Market sentiment is an important concept in forex trading that can be very useful in evaluating the collective investor ‘mood’ of market participants. Knowing what forex market sentiment is, and how it can be used to inform one’s own trading decisions, is an essential part of market analysis.

In this article, we will explore the concept of market sentiment and its importance in trading. We will also discuss the various indicators available to analyse market sentiment in the forex market and provide an example of how market sentiment can be used in your own analysis.

What Is Market Sentiment?

Market sentiment refers to the overall mood, attitude or tone of investors towards the market they are collectively trading. Traders keep a close eye on market sentiment to gauge whether investors are predominantly bullish or bearish, which in turn can help with identifying the possible trend direction of a market.

For example, if traders are generally bullish about the market, it should be reflected by rising prices. On the other hand, if market sentiment is bearish, prices will likely decline. A shift in market sentiment from bullish to bearish or vice versa may also indicate a potential reversal in a market.

Market sentiment can also be described as the overall crowd psychology at any given time, and many different external influences such as economic data, political events and central bank policy may all have an impact on the collective behaviour of investors.

Market Sentiment in Forex Trading

When it comes to forex trading, market sentiment can be influenced by both fundamental and technical factors, which may have a significant impact on currency pairs.

Because the forex market is open 24 hours a day and nearly seven days a week, the chances are that some news event somewhere in the world may influence a particular currency, and therefore a forex pair as a whole significantly increases.

Other markets such as stocks and futures have reduced trading hours compared to the forex market and can be influenced by different factors such as earnings reports, supply issues, etc. With the limited trading hours in these markets, they are slower to react to outside influences, whereas market sentiment in forex can change very quickly.

Market Sentiment Indicators

When we talk about market sentiment, forex traders should note that it is different from technical analysis or fundamental analysis, which looks at specific aspects of the market in order to make predictions.

Instead, market sentiment looks at the ‘bigger picture’ and attempts to gauge whether traders are generally bullish or bearish on a currency pair.

That being said, technical indicators can quickly detect a change in market sentiment because they are very sensitive to changes in price movement over the short term, making market sentiment an important metric to follow especially for day traders and technical analysts.

There are a number of different market sentiment indicators available to traders, each with its own strengths and weaknesses. Some popular sentiment indicators include the Commitment of Traders (COT) report, futures open interest (OI), the Volatility Index (VIX), and moving averages.

While no single indicator is perfect, using a combination of different sentiment indicators can give traders a well-rounded view of market conditions and help them make more informed trading decisions.

Market Sentiment Analysis

When using market sentiment to analyse the forex market, the main goal is to determine what the majority of market participants feel about a currency pair, such as the EUR/USD. Does the overall sentiment lean more towards the bullish or bearish side, and does it correlate with a rise or decline in prices?

Take the popular futures open interest sentiment indicator as an example. Let’s say that the futures price of the euro is currently rising (US dollar weakness) in conjunction with a daily increase in open interest. This can be interpreted as a sign of a strong or strengthening bullish environment, which will likely keep pushing the EUR/USD higher.

On the other hand, should the euro futures price continue to rise but the open interest starts declining, the bullish trend might be weakening as the direction of the price and open interest divert from each other. In this scenario, a reversal might be imminent.

Fundamental vs Technical vs Market Sentiment Analysis

There are three main approaches that traders use to analyse the forex market: fundamental analysis, technical analysis, and market sentiment analysis.

We already delved into what market sentiment is, but how does it differ from fundamental and technical analysis?

Fundamental analysis looks at the underlying factors that can affect a currency’s value, such as monetary policy, political events, etc. This approach can be very helpful in giving traders a long-term view of where a currency might be heading. However, it can also be quite complex, meaning that it can be hard to predict how the markets will react to an economic news release, for example.

Technical analysis is used to analyse and forecast price direction by identifying patterns in historical market data. This approach can be useful for short-term trading, as it can assist traders with identifying trading opportunities and to time and exit their trades more efficiently.

Some traders swear by only using one analysis method, while others might choose to use a combination of both fundamental and technical analysis. Whatever your choice might be, it will probably be a good idea to not base your trading decisions on market sentiment alone, but to also include either fundamental or technical analysis (or both) in your trading strategy.

An Example of Market Sentiment Analysis

What follows is a real-world example of how various market sentiment indicators confirmed the strong downtrend that has been persistent in the EUR/USD for multiple years, and how they could have been used to influence trade decisions.

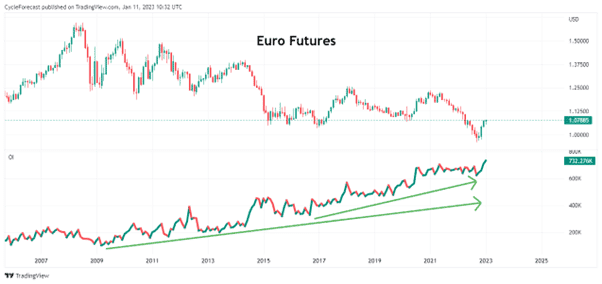

Image for illustration purposes only

The chart image above shows the price action of the euro futures (EUR/USD) over a period of multiple years. On the indicator panel below, the futures open interest for this market was applied to show how open interest continued to rise while the euro futures trended lower.

Earlier in this article, we mentioned that open interest should be used in conjunction with what price action is doing. In this case, open interest continued to increase while price was declining, meaning that it confirmed that the downtrend was strong.

Although this presented the ‘bigger picture’ view of market sentiment as indicated by the futures open interest indicator alone, the next image below displays another useful market sentiment indicator over a shorter time period.

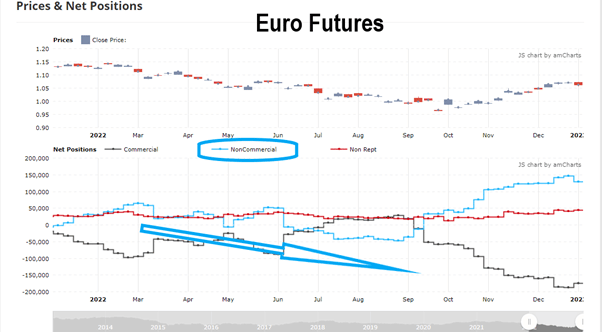

Image for illustration purposes only

The COT report is another important market sentiment indicator that is released each Friday by the Commodity Futures Trading Commission (CFTC).

In short, this report reveals the aggregate positions of various market participants and provides more detail into how many long, short and spread positions there are that make up the open interest.

The COT report and what it indicates might sound confusing at first, but for the novice trader, all you really need to understand is that it gives you better insight into what the ‘big players’ are doing in the market on a weekly basis. Are they predominantly long or short? Are there notable changes in their cumulative position sizes versus a previous week’s report?

A graphical view of the COT report for the euro futures is presented in the image above, and it shows the three main groups of market participants for the year 2022.

These groups are split into commercial, non-commercial, and non-reportable positions (small traders).

The commercial group is mainly composed of banks or, more broadly speaking, any trader who trades on behalf of a business or institution. Commercial traders primarily use the futures market to hedge against adverse price movements.

Non-commercial traders, on the other hand, do not use the futures market to hedge positions, but take positions for pure speculative purposes only. This group is also referred to as the large traders group, meaning that they typically trade with large sums of money, unlike your normal retail investor.

Non-reportable traders are generally small retail traders, and little emphasis is placed on this group when analysing the COT report.

Getting back to the chart above, special attention should be given to the non-commercial trader group (light blue line). Forex traders who use the COT report to determine market sentiment generally focus on this group to determine which direction price will likely move towards.

Note how the blue line gradually moved lower for most of 2022 as the cumulative net short positions of the non-commercial traders started to increase. The chart above accounts for all the weekly COT data for the euro over a one-year period.

For a retail trader, the fact that the non-commercial traders were adding more and more contracts to their short positions was a clear indication that the euro was likely to head lower.

Finally, another important factor that drove the EUR/USD lower was the Federal Reserve in the US starting to aggressively raise interest rates in 2022, which strengthened the dollar.

Use of the market sentiment indicators mentioned in this analysis, together with a fundamental factor such as a raise in interest rates, resulted in one conclusion – that the EUR/USD was very likely going to trend lower.

Armed with this knowledge, a forex trader would have had a better understanding of the prevailing market sentiment for the EUR/USD, which in turn could have heavily influenced their trading decisions by leaning more towards the short side of the market, rather than trying to trade against the overall bearish sentiment.

Related Articles

- How to Use Futures Open Interest in Forex Trading

- Forex Sentiment Analysis – A Beginner’s Guide

- Using Forex Market Sentiment Indicators

Conclusion

Understanding forex market sentiment and how it can be used to determine which direction a currency pair might take is an important and very useful tool to make better trading decisions.

Using various market sentiment indicators in combination with technical and fundamental analysis creates a better understanding of markets in general and all the influences that affect price action.

The market sentiment analysis example offered a brief explanation of how various sentiment indicators and fundamental influences confirmed the driving ‘forces’ behind the strong decline in the EUR/USD.

Hopefully, this article shed some light on the importance of market sentiment in forex and why you might want to use it if you haven’t done so before.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.