In “Part 1” of this two-part series, we outlined a very powerful forex trading strategy, commonly known as the “Range Expansion Reversal Strategy.” This strategy takes advantage of the tendency of markets to revert back to their mean average over time. In this case, we focus on the average daily trading range of a currency pair and look for high-probability situations where pricing behavior will complete a range move after markets open in New York.

The added benefit here is that you do not have to get up at 3:00 in the morning to catch the wave generated during the London session. The goal in this case is to seize those situations where momentum has built up and capitalize on the steam that remains. As we have always counseled at ForexTraders, you must approach the forex market with a disciplined plan and be ready to adapt to changing market conditions.

Trend-following strategies are the foremost way of achieving this objective, and this strategy is a derivation on that theme. As we have all learned, trading currencies involves high risk. There is a “50/50” chance as to where the market might move in the next moment. Achieving a “55/45” ratio in gains over losses will keep your broker happy and in the money, but if you want to succeed at this craft, you must aim for a “60/40” ratio for consistent net positive performance in your favor.

What to Look for and What to Avoid with this Strategy

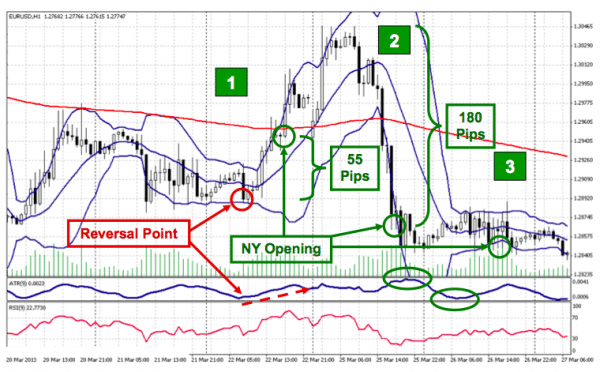

Let’s start by reviewing the following chart of pricing behavior for the “EUR/USD” pair:

From our earlier discussion and literature on the web, the Range Expansion Reversal Strategy is essentially a reversion to the mean strategy. Reversion to the mean is a statistical term that refers to the following mathematical law: over time, data will tend to return to the mean, or average, of the entire data set.

Therefore, in this strategy that means that as a currency pair exhausts its daily range each day or is in the midst of expanding it, it tends to reverse at some point and return back to achieving the average daily range. The reversal point is often a strong support or resistance level established recently, typically determined visually or with the aid of Fibonacci tools. The goal then becomes fading the daily momentum in anticipation that the currency pair will return back into its daily range or expand to fill it.

There are three situations depicted in the above diagram. The first situation is a high-percentage set-up, while the next two are exceptions to the rule that should be avoided to improve your performance with this strategy. Let’s review the characteristics of each situation.

Paul Tudor Jones, a very famous trader that amassed a billion dollar fortune from his trading prowess, once remarked, “When you see a range expansion, the market is sending a very loud, clear signal that it is getting ready to move in the direction of that expansion.” In “Situation 1”, the Euro began a strengthening move during the Asian session, then reversed off support established the previous day, just prior to the London open. The ATR indicator began ascending at that point, a range expansion signal that Jones would have surely noticed.

The London session added 55 pips, far short of its daily average of 120, setting the stage for the impending New York opening. The odds favoring a trade set-up are always increased when you have more evidence to support your interpretation. Here we have a reversal off support, range expansion, and ample room left in the average daily range to absorb. The trend wave is set to move upward, offering a good opportunity for gain.

This reversal strategy does not always work, as can be seen in the next two examples. In “Situation 2”, the Euro continued its upward run, but reversed severely during London trading, overrunning its daily average by a full 60 pips. New York trading was flat. Would there be a bounce back in “Situation 3”? Not in this case. Think of in terms of an athlete that has expended maximum effort, but has nothing left in his energy tanks to do a quick repeat performance. When a Max and Min of the ATR come so close together, it is an indication that volatility has run its course. The market needs time to recover.

Entry Points and Risk Mitigation

This strategy favors a quick-in, quick-out mentality. Since we are dealing within a pre-defined range of circumstances, namely the average true range and how much room is left for potential momentum gains, our profit expectations must be modified accordingly. Before jumping into a position, it is also helpful to know where key support and resistance levels reside. Applying the average daily range to the high or low for the London session is one factor. It is also recommended to review past trading history for similar price levels and to apply Fibonacci lines to previous strong market movements.

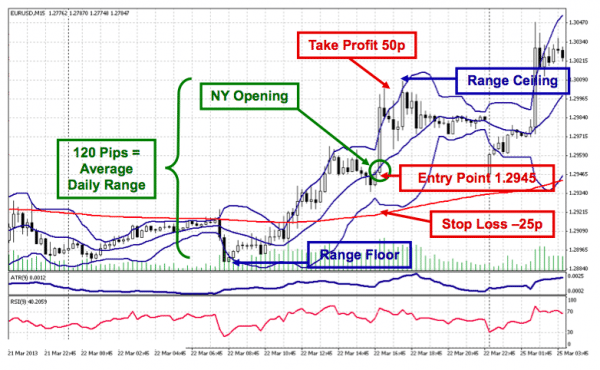

In order to finalize our execution instructions for “Situation 1”, let’s take a closer look at it under a 15-Minute microscope, as depicted in the following chart:

The focus again is to take advantage of what might transpire during New York trading. In this example, momentum started in London, and all signs suggested that it would continue when New York opened. The best entry point in this case is to wait for the usual profit taking on a positive run, which typically occurs before New York opens, to run its course. A Stop-Loss order of 25 to 30 pips is recommended (25 is taken here), with a “2X1” reward/risk ratio applied to establish a prudent Take-Profit position. In this case, that figure fell just below the projected ceiling for the average daily range.

It is not prudent to get too greedy with this strategy. Patience is often the order of the day, since it may take time to develop on a short timeframe window, but trust your instincts and disciplined approach to the market. Part of the reason this strategy works is that other traders and automated trading robots are wise to these predictable moves. You can assume that much of the trading community is already savvy to the above expectations before you are. For this reason, it is advisable to get in and get out quickly. Be happy with a 50-pip gain. The more often the better, and this set-up occurs more frequently than you might imagine. Be patient, but be prepared to act quickly.

Recap of the Range Expansion Reversal Strategy

The Range Expansion Reversal Strategy can yield many profitable trading set-ups, as long as you apply these principles carefully and heed the exceptions to the rule – avoid the set-up if the average daily range has been exceeded during the London session and avoid situations where volatility has hit high and low levels in a very short period of time. The simple fact is that strategies based on averages work best under normal situations, but when chaos prevails, most formulaic approaches go out the window.

Only very experienced traders are adept at making gains during chaotic trading sessions. It is often best to wait until the dust settles before venturing back into the choppy waters of forex. Your objective is consistency, based on a step-by-step trading plan that adapts to changing situations in the marketplace. You make your own luck, so to speak. Those gambling traders that depend on luck soon become market casualties. The staff at ForexTraders.com is committed to helping you make your own luck!

We now recommend you to read this article on common technical patterns.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.