If you are new to trading currencies, you have probably already heard about technical and fundamental analysis, but what about forex sentiment analysis?

The purpose of this article is to present a beginner’s guide to those who are unfamiliar with the concept of sentiment analysis. We will explore what it is and how it works, and discuss the important forex sentiment indicators that can be used to help you make better-informed trading decisions.

What Is Market Sentiment?

As a novice forex trader, it is important to be aware of market sentiment because it can have a big impact on currency prices.

Market sentiment simply refers to the overall mood of all market participants who are trading a particular currency pair. How the majority of traders ‘feel’ can offer valuable insights into the possible future price direction of a currency pair.

Forex sentiment analysis looks at various indicators and published reports that can give you an indication of how bullish or bearish traders are towards a currency pair they are collectively trading.

Another way to measure market sentiment is by keeping an eye on important news and economic data releases. These releases can often have a big impact on market sentiment, which in turn can affect currency pairs.

How Does Forex Sentiment Analysis Work?

Forex sentiment analysis is the study of market participants’ attitudes and expectations towards a particular currency pair by analysing certain sentiment indicators and reports.

These indicators and reports offer valuable information into the overall positioning of traders in the currency market.

Simply put, the main goal of market sentiment analysis is to figure out what the majority of the ‘crowd’ is thinking about a currency pair. Are they predominantly bullish or bearish?

Forex traders generally analyse the overall sentiment by looking at the positions of all traders in a market, and how their positions change on a daily or weekly basis, to get a better ‘feel’ of where currency prices might be heading in the future.

Using Forex Sentiment Indicators

Some of the most popular and useful sentiment analysis indicators and reports include futures open interest, the Commitment of Traders (COT) report, and brokers’ position summaries.

Let’s first discuss futures open interest.

Futures open interest is used to indicate the number of active contracts (positions) that are currently open on any particular futures market and that have not been closed yet.

Now, you might be thinking, what is the use of looking at the futures market when I want to trade the forex market?

Well, because the forex market does not have a centralised exchange, or one physical location where all forex transactions take place, it makes it difficult to accurately determine how many forex positions there are globally at any particular point in time.

The futures market is different – because all transactions take place at physical exchanges, it is easier for each exchange to report on various metrics such as volume or open interest. The futures market also has currency futures, which closely mimic various currency pairs in the forex market.

Open interest is calculated by taking the total number of new contracts added to a futures market minus the total number of contracts that have been closed or settled.

For example, if 2,000 new contracts were added to the Australian dollar futures market on any given day, while 500 contracts were closed or settled, then the open interest would increase by 1,500 contracts.

Now, if you were to see the open interest of the Australian dollar futures increase by 1,500 contracts compared to a previous day in conjunction with a rise in prices, then as a forex trader, this might indicate that the AUD/USD will likely move higher.

To find more information about futures open interest data, you can head over to the websites of the Chicago Mercantile Exchange Group (CME) or the Intercontinental Exchange (ICE)

Next, we will discuss the Commitment of Traders (COT) report, which is another useful forex sentiment analysis tool that can be used in your analysis.

The Commodity Futures Trading Commission (CFTC) releases a weekly Commitment of Traders report. This report tracks the amount of long and short positions taken by various groups of speculators in the futures markets.

What makes the COT report different from the futures open interest data is that it shows both the amount of long and short positions held by these groups of speculators, whereas open interest data only reports on the total amount of contracts added or closed.

The different groups of speculators are classified as non-commercial (large speculators), commercial hedgers and small traders.

Forex traders mostly pay special attention to what the COT report reveals about the positions of the non-commercial or large speculators group. This group is known to be composed of fierce trend followers. It predominantly consists of speculators who have no interest in using the currency futures market for hedging purposes.

Because of this, you will often see large speculators add more contracts to their long positions during a bullish trend or add more contracts to their short positions during a downtrend.

Another way that traders interpret the sentiment of this group is to watch for signs that their overall long or short positions have reached extreme conditions – meaning that they may start taking profit on their positions, which could result in a trend reversal.

To find more information on the weekly COT report, you can visit the CFTC’s website to view the data in tabular format or visit a website such as Barchart.com to view the data in graphical format.

Another source that can be used for forex sentiment analysis are broker position summary reports.

Many forex brokers will keep an updated position summary of all their clients’ trading activity, including the percentage of long and short positions and the overall changes in these positions over time.

This information can be useful in gauging market sentiment, as it can give an indication of how bullish or bearish traders are feeling.

One important consideration that needs to be taken into account with these kinds of reports is that it only reflects the sentiment of all the traders who have accounts with a particular broker and does not reflect the sentiment of the entire forex market as a whole.

An Example of Forex Sentiment Analysis

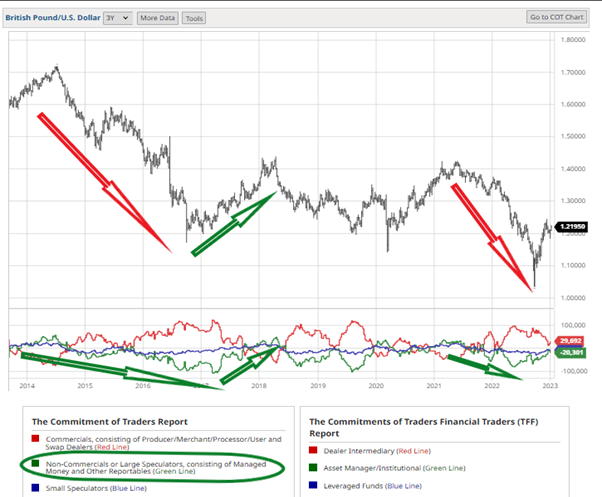

Source: Barchart.com

What follows is an example of how various sources of sentiment analysis can be used to forecast price direction and influence trade decisions.

The image above shows a graphical view of the COT data applied to the British pound currency futures over a period of multiple years. As mentioned previously, forex traders tend to pay close attention to the non-commercial or large speculators group (green line).

Note how the green line declined during periods when price declined and rose during periods when price moved higher. Whenever the green COT line moved lower, it meant that large speculators were adding more contracts to their short positions. The opposite was true when price moved higher – large speculators reduced their number of short positions and added more contracts to their long positions.

Image for illustration purposes only

Our next chart shows the open interest of the British pound futures. As mentioned before, this indicator does not calculate the amount of short and long positions, but only shows an increase or decrease in the total amount of contracts traded.

To use this indicator, traders need to figure out what open interest is doing in conjunction with price direction. In this case, when the British pound futures market declined, the open interest steadily increased, which revealed a strong bearish sentiment over the marked time period (red and green arrows).

Both the futures open interest and COT data in this example exposed the bearish sentiment towards the British pound futures during 2022. There was also a key fundamental factor that dominated economic headlines during the same year.

The fundamental factor that we are referring to is the aggressive interest rate hikes that were implemented by the Federal Reserve in the US, which resulted in a stronger dollar and weakness in other currencies.

All of the above forex sentiment analysis could have been used to influence a forex trader’s directional bias depending on the trading style they preferred to use.

The Benefits of Forex Sentiment Analysis

The main benefit of using forex sentiment analysis is that a trader can get a better overall understanding of what the majority of market participants are feeling about a market by looking at their trade positioning.

Understanding what the majority of the ‘crowd’ is doing or feeling will likely influence the price direction of a currency pair, which can either lead to a trending market or potential reversal.

The Drawbacks of Forex Sentiment Analysis

Forex sentiment analysis also have drawbacks that beginner traders need to be aware of. As with any form of analysis, sentiment analysis does not always provide 100% accurate signals.

Perhaps the biggest flaw of sentiment analysis is that it can be very subjective in nature, meaning that one analyst might interpret sentiment data differently from another.

Additionally, some sentiment indicators might be slow to respond to political or economic news events, which is why most traders include other forms of analysis to deal with sudden changes in market conditions.

Related Articles

- How to Use Futures Open Interest in Forex Trading

- What Is Market Sentiment in Forex?

- Using Forex Market Sentiment Indicators

Trade Forex With Our Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk

Founded: 2011 Your capital is at risk

Founded: 2011 |

|

CySEC, FSC, FSCA, MISA | MT4, MT5, OctaTrader | ||

Conclusion

Forex sentiment analysis is a valuable tool and can be an incredibly helpful way to understand the underlying dynamics of the markets and help you make better-informed trading decisions.

As a beginner, including forex sentiment analysis in your strategy might take some time to get used to. However, with enough practice and experience, you will soon see the benefits of sentiment analysis and also understand the limitations.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.