Reading Between the Lines

On Wednesday, Jerome Powell was able to deliver a statement that reflected his being in the top job at the Fed for three years. When calming markets, there’s nothing wrong with repeating yourself, and Powell was more than happy to use stock phrases which he can at least assume investors understand by now. He maintained that the Fed was:

- “committed to using a full range of tools” and that,

- “policy will remain accommodative until the Federal Reserve achieves its goals” and,

- “asset purchases will continue until substantial further progress has been made”.

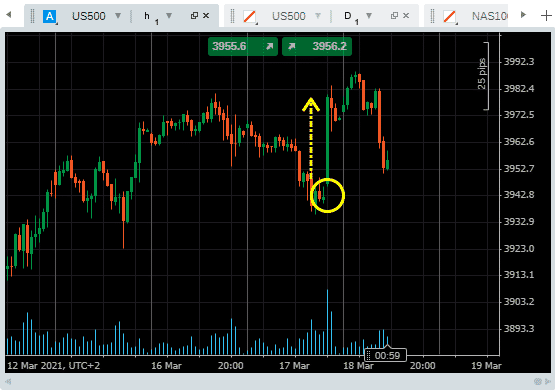

Equity markets welcomed the news but then retreated.

Source: Pepperstone

Growth and employment data has turned upward “recently”, but sectors most impacted by the pandemic continue to struggle. It’s these sectors of the economy that the Federal Reserve policy is prioritising. Accordingly, the Fed kept interest rates near zero and will maintain the current pace of asset purchases.

- Improved Growth – officials upgraded expectations for GDP raising growth rates to 6.5% for 2021, up from 4.2% as previously forecast.

- Jobs numbers look healthier – estimates for the unemployment rate have shifted with the new 2021 forecast sitting at 4.5% and falling to 3.5% by 2023.

- Inflation – at or above 2% this year and through 2023

- No change to interest rates – more members anticipate rate hikes in coming years, but not enough to change the forecast of no increases until at least 2023.

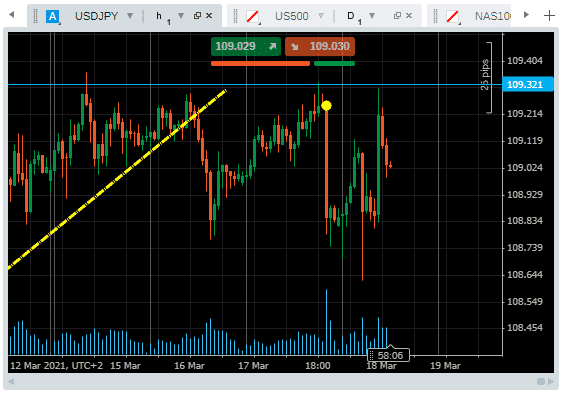

US Dollar fell in value then recovered

Source: Pepperstone

What Were the Surprises in the Fed’s Announcement?

At the previous FOMC meeting in December, only one Fed official forecast rate hikes in 2022. At Wednesday’s meeting, that number rose to four. Seven committee members now predict rate hikes in 2023, up from five at the December meeting.

What are the US Fed Targets?

It’s probably worth reconsidering the Fed’s stated and unstated aims.

Inflation above 2% – The Fed has been relatively clear on its inflation target and importantly targets a rate “above” 2%. A little bit of inflation is seen as not being a problem, particularly as it would help erode the actual cost of all the borrowing it has sanctioned in recent years.

Unemployment at 3.5% – This target is less clear. Analysts currently consider the 3.5% level to be the target purely because that was the previous low level.

Wednesday’s statement forecasts that the Fed doesn’t see both of these levels being hit until 2023. The suggestion was also made that they don’t see the need for rate hikes even then.

Shifting Dynamics on the FOMC

During the pandemic, a broad consensus was built across the committee. Some of the die-hard hawks and doves appear to be reverting to their pre-panic opinions. It can be expected that more and more members of the committee break ranks and look to hike rates.

This return to normality will mean the opinion of the Chair will become increasingly important. For now, at least, there is little suggestion that Powell sees the need for any rate increases until 2023.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk