- Early February has been dominated by an violent sell off in global equity markets, primarily triggered by a shift to higher yield territory across the UST curve (with the 10yr pushing though 2.70%), in turn assisted by potential inflationary pressures developing, highlighted by the recent rise in US average hourly earnings.

- Forex markets have been impacted, with the US Dollar seen as a safe haven and generally strengthening versus most major currencies (apart from the ultimate safe haven, the Yen).

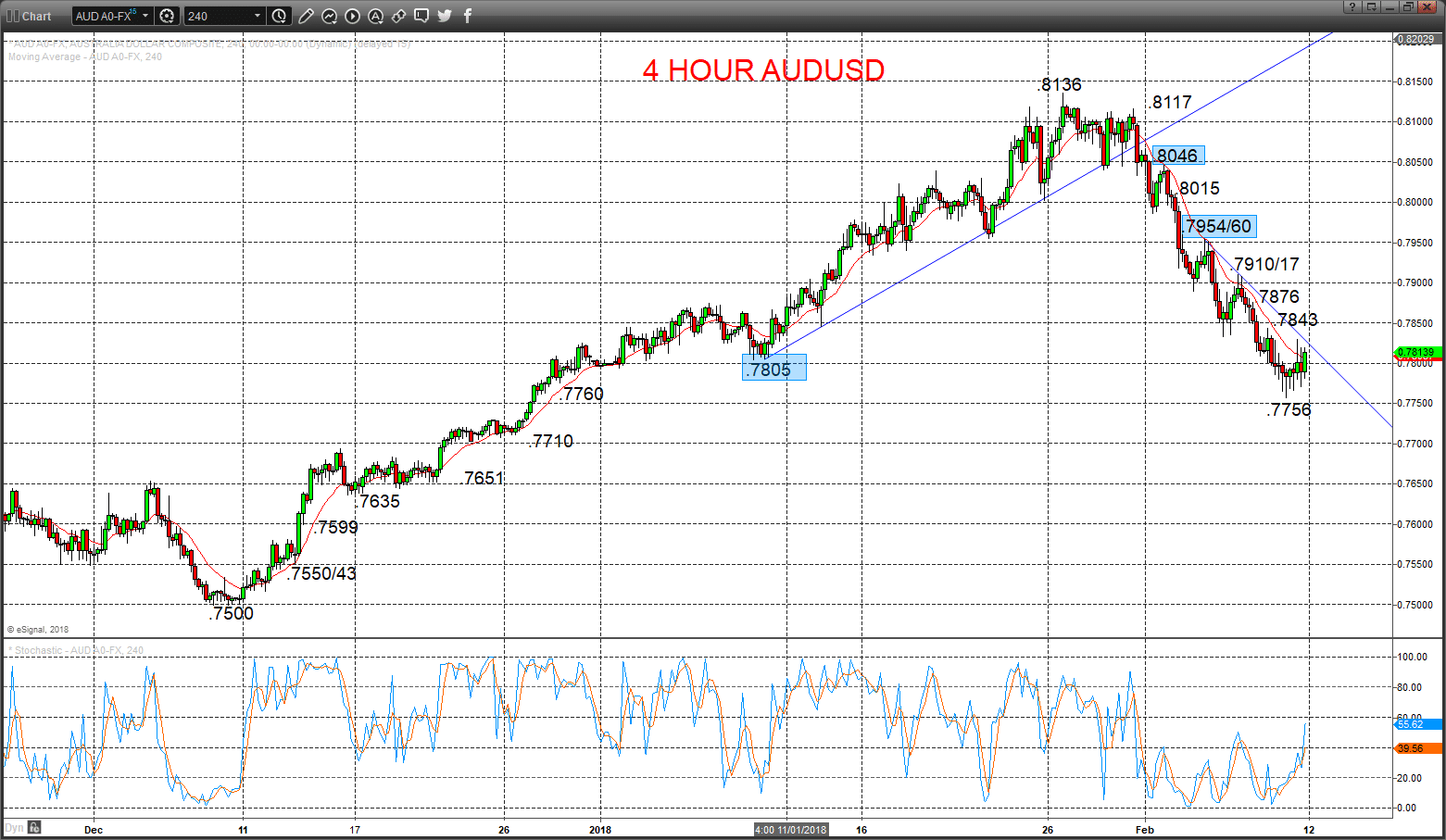

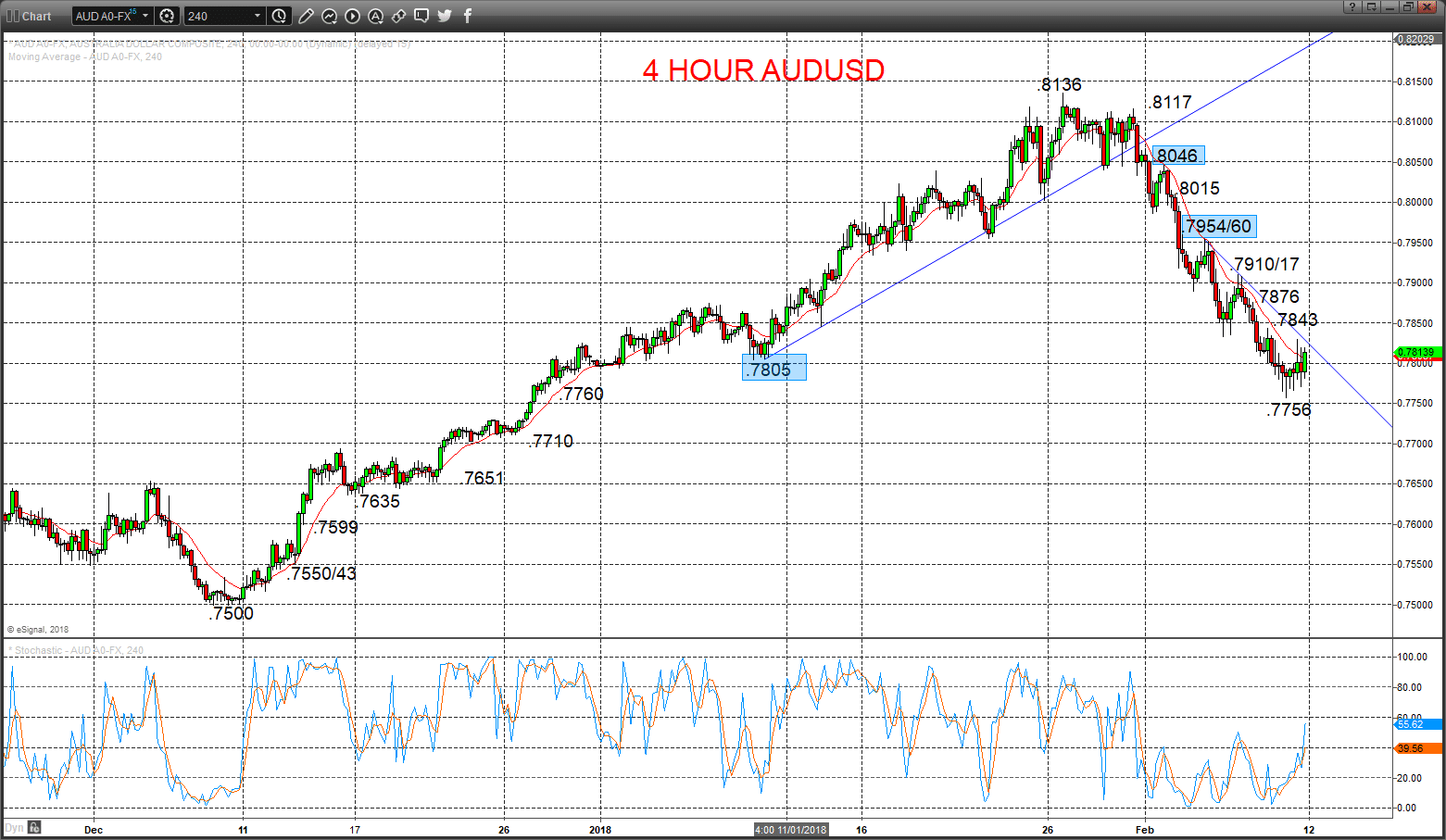

- This has seen the AUDUSD currency rate sell off through key supports, most notably recently through .7805, shifting the intermediate-term outlook to bearish..

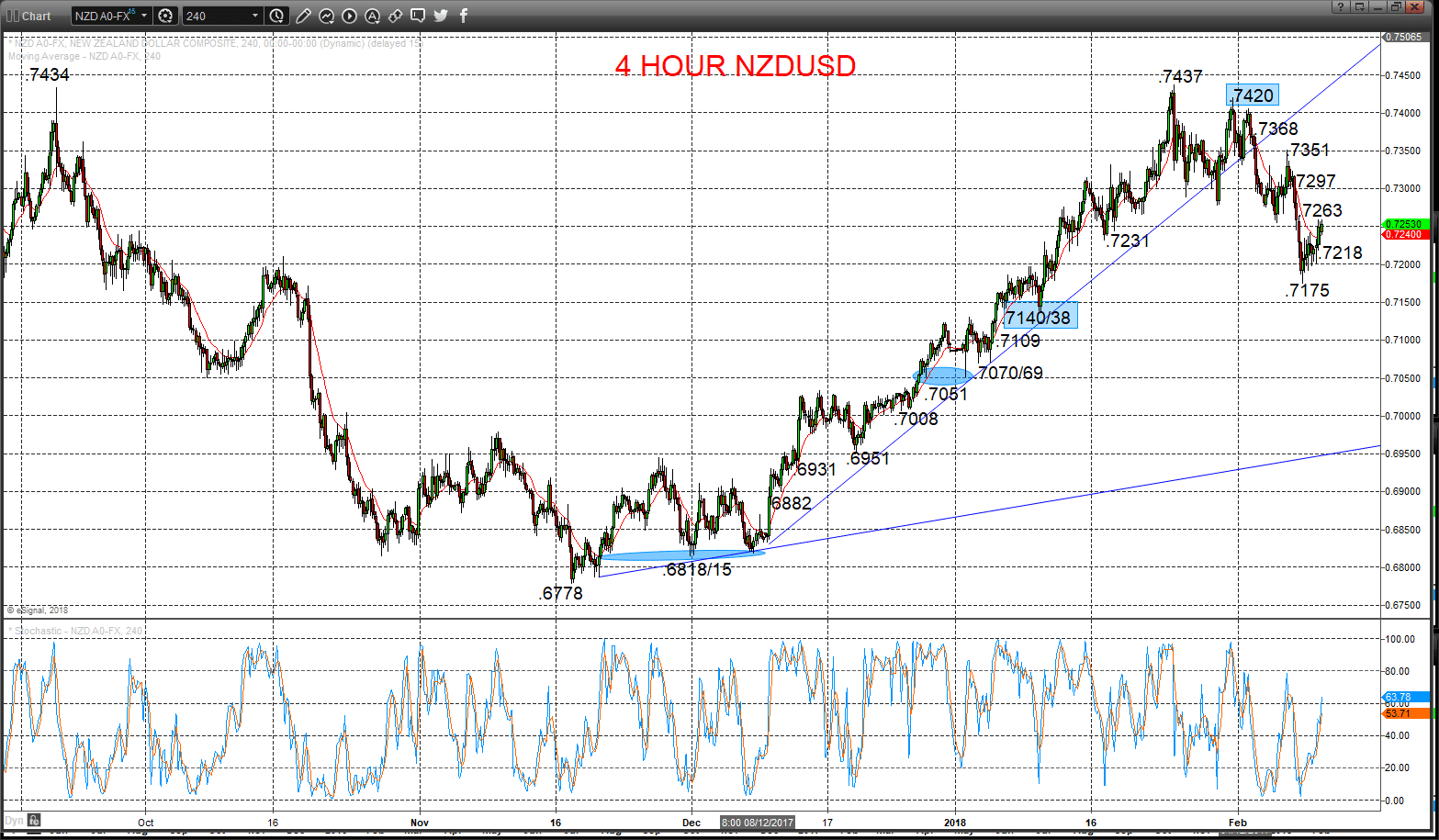

- For the NZDUSD forex rate, the recent surrender of .7231 neutralised the bullish intermediate-term trend for a non-trend environment, BUT with risk growing for a bearish shift below .7138.

AUDUSD Intermediate-term bearish shift, BUT upside correction bias

Despite the negative price action last week with the break of the key .7805 level (see below),, the dip and then firm rebound on Friday , shifts risk for a potential corrective recovery for Monday.

The early February break below .7805 produced a shift to a bearish intermediate-term view into February.

For Today:

- We see an upside bias for .7843; break here aims for .7876 and potentially targets .7910/17.

- But below .7780 opens risk down to .7756, maybe towards .7733 and even .7710.

Intermediate-term Outlook – Downside Risks:

- Whilst below .7960 we see a bear theme to target .7635 and .7500.

What Changes This? Above .7960 signals a neutral tone, shifting bullish below .8046.

Resistance and Support:

| .7910/17 | .7954/60** | .8015* | .8046** | .8117 |

| .7780 | .7756* | .7731 | .7710* | .7710* |

4 Hour AUDUSD Chart

NZDUSD Rebound bias (after prior intermediate-term shift to a range theme)

A Friday rebound from a mini-basing attempt, easing negative forces from the bearish break Wednesday through the key .7231 level, flipping the bias back to the topside for Monday .

The break below .7231 produced a shift to a range defined as .7420 to .7138, with the asymmetrical risks for a bearish shift into February below .7138.

For Today:

- We see an upside bias for .7263; break here aims for .7297, even .7351.

- But below .7218 opens risk down to .7175.

Intermediate-term Range Breakout Parameters: .7805 to .8136.

- Downside Risks: Below .7805 sees a bear trend shift to target .7635 and .7500

- Upside Risks: Above .8136 sets a bull trend to aims for .8164/66, .8295 and the .8452/82 key retracement target area.

Resistance and Support:

| .7263 | .7297* | .7351** | .7368 | .7420*** |

| .7218 | .7175 | .7138*** | .7109 | .7070/69** |

4 Hour NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.