Stock markets have had a rollercoaster week, both down and up, but investor uncertainty is always typical before earnings seasons begin in earnest. The Tokyo Olympic Games have already generated a multitude of articles about COVID-19 flare-ups – another reason for concern, especially in the Asia-Pacific region – but prospects for the near-term future remain positive in most quarters.

Meeting minutes from recent deliberations by central bankers in Australia still retain an optimistic tenor: “Members commenced their discussion of international economic developments by noting that the global economic recovery was well under way and that risks to the outlook had become more evenly balanced. Policy settings remained highly accommodative.”

Nevertheless, their outlook does contain reservations related to COVID-19 and its variants: “Ongoing outbreaks of the virus, including of more transmissible variants, had hampered the recovery in many economies. A significant resurgence in cases in Asia over preceding months was contributing to ongoing complications in global supply chains.”

Market reactions remain positive

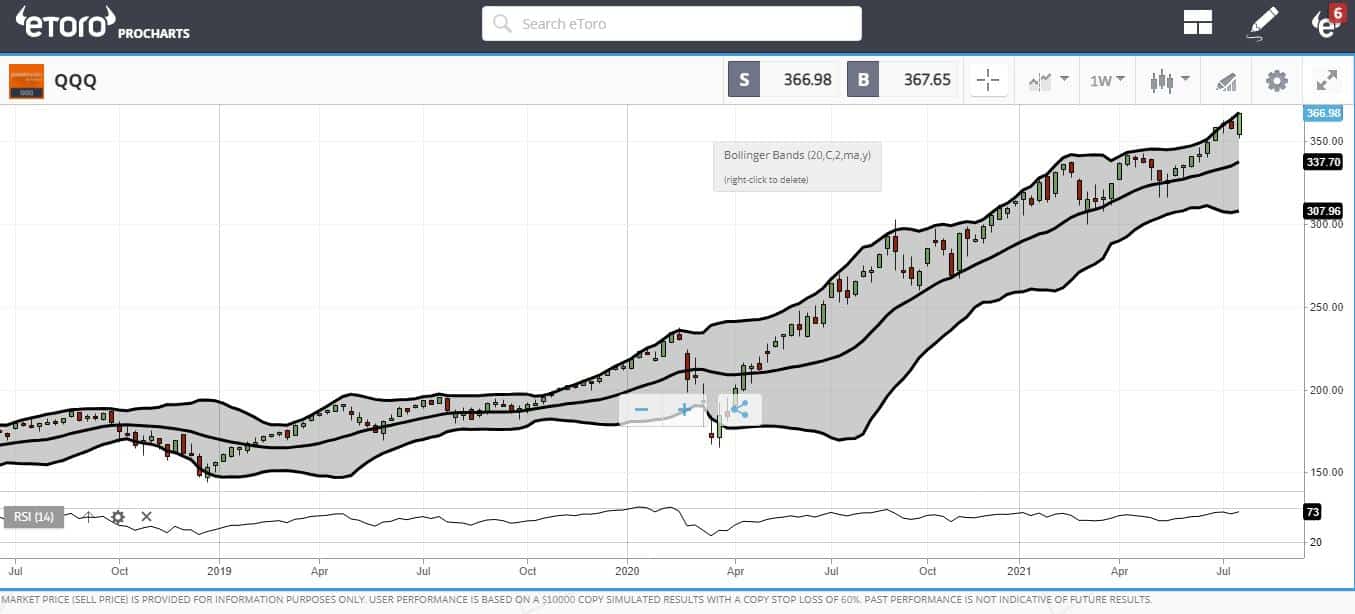

After Monday’s general falling out last week, the positive development was that investors rushed into the fray to buy on the dips. Technology stocks remained in demand, maintaining long-term trend lines, as demonstrated by this weekly version of the QQQ’s pricing behaviour:

Source: eToro

Current volatility has also been driven by reports across the globe of increasing virus-related outbreaks in South America and Africa. Markets are no longer purely US-centric. Global issues will continue to drive price action across the globe. Consumer price inflation has increased, most notably in several developed economies. Fortunately, central bankers are viewing these latest inflation rises as transitory and that any resulting pricing pressure will fall within expectations going forward.

There may be a bumpy road a few months out

While pent-up buying demand keeps short-term forecasts on trend, analysts away on holiday may have kept market corrections to a minimum. Coincidentally, Chairman Jerome Powell appears to enjoy favourable support from the Biden administration for continuing at his post, so no disruptions from an FRB shake-up are seen as likely. Studies, however, have shown that analysts tend to rethink their plans abruptly after returning to their desks from extended holiday periods. Late August and September may hold a few surprises.

Scott Minerd, chairman and chief investment officer of Guggenheim Investments, is concerned for both stocks and cryptocurrencies. He sees the potential for a 15% correction in stocks in September and October, while he expects Bitcoin to retrace 80% of its most recent rise. Neither situation bodes well for risk assets going forward. He likens Bitcoin to a bellwether, suggesting that it could be the “canary in the coal mine that’s telling us we have more problems ahead for risk assets, and in particular stocks”.

Concluding remarks

Investor eyebrows were raised when the past week commenced, but it soon ended on a good note. Will positive trends continue? There is cautious optimism for the near term, giving way to more negative prospects down the road. Fast-money retail flows may have saved the day last week, but how much longer can we depend on them? One analyst at OANDA put it this way: “Fast-money flows are just that, and the winds could change direction very quickly in these types of markets. Investors who insist on playing should remain light on their feet.”

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk