If money management is one half of trading, determination of entry/exit points constitutes the other half. No amount of successful analysis will be useful if we can’t determine good trigger points for our trades. Even if we know that the value of a currency pair will appreciate in the future, unless we have a clear conception of when that appreciation will occur, and where it will end, our knowledge is unlikely to bring us great profits. Similarly, even in the unfortunate situation where the analysis that justified the opening of a position is false, mastery of trade timing might allow us to register positive returns due to the high volatility in the forex market. Clearly, we need powerful strategies to help us calculate the best trigger values for a trade warranted by careful and patient analysis.

We have discussed the various ways of creating stop-loss orders on this website, and in this article we’ll continue on that theme by handling this subject in a more general way by identifying some principles for the management of our positions. The opening and closing of a position are the most frequent activities of any trader; it is obvious that this should also be the subject to which we devote the greatest attention. However, as in the case of a doctor or an engineer, the final task that is performed routinely and most frequently depends on certain skills, education and study which for the most part lack any obvious relationship to it. Thus, it is important to note that the study of trade timing is one of the final lessons for which the trader must prepare himself. The other courses that would lead us to this subject, such as technical and fundamental analysis, may not always have clearly definable benefits at first sight, but they pave the way to our ultimate goal of timing our trades successfully and profiting from them.

Before going into the technical aspects that complicate our trading decisions, we must say a few words on the necessity of emotional control in ensuring a successful and meaningful trading process. Let’s repeat again, as we’ve done many times on this site, that without proper control over our feelings not a single word in this text would help us to trade profitably. The psychological endurance necessary for achieving a successful trading career is an important precursor to both money management and trade timing. Consequently, even before beginning the study of trade timing, we must concentrate our energies toward the goal of understanding and restraining our emotions, and gaining control over the psychological aspects of decision-making in a trading career.

The Main Principle of Trade Timing

The first principle of trade timing is that it’s impossible to be certain about both the price and the technical pattern at the same time. The trader can base their timing on the actualization of a technical formation, or they can base it on a price level, and they can ensure that their trade is only executed when either of these events occur, but they cannot formulate a forex strategy where their trade will be executed when both of these occur at the same time. Of course it is possible that by chance a predefined price level is reached precisely at the time that the desired technical pattern occurs, but this is rare, and unpredictable.

Supposing that the trader is desiring to buy one lot of the EURUSD pair, they have the option of basing their entry point on the realization of a technical pattern, or the reaching of a price. For example, they may decide that they’ll buy the pair when the RSI indicator is at an oversold level. Or they may decide, for money management purposes, that they’ll buy it at 1.35, to reduce their risk. Similarly, they may choose to place their stop-loss order at the price point where the RSI reaches 50, or they may choose to enter an absolute stop-loss order at 1.345, to cut losses short. But due to the unpredictability of the price action it is not possible to define an RSI level, and a price level at the same time for the same trade.

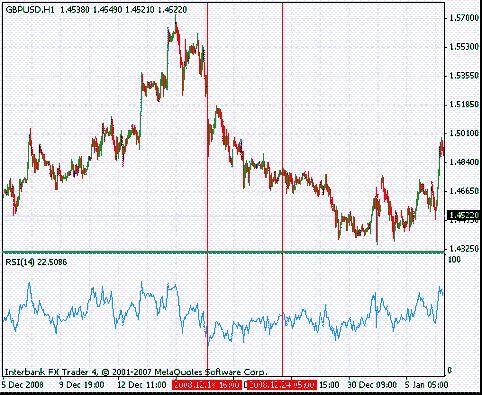

We may examine this further on a chart.

This is an hourly chart of the GBPUSD pair between 5 December 2008 and 5 January 2009. We’re supposing that we opened a long position at around 1.5, where the RSI registered an extreme value at 24. In this case we expect to close our position when the value of the indicator rises above 50, to acquire healthy profits while not risking too much by staying in the market for long. We could have alternatively placed a real stop-loss order at 1.48, for example, but we decide not to do so because of the high volatility in the market. However we do expect that if the RSI rises, we will not need a stop-loss order, because the price would have been at a higher level indicating a profit, since it’s supposed to rise with a rising price.

But such is not the case, as we can see in the picture above. When the RSI had risen to 49.35 on the chart, which is a close enough point for our goal on the indicator, our position is, surprisingly, in the red. Not only do we fail to match our stop-loss to a lower price, but we actually match a lower price with our take profit point, which was 50 as mentioned. To put it shortly, the indicator converged on the price action, contrary to our expectation that it would move in parallel.

How to time our trades: Layered trade orders

What are the lessons derived from this example? First, the correspondence between technical values and actual prices is weak. And as we stated in the beginning, it’s not possible to base our trade timing on a price and an indicator at the same time. Second, technical indicators have a tendency to surprise, and how much a trader relies on them will depend on both his risk tolerance and trading preferences. Lastly, technical divergences, while useful as indicators, can also be dangerous when they occur at the time when we are willing to realize a profit.

So what is the use of technical analysis in timing our trades? Most importantly, how are we going to ensure that we don’t suffer great losses when divergences on the indicators appear and invalidate our strategy, and blur our power of foresight?

The potential of the divergence/convergence phenomenon for creating entry points has been examined extensively by the trader community, but its tendency to complicate the exit point has not received much attention. But it is just one of the many aspects of trade timing that is complicated by the unexpected inconsistencies which appear between price and everything else. So if we had the choice, we would prefer to exclude price from all the calculations made in order to reduce the degree of uncertainty and chaos from our trades. Unfortunately that is not possible, as price is the only determinant of profit and loss in our trades.

In trade timing, the trader has to take some risk. The best way of taking the risk and avoiding excessive losses is using a layered defense line, so to speak, against market fluctuations and adverse movements and we discussed how to do this in our article on stop loss orders. The best way of taking the risk and maximizing our profits is the subject of entry timing, and the best way of doing so is using an attack line that is also layered. What do we mean by that?

In ancient warfare, it was well-understood that the commander must keep some of their forces fresh and uncommitted to exploit the opportunities and crises that arise during the course of a battle. For instance, if the commander had run out of cavalry reserves when the enemy launched a major charge against one of their flanks, they might have found themselves in an extremely unpleasant situation. Similarly, if they had no rested and ready troops to mount a charge at the time their opponent demonstrated signs of exhaustion, a major opportunity would have been lost.

The layered attack technique of the trader aims to utilize the same principle with the purpose of not running out of capital at the crucial moment. In essence we want to make sure that we commit our assets (that is our capital) in a layered, gradual manner for the dual purpose of eliminating the problems caused by faulty timing, and also outlasting the periods associated with greatest volatility. By opening a position with only a small portion of our capital, we ensure that the initial risk taken is small. By adding to it gradually, we make sure that our rising profits are riding a trend that has the potential to last long. Finally, by committing our capital when the trend shows signs of weakness, we build up our own confidence, while controlling our risk properly by placing our stop-loss orders on a price level that may bring profits instead of losses.

To sum it up, the golden rule of trade timing is to keep it small, and to avoid timing by entering a position gradually. Since it is not possible to know anything about the markets with certainty, we will seek to have our scenario confirmed by market action through gradual, small positions that are built up in time. This scheme will eliminate the complicated issues associated with trade timing, while allowing us great comfort while entering and exiting trades.

Of course, there are cases where the risk/reward ratio is so positive that there is no great necessity for gradual entries. In such cases, the exact price where the position is opened is not very important. So we will not be discussing such situations in this article.

Conclusion

In surveys on what traders find most difficult about trading, timing often comes up as the top issue. Since timing is the only variable that directly influences the profit or loss of a position, the emotional intensity of the decision is great. While it is expected that every successful trader will achieve a degree of emotional control and confidence, the pressures of trade timing are often so severe for many beginners that the process that leads to a calm and patient attitude to trading never has a chance to develop.

To avoid this problem, the role of trade timing must be minimized, at least at the beginning of a trader’s career. And this can only be achieved if the size of the position is built up along with the trader’s confidence in it, and stop-loss orders are created where the closing of the position may result in gains, albeit small. All these factors lead us to consider the gradual method to be the best one for trade timing, while minimizing our risk.

Further reading:

Read more on stop loss orders.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.