Arbitrage is a process whereby a trader, better known as an Arbitrageur, attempts to profit from real-time pricing inefficiencies in the market for a particular asset or grouping of assets. In the world of foreign exchange, arbitrage is primarily the domain of major banking institutions or hedge funds, although sophisticated software algorithms have created a space for independent high-frequency traders to benefit from this form of trading.

If you are a retail forex trader, then forex arbitraging may be beyond your scope, unless you are trained in automated trading techniques and have a broker that will support your effort with fast execution speeds and institutionally tight currency spreads. Profit margins tend to be very thin, especially after deducting trading costs, but, as with scalping and day trading, many small gains can add up over time.

As you read on, we will outline a few more details about this form of trading. We will discuss its history, its background and its context within today’s modern markets. We will also walk through a detailed example of what is called the triangular arbitrage process and speak to the profitability of this form of trading.

Background/Context to arbitrage

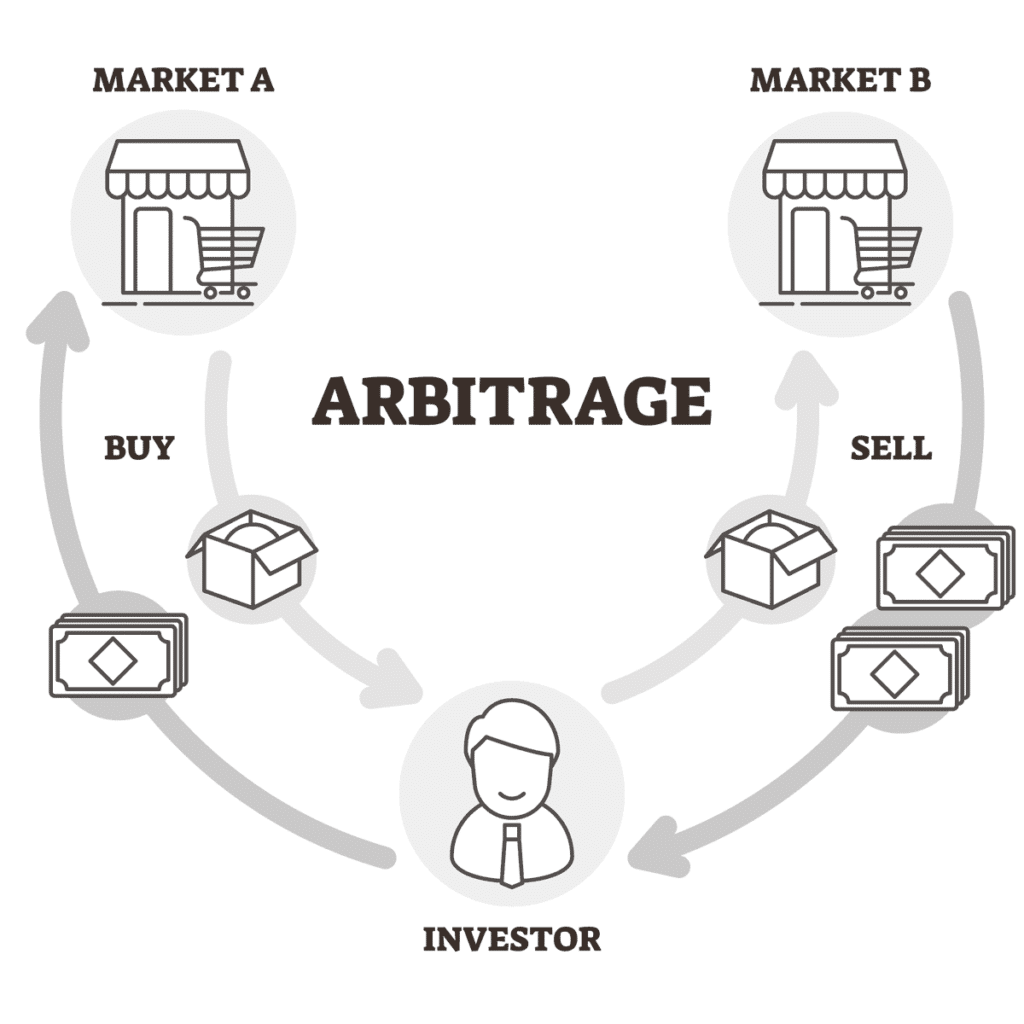

What is arbitrage? Assets simply do not always trade at the same price in different markets. Communication lag times have always created pricing discrepancies between various exchanges – especially in stock and bond markets. Nimble traders with better market access have always attempted to exploit these pricing weaknesses, and experts have always maintained that this form of speculation is good for our markets. In the short run, market-pricing inefficiencies will evaporate due to the attention paid by arbitrageurs. Stability will return, which is a good thing.

Arbitrage is, therefore, nothing new, and it is also legal. Major banks with a global footprint have been doing it for years in the foreign exchange markets. However, profit margins have shrunk as the interconnectedness of global markets, exchanges, and automated traders have been enhanced by technology. Today, highly sophisticated computer routines seek out these opportunities and execute the necessary trades in milliseconds.

In order to exploit minimal pricing discrepancies, firms focused on this arena have had to build access to a variety of markets to execute the necessary trades. For an arbitrage opportunity to arise, there typically needs to be a disruptive force that shakes the financial system across the globe. In the aftermath, various exchanges will quote prices as best as they can as the market absorbs the disruption and seeks equilibrium.

For example, a major bank in London may quote a price for the ‘EUR/JPY’, which may differ by a few pips from another major bank in Tokyo. If the arbitrageur moves quickly, they can buy in one market while selling in the other. They then wait for the two markets to synchronise at the same exchange rate to close both positions. After netting the two positions and deducting costs, there will be a small net gain, which on a trade position of 5 million euros can be sizable enough to justify the work in the back office.

As you have most likely surmised by this point, an aggressive trader staring at a computer screen does not perform this type of trading. High-frequency trading routines are the preferred tool of attack. In the forex market, the most prevalent method involves triangulation mismatches in three cross-rates. More on this type of trade appears below, but arbitrage opportunities also arise, as discussed in the previous paragraph or when swap markets and futures markets are not aligned.

The major change over the past few decades is that arbitrage opportunities were prone to exist for seconds, even minutes, before the pricing disparity disappeared. Advances in technology, especially in telecommunications, trading platforms, and artificial intelligence, have cut these timeframes down to milliseconds. In other words, individual traders cannot perform at the required level in the forex arbitrage arena today to make a profit or a difference.

Although discovery and execution speed requirements pose a formidable hurdle for an individual trader, there are tools available in today’s forex market from third parties and forex brokers that can aid in the process. If you have the appropriate broker for providing real-time price quotes where needed, then you can buy software that is called a Forex Arbitrage Calculator.

These software products, however, are much like signal providers and trading routines that promise ultra-high winning percentages. A claim is not necessarily something that will repeat positive results after a period of market volatility. The intent may be there, but it is always wise to test these products on a demo system to assess their applicability and determine if the routine is something that you fully understand and control as well.

Is forex arbitrage trading right for you? If you are a trader who enjoys the use of automated trading routines, then you might want to test out the process before adding this tool to your arsenal. There will always be events or news announcements that disrupt market conditions and bring the volatility necessary to make an arbitrage trading strategy work. If you have the necessary tools and access to lightening quick executions at razor-thin spreads, then you might be able to win at forex arbitrage on a consistent basis. Otherwise, we can always help you find another forex trading strategy that suits your trading personality and personal objectives.

Forex Arbitrage Example

There are several types of forex arbitrage. There are the two straightforward methods discussed above, involving forex pair quotes from two different exchanges and the more frequently cited method, triangulation, where the cross-rates for three currencies play a role. There are also other very technical varieties that entail buying a futures contract while also trading against interest rate differentials between two currencies. The same path can be taken in the spot and futures market, as well, but both of these alternatives require specialised brokers who cater to professionals.

The triangulation method is often demonstrated by using the Japanese Yen and a European currency when cross-rates with the US Dollar are advantageous. For this example, we will start with 1 million USD. Based on your research, the steps would proceed as follows:

- From Bank A, buy EUR at a rate of 0.9694, or 1,031,530 EUR at Bank B

- From Bank B, buy JPY at a rate of 141.82, or 146,281,600 JPY at Bank C

- From Bank C, buy USD at a rate of 146.20, or 1,000,560 USD and deposit at Bank A

In this example, the trader is exploiting disparities between cross-rates for the EUR and the JPY versus the USD. There would also be trading costs and spreads, but the opportunity, as brief as it might have been, would have roughly yielded something around $500.

This type of manoeuvre in today’s market would occur in milliseconds. Arbitrage algorithms would have done both the discovery and order executions. The entire deal would have to be done nearly instantaneously since the same forex robots at other firms would have spotted the same opportunity and moved quickly to close the gap.

Although the return in this example may seem minuscule compared to the level of capital committed to the task, these types of opportunity are frequent enough to justify the time and effort to develop the necessary software to handle each aspect of the arbitrage trade. Several firms and banks perform these actions routinely.

Forex arbitraging is not for everyone for a number of reasons. The challenges entail access to capital to enable large-scale trades from major institutions, which can enable very tight trading spreads. Not every forex broker in the brokerage community, however, is interested in high-frequency automated trades since this type of customer tends to tie up servers with their volume of trading turnover.

Related Articles

- Simple 1, 5 and 15-Minute Forex Scalping Strategies

- Forex Scalping Using Signals

- Chart Patterns Scalping Strategy

There are brokers that will accommodate forex arbitrage, and the reader must have fast execution and automated trades with tight spreads. Lastly, you must have the ability to discover and act upon arbitrage opportunities in milliseconds when they make themselves known. Tools are available, but they are but one piece of the arbitrage puzzle.

Conclusion

Is forex arbitrage still relevant today? Yes, but today’s arbitrageur is more likely than not to be a member of a major banking institution or a global hedge fund. Automated trading has been ramped up over the past few decades in the forex space. As such, these potential trades require dedicated software and capital to reap acceptable profit margins, but volatility will always create arbitrage opportunities.

Is forex arbitrage right for you? The barriers to entry in this field can be daunting for an individual, but it is not impossible. There are brokers with fast execution platforms and razor-thin spreads that will support your effort. Find a good Forex Arbitrage Calculator, test it out on a demo system, and get familiar with its use. If the opportunity is still appealing to you, give it a go to see if it warrants your time over traditional forex trading, but enjoy the process, if it works for you.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.