates back on 29th April here we highlighted ongoing intermediate-term bear themes.

- Since this report, global financial markets have seen a move to a “risk off” environment, with concerns regarding US tariffs on Chinese goods potentially impacting negatively on the US-Sino trade talks.

- Equity markets have plunged lower, whilst “risk” currencies like the Australian and New Zealand Dollar have suffered and the safe haven Japanese Yen has rallied.

- Subsequent losses by both AUDUSD and NZDUSD currency pairs have seen these markets make new multi month lows (in the case of NZDUSD to the lowest level since October 2018), for a more negative technical picture.

- A recent May rate cut by the Reserve Bank of New Zealand (RBNZ) and the expectation of a Reserve Bank of Australia (RBA) rate cut in June will likely keep pressures lower for AUDUSD and NZDUSD.

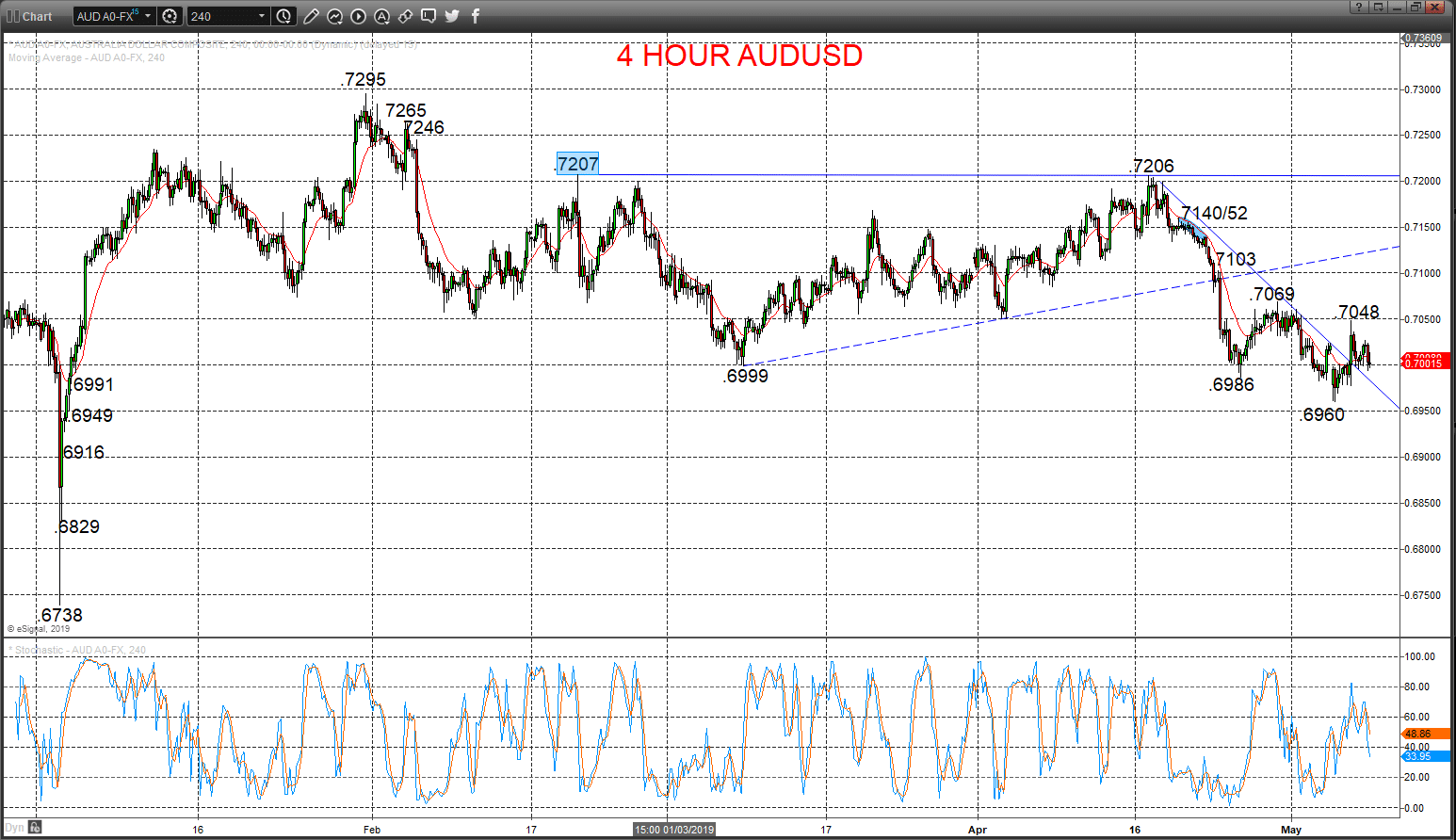

AUDUSD still aiming lower

A negative consolidation tone Wednesday after Tuesday’s rebound failure after the RBA decision from below.7069 resistance (from .7048), sustaining downside pressures evident since the Fed at the start of May that produced a push below the April swing low at .6986, to keep risks lower for Thursday.

The early February push .7073 set an intermediate-term bear trend.

For Today:

- We see a downside bias for .6960; break here aims for .6949, maybe even .6916.

- But above .7048 aims for .7069.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .6916.

- Lower targets would be .6829 and .6738

- What Changes This? Above .7207 shifts the intermediate-term outlook straight to a bull theme.

Resistance and Support:

| .7048 | .7069* | .7103* | .7140/52 | .7207*** |

| .6960 | .6949* | .6916 | .6870/67 | .6829* |

4 Hour Chart

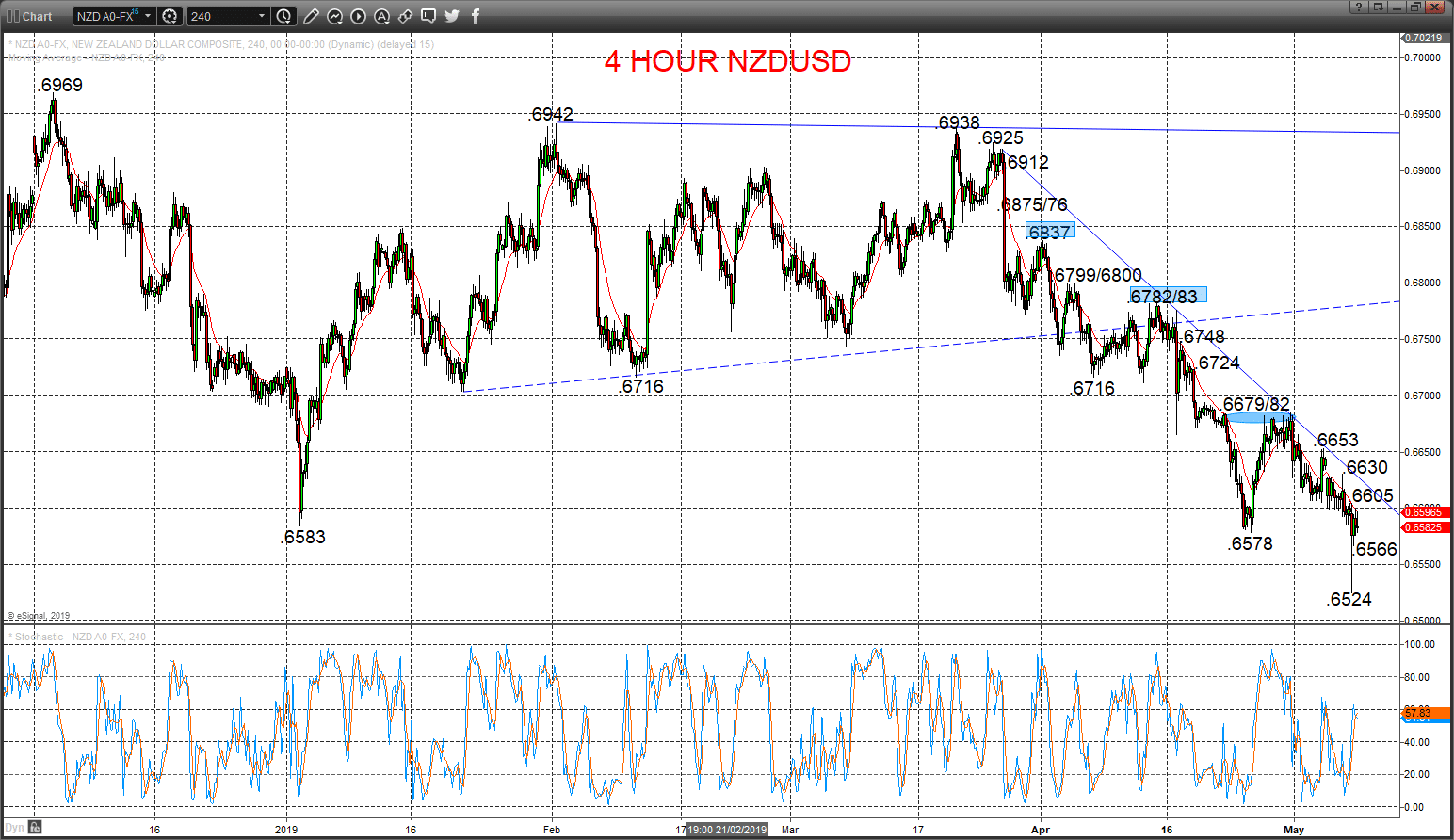

NZDUSD negative theme intact, after RBNZ rate cut

A plunge and a bounce Wednesday through the RBNZ rate cut, breaking supports as low as .6542 to just hold at our .6519 level (at .6524), but despite the bounce, whist capped by .6605 we still see negative forces from the push lower from early May (after a disappointing New Zealand Employment report and the Fed), leaving the bias lower Thursday.

The April push below .6716 set an intermediate-term bear theme.

For Today:

- We see a downside bias for .6566; break here aims for .6524/19, maybe .6519.

- But above .6605 targets .6630 and maybe aims for .6653.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .6347 and .6195

- What Changes This? Above .6783 shifts the outlook back to neutral; above .6837 is needed for a bull theme.

Resistance and Support:

| .6605 | .6630* | .6653** | .6679/82** | .6724* |

| .6566 | .6524/19* | .6500** | .6471 | .6437 |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.