There are many different metrics in the financial markets that trading exchanges track and report on that can offer valuable insights to investors when they analyse their favourite markets.

One such metric is futures open interest. Open interest simply means the total number of contracts, such as futures contracts, that have not yet been settled. This can give forex traders a better idea of where the money is flowing to and highlight potential trading opportunities as well as providing an overall picture of market sentiment.

In this article, we will discuss what futures open interest is, how it is calculated, and how forex traders can include it in their own analysis.

What Is Futures Open Interest?

Before we discuss how to use open interest futures in forex trading, we first need to define what a futures contract is.

A futures contract is an agreement to buy or sell a specific asset at a predetermined price on a future date. The asset underlying a futures contract can be anything from a commodity such as gold or oil, to a financial instrument such as a currency or bond.

In the world of futures trading, open interest refers to the total number of open contracts in a particular market. It is a measure of the total number of futures contracts that have been bought or sold but have not yet been settled or closed at the end of a trading day.

Open interest can be a useful indicator of market activity, as it reflects the total number of contracts that are currently being held by traders. An increase in open interest indicates that more traders are entering the market, while a decrease in open interest suggests that traders are leaving the market or closing their positions.

Futures Open Interest Explained

Open interest is calculated by taking the total number of opened contracts and subtracting the total number of contracts that have been closed or settled. For example, if there are 100 new contracts added to the market, and 50 contracts closed or settled, the open interest would increase by 50.

It’s important to note that open interest does not necessarily reflect the direction of a market. An increase in open interest can be the result of either buyers or sellers entering a market, and it’s up to traders to interpret the meaning of the open interest data in the context of other market indicators.

Unlike the forex market, which operates via a global network of banks with no central location, futures are traded on physical exchanges around the world. All currency pairs that include the dollar in the forex market can also be found in the futures market, but instead of naming the entire pair, such as the AUD/USD in forex, in the futures market this pair is simply called the Australian dollar futures instead.

Forex traders who wish to track the open interest of the currency futures market may do so by visiting the websites of the Chicago Mercantile Exchange Group (CME) or the Intercontinental Exchange (ICE), where the open interest of all the available currency futures can be found.

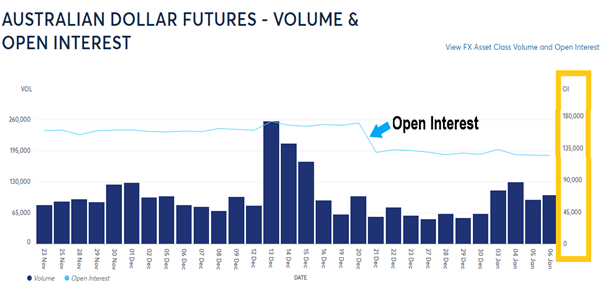

Image for illustration purposes only

The image above shows the daily open interest (light blue line) and volume for the Australian dollar futures as reported by the Chicago Mercantile Exchange (CME).

Additional sources such as brokerage platforms, financial news websites, and market data providers may also offer open interest data, but wherever you decide to get your information from, it is important to note that open interest data is usually published on a daily or weekly basis, rather than in real time.

As such, it may not always be up to date, and it can potentially vary depending on the source, so it might be a good idea to always cross-reference data from multiple sources to get a more accurate picture of the open interest in futures.

Trading Forex Using Futures Open Interest

There are several ways that forex traders can use futures open interest to make trading decisions in the forex market.

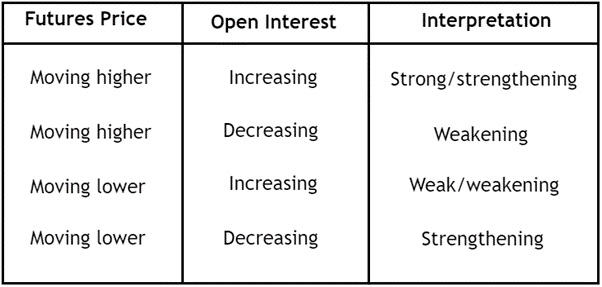

Referencing the table above, if the open interest of the Australian dollar futures is increasing (for example), while the price of this currency future is moving higher, it can be interpreted as bullish, and that the uptrend is strong or strengthening.

Forex traders can then use this information to trade the AUD/USD forex pair, assuming that prices will continue higher.

On the other hand, if open interest were to decrease while the Australian dollar futures is moving higher, it might indicate that the uptrend is weakening. In this scenario, it might be an early warning sign that traders are taking profits and that a reversal might be imminent.

Forex traders might then want to consider taking profit or to stay on the sidelines, assuming that the trend in the AUD/USD might be nearing an end at any moment.

Although the table above shows the different ways that open interest can generally be interpreted in combination with the direction of price movement, there are other important considerations that need to be taken into account.

For example, very high open interest numbers that occur at market tops can be a bearish signal, especially if a sudden drop in price occurs at those tops.

Record high or unusually high open interest during a bull market can also be seen as a warning sign that a reversal might take place, especially if open interest starts to reverse.

Finally, during times when a market is stuck in a consolidation phase or range while open interest is increasing, price is likely to experience a strong breakout when the consolidation ends.

Judging by the various ways that futures open interest can be interpreted in relation to how price is behaving, there can be some subjectivity involved in making sense of the data. As a forex trader, it is therefore important to study past price behaviour with open interest data to get a better ‘feel’ for this type of analysis.

Many forex traders will also use other means of analysis in combination with market sentiment analysis to get a better understanding of the current market ‘climate’.

Related Articles

- What Is Market Sentiment in Forex?

- Forex Sentiment Analysis – A Beginner’s Guide

- Using Forex Market Sentiment Indicators

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Trade Forex With Our Top Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Conclusion

Futures open interest is a useful indicator that can provide insight into market activity and sentiment. By tracking changes in open interest, traders can get a sense of the overall mood of the market and identify potential trading opportunities.

That being said, it is important to note that open interest should not be used in isolation and that it is a good idea to combine open interest with other technical indicators and/or fundamental analysis to get a more complete picture of the market you are planning to trade.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.