The Australian and New Zealand Dollars have maintained their bullish tone through mid-April. Having overcome further notable resistance levels versus the US Dollar, the bias is higher for AUDUSD and NZDUSD again through month-end.

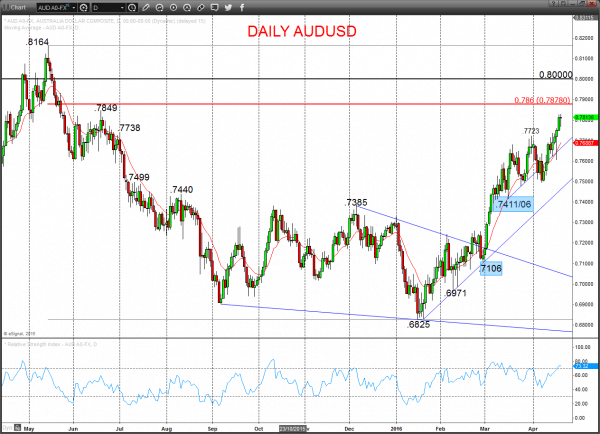

AUDUSD

A resilient, high level consolidation Wednesday after a strong upside follow-through to another new recovery high Tuesday, to build on the aggressive bullish outside Monday pattern to again leave a bull tone for Thursday.

For this week:

- We see an upside bias for .7828 and .7849; break here aims for .7878, maybe .7932.

- But below .7762/59 opens risk down to .7705/00.

Short/ Intermediate-term Outlook – Upside Risks: The break above .7243 set a bull theme.

- We see a positive tone with the bullish threat to .7738.

- Above here targets.7849 and .8000.

What Changes This? Below .7411 signals a neutral tone, only shifting negative below .7106.

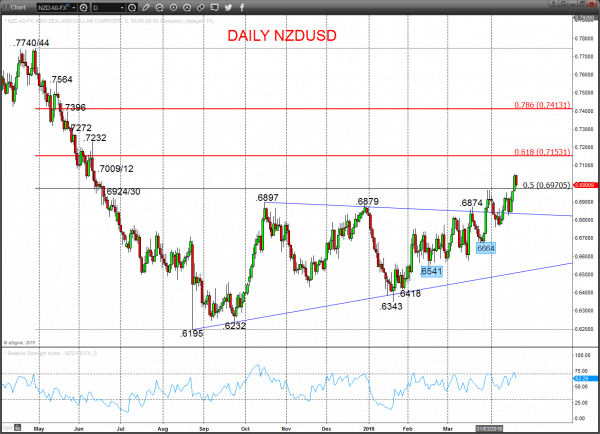

NZDUSD

A corrective dip lower Wednesday, but holding initial support at .6955/50, a correction in reaction to the Tuesday extension through 6965/66/70 and 7000/09/12 resistances and the strong rebound from trend line support on Monday (off .6842) to leave the bias higher Thursday.

For this week:

- We see an upside bias through .7054 for .7100; break here aims for .7153.

- But below .6955/50 aims for .6905/00.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to .7000/12.

- Above here targets .7232 and .7396/7413.

What Changes This? Below .6664 signals a neutral tone, only shifting negative below .6541.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.