The USD Index is a calculated measure of the value of the US dollar versus a select grouping of foreign currencies. It also goes by other names such as USDX, DXY and DX. Sometimes, it is informally referred to as the ‘Dixie’. It is not a measure weighted against the other seven major currencies. The six pairings that have been chosen are said to approximate the major trading partners of the US over time. Six are majors, and one is a minor currency of note.

The so-called ‘basket of currencies’ has a separate weighting for each participating pair, such that the total value of the index at any given point in time is a computation of six market values, comprised as follows:

- Euro – EUR/USD – 57.6%

- Japanese yen – USD/JPY – 13.6%

- Pound sterling – GBP/USD – 11.9%

- Canadian dollar – USD/CAD – 9.1%

- Swedish krona – USD/SEK – 4.2%

- Swiss franc – CFH/USD – 3.6%

The plotting of these values over time can be found from a number of sources on the internet. A chart for the last five years, courtesy of TradingView, is as follows:

The USDX had begun to surge north back in 2018, based on strong economic results in the US market. When the COVID-19 pandemic erupted around the globe in 2020, the US dollar pulled back, but it eventually charged back, as other economies floundered. The ‘100.0’ value is seen as parity over the long term, if all economies were to come into balance, which is rarely the case.

As US trading partners struggled with fiscal and economic programs to respond to the ravages of COVID-19, the US dollar and economy did not follow suit. The Federal Reserve has begun raising interest rates to combat inflation, while other central banks are taking a more cautious approach. As a result, the USD Index has risen 25% in nearly two years.

Can the USD rise higher? Is it due for a major pullback? How can a forex trader take advantage of the eventual decline in this index? In this article, we attempt to find answers to these questions, while also providing more background information related to the Dixie.

Background/Context

What is the USD Index? Its definition is an answer to another question: how do you determine the relative value of the US dollar versus the rest of the world’s currencies? To be all-inclusive would seem to be too great a challenge, and for that reason and because many currency values are fixed or regulated, a shortcut was taken back in March 1973, when the Bretton Woods Agreement came to an end, and the USD joined other currencies in a floating global forex market.

The weightings described above have remained as stipulated, except for one change. When the euro was introduced, a single accommodation was made to reweight each currency pair so as to yield an equivalent value at the time of conversion. Since the 1970s, various exchanges have created financial products to mimic the value of the USD Index to enable traders to take advantage of the opportunities created by the index. Today, it is possible to trade futures, options, exchange-traded funds (ETFs) and mutual funds that are tied to the fluctuations of the Dixie.

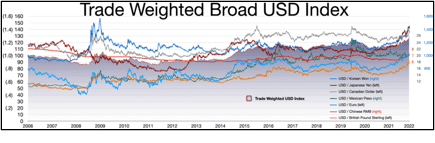

Industry observers have noted that globalisation has reshaped international trading relationships in the past few decades. They argue that the USD Index misrepresents the relative value of the greenback, and they suggest that changes are needed to allow for influences from China, South Korea, Brazil and Mexico. Since 1998, the Federal Reserve has attempted to accommodate these arguments with its broadly weighted USD Index, tied to the changing values of the major trading partners of the US. Here is a current version, courtesy of Wikipedia:

From this broader perspective, the USD has not accelerated in value over the past five years quite as radically as in the primary USD Index example depicted in the introduction. The broadly based chart, however, does not reflect the sudden surge in 2022. When you take into account these timing differences, the two charts are fairly consistent in their representations.

Since the differences are minimal and since the Federal Reserve does not update this broadly weighted index on a real-time basis, analysts, government officials and traders confidently regard the USD Index as a fair representation of the strength of the US dollar. Since the index is so heavily weighted to the value of the euro, it is often said that the index moves comparably in an inverse correlation with the popular EUR/USD currency pair.

Indices are nothing new in financial markets. The Dow Jones Industrial Average has a long history and provides a quick reference point as to how major companies and the US economy are performing. Its participants have changed over time, as have its weightings. What is comparatively new, however, is index trading. Futures contracts on major exchanges provide a basis for creating a host of funds that enable the buying and selling of shares in a fund, whether it is an ETF or a mutual fund.

Nearly every forex broker has responded to these changes in trading alternatives by expanding their portfolios to include various indices across the globe, including the USD Index. You may either buy shares in the funds directly or speculate through the use of contracts for differences (CFDs) with your forex broker. The benefit of index trading is that fees tend to be low and risk management issues are lessened due to the broad diversification of asset groupings.

Related Articles

While index trading has its benefits, the availability of leverage is very limited. With traditional forex trading, a trader can access levels of leverage from ‘30:1’ and up for major currency pairings, depending on their country of residency. Trading of indices may only have access to margin at a cost and at much lower amounts. Leverage can magnify gains, but it can also magnify losses. Caution in its usage is always advised, especially for beginners.

Example of the USD Index Long-Term Trend

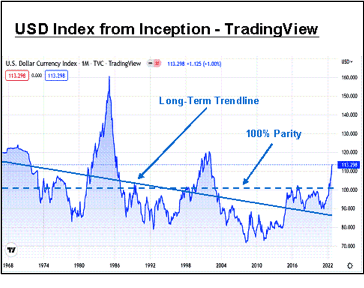

If you only relied upon the five-year chart depicted above in the introduction, you might reach an incorrect conclusion about the value of the US dollar over the past 50 years. Would you believe that the long-term trend is actually downward in its formation? The Federal Reserve has consistently expanded the US dollar money supply in circulation, without the curbs and limitations that other countries face in order to trade internationally.

The US dollar is the world’s reserve currency, due to its stability and the US economy, but the following chart depicts how waves in the value of the USDX have fluctuated over time:

Calculations were actually made prior to the floating of the US dollar on global forex markets in 1973, but at commencement, the parity value of ‘100.0’ marked its introduction. A dotted line denotes this parity value over the ensuing time period. From its beginning, it has been a rollercoaster ride, ascending to as high as 160 in 1984 and descending to as low as nearly 70 in 2007. The Great Recession produce a great deal of economic carnage, but the US dollar has been roaring back since its low point prior to the financial crisis.

With the USD Index behaving in such a wavelike fashion, how can a forex trader cash in on the opportunities presented? Based on the triennial survey taken by the Bank for International Settlements (BIS), anywhere from 80% to 90% of all currency trades involve a pairing with the USD. A unique property of the US dollar is that it often strengthens during times of global economic uncertainty or when the US economy is leading the pack.

The path of the index over the previous 15 years is evidence of these two properties, but is the index about to reverse? The USD Index has had a tendency to establish long-term trends, but it has also fluctuated from time to time within well-defined channels. There is also a trading strategy of the index referred to as the ‘USD Smile Theory’. Risk aversion and a weak US economy tend to reverse and form a ‘smile’ during a recovery phase. Can you see the recent ‘smile’ that has almost completely formed?

Technical interpretations, based on previous pricing behaviour, can often beat the odds, but they can also be incorrect. A reversal looks imminent, but be wary.

Conclusion

The USD Index has more than 50 years of recorded history. Although it is a weighted index involving only six currency pairs, it is still regarded as the best barometer that we have for instantly reflecting the relative value of the dollar. Analysts and commentators use it for such reasons, even though it is an approximation of its relative value.

Forex traders can take advantage of the predictable wavelike character of the USDX by trading directly in the futures markets or indirectly though ETFs, mutual funds or CFDs.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.