Trading in the forex markets is essentially binary. The price of a currency might go up or down, and a trade might post a win or a loss. At that simple level, trading the forex markets could be equated to gambling or making decisions based on chance, somewhat similar to a coin toss. The difference between forex trading and gambling, and the reason some investors can make sustained financial returns, is that various strategies and techniques can be used to create a more professional approach. These are the money management and risk analysis guidelines to follow to move your forex trading to the next level and tilt the odds in your favour.

Is Forex Trading Gambling?

One of the easiest ways to move away from your forex trades being random gambling is to develop a trading strategy and apply it with a degree of discipline. Taking that approach to a higher level would include conducting post-trade analysis to establish what works and what doesn’t and incorporating that information into your future trading.

Forex trading differs from gambling because good brokers provide a range of tools which allow you to test strategies in risk-free environments. That enables you to make mistakes for no monetary loss and gives you greater confidence when you move on to trade with real cash. Gambling casinos don’t offer such services and, in reality, rely on catching people’ cold.’

It’s also worth considering the level to which you can work on improving the odds of being successful. Casino games, such as roulette, are entirely chance-based. While some blackjack players may develop the underlying skill of card counting, compared to a well-developed forex strategy, gambling in a casino offers fewer opportunities to invest in developing your understanding of the situation.

Trading Forex as a Business

Adopting an approach where you treat your forex trading like a business will take you to one of the most crucial elements of the process – understanding your investment aims. Once you develop a clear understanding of what return you want to make, over what period, and what losses you are willing to accept, you can engineer an approach that gives you the best chance of meeting your targets.

If you want to make a net 15% return on your account in the space of one month, you’ll have to trade different strategies than if you want to make 10% over the course of a year. You’ll also have to consider which forex market to trade, as different currency pairs have varying levels of price volatility. Some are better suited to short-term day trading and some for longer-term strategies.

You should develop a professional, business-like approach before you book your first real trade. And once you are trading, it is important to remain disciplined. A successful trading mindset will include accepting that not all trades will be winners. The aim of any forex strategy should be to consistently make net-positive returns rather than trade ‘perfectly’. The benchmark of success will not be returns posted by other traders or the overall performance of any market but whether you are on course to meet your investment aims.

Managing Risk

Accepting that not all trades will be winners opens the door to incorporating risk management into your approach. An effective strategy will build in instructions such as a stop-loss, which will close out a losing trade and crystalise a loss. No trader likes losses, but allowing bad positions to run is one of the main reasons inexperienced beginners blow up their accounts.

Sticking with the philosophy that the ultimate aim is to meet your investment targets, not to become rich overnight, also involves securing profits on winning trades. Instructions such as take-profit orders can be booked into your trading dashboard to automatically crystalise gains even if you are away from your screen.

Using stop-loss and take-profit instructions is still no guarantee of overall success. If your strategy is set up to trade certain market conditions, but news events cause a shift in market dynamics, you could enter a sustained losing streak. It is essential to monitor news events and metrics such as price volatility, which indicate market sentiment.

Another risk management tool which can help you navigate the markets is money management. Whereas a gambler may allocate cash randomly, there are techniques which forex investors use to determine how much capital to allocate to particular trades. Adjusting position size over time can be done by using the risk-reward ratio to determine position size.

Forex Trading Strategies

Designing a forex strategy requires a combination of higher-level thinking and hands-on testing. The process should be iterative so that lessons are learned on the way. Following the below steps doesn’t guarantee your trading will be profitable, but it will allow you to consider a wide range of factors. It will make you better prepared and even test if your theoretical conclusions are backed up by historical events.

Strategy Design

Spotting trading opportunities can be achieved using fundamental or technical analysis or a combination of both. Fundamental analysis in forex markets considers real-world events such as decisions by central banks to increase interest rates, the relative strength of the economies of two countries, or geopolitical news events. Technical analysis is based on market data. It considers historical price moves and trade volumes to identify patterns which might determine future price moves. It is enhanced by using indicators, which are easy-to-use statistical formulae that crunch particular data sets to give traders a sense of the market’s mood.

Backtesting

Once you’ve established when the next trading opportunity might arise and what catalysts might trigger it, you can test your analysis using historical data. Backtesting allows you to verify if your strategy would have been successful.

Backtesting is limited by the obvious caveat that you are applying a strategy to a previous period. Market conditions can alter in an instant, and all strategies are exposed to the risk of a paradigm shift.

Demo Account Trading

The risk-free way to establish if your strategy is suited to current market conditions is to book trades in a Demo account. That will allow you to trade using live prices but virtual funds. It is also an opportunity to try different money management techniques to see how allocating different amounts of capital to trades impacts overall returns. There is still the risk that when you switch to using real cash, it coincides with a change in market conditions; however, the testing process should highlight errors in your analysis that can be corrected before going live.

Post-trade Analysis

Reviewing your trading performance is a crucial part of the investment process. It can pinpoint why trades did or didn’t work and if you closed positions too early or too late. That information can be fed back into your trading strategy so that your approach factors in current market conditions. There are a variety of metrics which can be used to establish how well your strategy is performing and why, with the below being some of the most commonly used tools.

- P&L – cash is king, so the profit and loss reading on individual trades and your overall portfolio is a key metric to consider.

- Win-Loss ratio – calculated by dividing the number of winning trades by the number of losing ones.

- Risk-return ratio – the expected return on a trade divided by the expected loss should the initial decision to buy or sell be the wrong one.

- Sharpe ratio – this mathematical formula is one of the most widely used methods for measuring risk-adjusted relative returns. It not only considers the overall return of a portfolio but also the volatility of those returns. The higher a fund’s Sharpe ratio, the better its returns have been relative to the amount of investment risk taken.

Avoid Over-Optimisation

One potential pitfall to avoid is over-optimisation, the building of a strategy which maximises returns in certain market conditions, whereas the aim should be to develop a trading format which can be applied to a range of market situations.

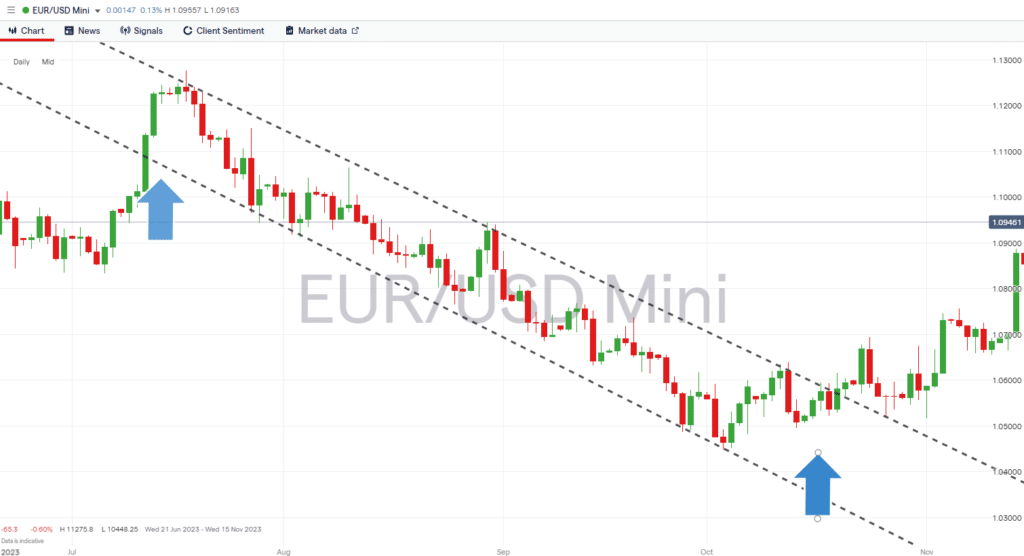

An example of over-optimisation would be designing a strategy in the EURUSD market based on data during a period when the price traded in a narrow downward channel. Deciding that a trend-following strategy is the best approach appears logical. However, following a change in market conditions when the following period is marked by higher price volatility and sideways trading, a mean-reversal strategy would have been more effective.

EURUSD Daily Price Chart – Downwards Trend

Source: IG

EURUSD Daily Price Chart – Sideway Trade Pattern

Source: IG

Creating a Trading Plan

Military tacticians might be correct that the first casualty of battle is the plan. However, developing an approach that accounts for possible eventualities can help you maintain discipline and avoid emotional trading.

Once real cash is applied to positions, the fluctuating P&L on trades can play havoc with a trader’s mindset. Psychological studies relating to loss aversion show that many individuals fear loss more than they appreciate gains, which can result in closing out winning trades earlier than is optimal to avoid them becoming losers. It can also result in traders not using stop losses or adjusting them mid-trade to try, unsuccessfully, to prevent crystalising losses.

An effective plan should also consider external influences. If the market has significantly altered, it is probably a good idea to cease trading and return to designing a strategy. It is crucial to trade the markets in front of you rather than what you think the market ought to be.

Avoid Gambler’s Conceit

Although trading forex can be seen as unrelated to gambling, some elements of gambling philosophy and mindset can be considered to help you become a better trader. Gambler’s conceit, for example, explains how a trader accounts for winning trades being down to their exceptional luck, skill, or insight. Fortified with this false confidence, when inevitable losses occur, they will ponder what went wrong with their trade, which indicator, and which scheme needs to be revised and refined instead of accepting and understanding that gains are unlikely to be permanent.

Gambler’s conceit, especially when it forms on a highly leveraged account, can result in winning trades potentially being even more destructive than losing ones. Losses teach a trader to be humble and lead to a review and revision of trading methods. Conversely, gains can result in hubris and the continuation of a trading approach that generates returns based on luck rather than skill. The analogy would be that although statistically unlikely, a coin tossed ten times could turn up heads ten times and tails none. In the same way, ten winning trades based on luck are not proof that a trader or their strategy is set up to make consistent gains.

The first step toward avoiding gambler’s conceit is to be aware of the issue. The second is to keep your investment aims in mind and not to seek exceptional results but consistency. That involves sticking with a well-thought-out strategy, which includes trade entry and exit points. It is essential to constantly try to improve your skills and recognise your errors. And if you hit a losing streak, it is probably time to take a break from trading and reevaluate your approach in a risk-free environment.

Final Thoughts

Unsophisticated forex traders have a lot in common with the casual gambler. Moving away from that approach involves developing a better understanding of the markets, your aims, and your trading style. There are still no guarantees of success, but having a well-thought-out strategy does help you approach the situation in the best possible way. It can help you navigate the markets when surprise events inevitably occur.

Further reading:

- All our articles about money management

- Our top five money management tips.

- Determine the position size using the risk reward ratio.

- Key risk management principles when trading forex.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.