Your assignment now is to convert the above scenario into a step-by-step trading plan that details each decision that you would have had to make. It is best that you do this on your own in order to feel comfortable with the result. You will then want to practice on a free demo system to fine-tune each step. The purpose of the plan is to remove your emotions from your decision-making process, something that every trader has difficulty doing, but must be done if you are to become consistent and survive in this investment activity. Allowing your emotions to undermine your decisions can be deadly.

There are a few extras that need to be added. We will cover those now.

- Lot Size: Assume that you have a $1,000 account. A $200 placement at “50X1” leverage would secure a 10,000-unit position in the market. A 20 basis point loss plus commission would approximate your loss limit of $25 that we established back in the initial rules section. The 10,000-lot size is known as a “Mini Lot”. 100,000 is standard. 1,000 is a “micro lot”.

- Stop-Loss Order: When you open a position, your execution order will also allow you to place a stop-loss order at the same time to protect your downside risk. This discipline is highly recommended. The way beginners get into trouble is by removing these protections, thinking that the market will surely come back. NOT!!! In our example, 20 basis points is the prudent stop-loss level, but it is never a guarantee. If market action is severe, the broker may not perform, and his contract probably exempts him from damages.

- Risk/Reward Ratio: Based on the above example, your exit targets, assuming a “2X1” or “3X1” ratio, would be 40 or 60 basis points (or “pips”) above your entry price. You will have some discretion here, but beginners usually lose their nerve and exit too early. Practice regimens can help here. Trust your plan and your indicators and the targets they suggest. Remember that a gain is not a gain until the position is closed!

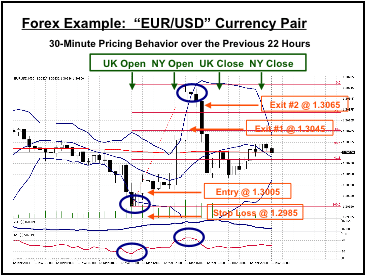

Adding these bits to the plan would produce the following chart:

After the oversold condition on the RSI and after the market bounced off the lower Bollinger Bands, an entry point of 1.3005 would follow, with a Stop-Loss order set at 1.2985. Depending on market conditions and how aggressive or conservative you may be, the 40 and 60 pip exit targets would fall at 1.3045 and 1.3065, respectively. This trade would have netted roughly $50, or a 25% return on your $200 bet.

On this particular day, there was another opportunity for gain indicated by this strategy. Can you see where it was? Trading the forex market is very flexible in that you can easily make money on the waves of motion when they go up or down. When the “oversold” condition was indicated by the RSI, the second “blue” oval in the indicator area, there was a chance to go Short-Euro.

As an exercise, you can plot how your plan would have worked, remembering that the market was moving back to the mean for the day before the New York close. Where would you enter? Where would you put your Stop-Loss? Where would you exit, based on what indications? What would your gain have been?

More Free Forex Lessons

subscribe to get a FREE BONUS LESSON, plus course updates, trade ideas and market news - straight to your inbox

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.