Even if you are just starting your forex journey or already have many months of experience under your belt, your most helpful assistant will be your trading platform, and the most popular and user-friendly platform today is undoubtedly MetaTrader 4 (MT4). Developed by MetaQuotes Software back in 2000, it has delivered the goods for more than two decades and is so popular within the global trading community that brokers often offer it without question, even if they have their own proprietary trading platform.

With more than 3,000 global forex brokers offering access to MT4 on their respective websites, traders appreciate its reliability, user-friendliness and technical simplicity. In addition, skills learned on the MT4 platform are readily transferable to any other broker offering similar MT4 access. It is important to remember, however, that MetaQuotes is not a broker. You may only access its products through your chosen broker.

At first glance, MT4 can be quite intimidating with so many items on a single screen. Practice time on a demo system is the best way to learn the ins and outs, along with watching MT4 tutorials. One area of focus will be on the variety of executable orders that MT4 supports. These orders regulate how you enter, exit and protect against downside risk for your position in the market. In this article, we will focus on the risk management aspects of MT4 orders, and you will learn how to set stop-loss and take-profit orders in MT4.

What Are Stop-Loss and Take-Profit Orders?

A trader may enter the market by using either a ‘Market’ or ‘Pending’ order, but once the position is secured, how does the trader protect themselves if the market moves radically against them? They could, of course, keep their eyes glued to the screen, waiting to see if they need to close their position. An alternative method is to use a stop-loss order.

A stop-loss order is set to operate once a position is active in the market. It is an instruction to the broker to close the position, in this case to sell, when and if the price falls to a level specified in the order. The goal is to put a limit on the amount of loss that you are willing to absorb. A take-profit order is exactly the opposite. When the price rises to a specified amount, the broker is ordered to sell the position for a profit. Going short reverses the process.

Stop-loss and take-profit orders, however, are imperfect. Check your trading agreement with your broker, and you will find a section that exempts the broker from responsibility for not executing these orders when the market is especially chaotic. In some cases, however, you can pay a fee for a guaranteed stop-loss order, or your broker may close a position due to margin rules or provide what is called negative balance protection.

How to Set Stop-Loss and Take-Profit Orders in MT4

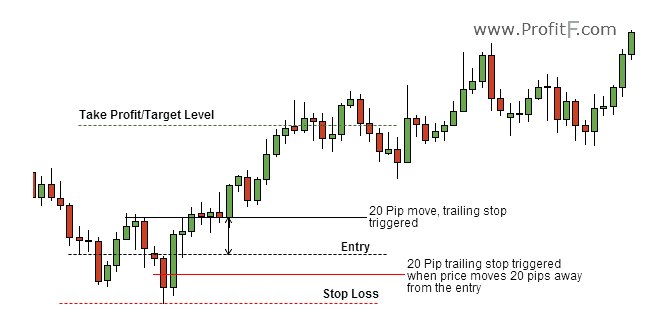

Let’s now take a look at an example in the market. You have decided that the market is trending upward, and you have selected your entry point:

Graphic courtesy of ProfitF.com

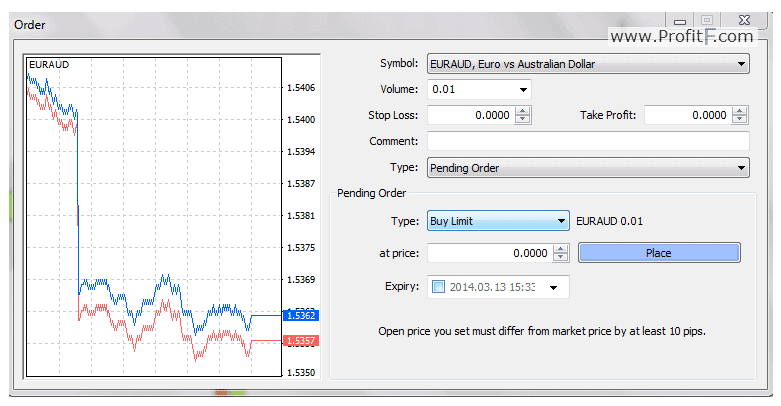

On MT4, select the ‘New Order’ tab at the top of the screen. An order template will follow, as depicted below:

Graphic courtesy of ProfitF.com

You may enter your stop-loss and take-profit prices at this point, before the pending order is executed, or wait and adjust the prices later.

How to Adjust Stop-Loss and Take-Profit Levels

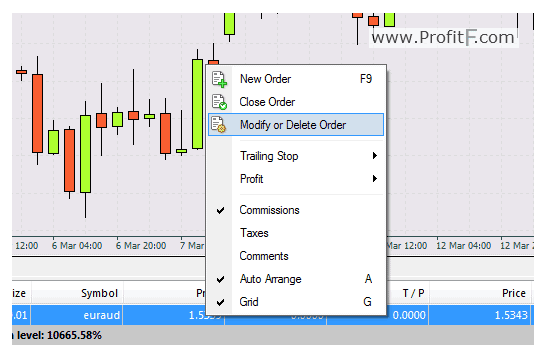

Making an adjustment on an active trade order in MT4 is also easy. Just click on the trade order in blue, select ‘Modify or Delete Order’ (shown below), and enter your values where necessary:

Graphic courtesy of ProfitF.com

Where to Place Stop-Loss and Take-Profit Levels

How do you know where to set a stop-loss order, assess the risk-reward of a potential position, size your position appropriately, and then take your profit? There is a science to answering these questions, and it involves the study of risk management techniques. These rules to live by are the means by which you are able to return to trading another day after incurring a string of losses. Every trader would be wise to learn these rules, practice them until they are familiar, and then use them as if by second nature.

Does everyone need to use a stop-loss strategy to protect their downside while in the market? Most professionals rely upon their mental picture of where they need to exit a market, but they are dealing in much larger quantities than the average retail trader. Large positions require special handling, and professionals often jerk the market in a direction in order to gobble up stop-loss orders that are placed too closely to the action, a strategy called stop hunting or fishing.

Where to place your stop loss is therefore a matter of personal preference. There are several methods, but relying upon a fixed amount, such as 15 to 25 pips, is not recommended due to the hunting/fishing threat. If you estimate the amount of loss that you are willing to accept on a potential trade, then that level could be where to set your stop. If your profit expectation is ‘2X’ or ‘3X’ this amount, then either of those levels would be ideal for setting your take-profit order.

Experienced traders, however, tend to rely on other methods for setting their stop losses. Some use a percentage, which can vary with the chosen asset price. Using an average true range (ATR) indicator can provide protection based on how asset prices have been moving recently. Choosing an inflection point of a long-term moving average is another way, but many traders prefer to set their loss protection based on a prior level of market support or resistance or by the last lowest or highest price recorded in the recent past. Let your trading style choose the best method for you.

Related Articles

- The Best MT4 Forex Brokers

- How to withdraw money from MetaTrader4

- How to Use the MetaTrader4 Forex Trading Platform

Concluding Remarks

Stop-loss and take-profit orders are highly recommended risk management tools that a trader can use to protect their capital and control their trade while away from their market access device. There are several methods for this process, but MT4 makes it easy to accomplish. Study the various methods and choose the one that feels most comfortable for you.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.