The Euro/US Dollar currency pair (also referred to as EURUSD and EUR/USD) is the most actively traded pair in the world. In this article, we will examine how EURUSD is performing.

EURUSD Key Stats

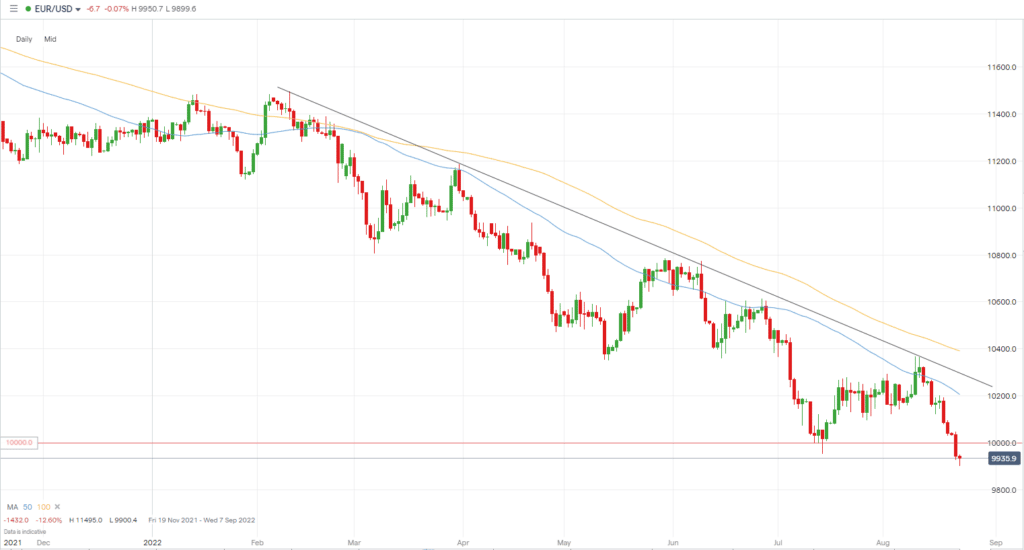

- 2021 high: 1.2349

- 2021 low: 1.1186

- YTD high: 1.1494

- YTD low: 0.9952

- YTD % change: -11.97%

EURUSD Forecast

The euro has had a torrid time over the last year or more, tumbling as inflation skyrockets and Russia’s invasion of Ukraine pushes energy prices significantly higher. The euro dropped below parity for the first time since 2002 earlier this year as a result of the pressures and the ECB’s initial lack of reaction, and after a brief move back above, it fell back below again, hitting a low of 0.99. Unfortunately, with the current dollar strength and euro weakness, it’s hard not to expect further downside. However, it is best to keep shorter targets because the bearish move is extremely stretched.

EURUSD Fundamental Analysis

As mentioned, over recent months, the euro has been a heavy talking point due to it falling below parity with the dollar. The ECB’s decisions caused much debate, but they did raise rates in July, initially boosting the European bloc’s currency before the dollar showed its strength once again. ECB President Christine Lagarde has previously said they are ready to ‘move faster’ on rates if needed. However, given the complexities of managing the various economies within the euro, finding the right balance seems almost impossible. Moreover, with inflation still rising, it’s hard to have a positive outlook at this moment in time.

The USD is the go-to currency for most, especially during times of economic instability. This is due to the power of the USA economy and the fact the USD is the reserve currency for international trade. As a result, the currency has earned the title of “King Dollar,” which is rightly deserved given its use globally and the economic stability of the US.

Several key economic data releases in the US are posted each month, such as inflation data, GDP, retail sales, non-farm payrolls, and much more. These releases help central bankers, the government, traders, investors, economists, and others analyse and understand the current state of the US economy, which also filters out to other economies worldwide. These data releases can also cause significant price swings in the USD and other related assets. With inflation soaring, the Fed has adopted an aggressive rate hike policy. However, the most recent reading showed a slight slowdown, so it’s essential to watch how the Fed will react. Given the global economic uncertainty and the Fed raising rates, it’s obvious why the dollar has recently been on a major bull run.

Related Articles

- EURGBP Forecast and Live Chart

- USDCAD Forecast and Live Chart

- What Are Major Forex Pairs?

- Forex Charts

EURUSD Technical Analysis

The downside move for the pair since last year has been unrelenting, and the price recently hit its upper trendline before declining once again. In addition, the EURUSD price has adhered reasonably well to the 100 MA on the daily chart, and if we were to get a more considerable pull back, a break above might be something to keep an eye on. On the other hand, if we are looking at levels to the downside, we would have to go all the way back to 2002 for the last time price was this low. However, a potential entry spot to go short could be a pullback to parity.

Trade EURUSD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

73% of retail CFD accounts lose money

Founded: 2014 73% of retail CFD accounts lose money

Founded: 201473% of retail C... |

|

FSA SC | MT4, MT5 | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.