The Almighty Dollar continues to surge, but in analyst circles, inclusive of both bankers and investment gurus, the greenback “gets no respect”, as one comic of old was prone to say at times like these. The reasons for the surge are many: monetary policy divergence, rising interest rate differentials in government securities, and rising global tensions. Forex experts, however, are not impressed. They cite technical data, such as trending oscillators screaming overbought and that long-term charts dictate that south is the only way the USD can go. In the meantime, the Dollar is King, back on its throne.

Although “dovish” may have been the characterization, the market ignored any suggestion of intransigence and pushed the USD index up to 94.1. Three weeks back, it had, according to many in the know, supposedly crested at 92.4. As we noted, “Banking types were describing the action as merely a temporary situation where shorts were being squeezed in the T-Bill market. According to them, their end-game thesis had never changed, i.e., the global economy is charging ahead and overcoming any advantages that the USD may have enjoyed due to interest rate differentials.”The Fed did not reveal any recent surprises. Per one reporter: “The Federal Open Market Committee released the minutes from its May meeting yesterday. Most analysts characterized the Fed minutes as more “dovish” than expected. The FOMC hinted that it will continue its gradual pace of raising interest rates, with a June increase likely. But it did not give any indication that it might push rates up faster. The minutes also reiterate that the Fed may allow inflation to creep above the much ballyhooed 2% target.”

Where is the next decision point for the Dollar? The 95 level, a support plateau visited last November, now represents formidable resistance for the current rally. No one is suggesting that the greenback will return to its high of 104-ish, attained at the end of 2016, but recovery Fibonacci levels are now the apparent guideposts that traders are fixated upon: 94 = 38.2%, and 98 = 61.8%. In case you missed it, 88.2 was the bottom established in February. Has Trump’s desire for a weak Dollar fallen on deaf ears?

Read all forex and financial news

What did the Fed articulate at its last meeting per its minutes?

Like it or not, financial markets have converged on convenient technical levels, awaiting the next consensus, as far as near and long-term directions go. The focus has shifted to the machinations of the Fed, the one central bank perceived to be at the helm of policy-making decisions that will drive future fundamental forces. For this very reason, the recent release of Fed minutes was more captivating than their past few releases. Each Fed governor spoke to the issues at hand, displaying a transparency that was more than pleasing, while evoking an uncertainty that was termed as “agonizing”.

The Fed is definitely caught between a rock and a hard place. Its normalization process, defined as a series of interest rate hikes and a reduction in asset purchases in the free market, is coming under increasing scrutiny. When will interest rates hikes hit a “neutral point”, where domestic growth perpetuates a “Goldilocks” scenario? How far past the 2% target should inflation be allowed to go? At what point does the ego of Chairman Powell take over and squelch the opinions of his colleagues? The latter comment has become an issue, since Powell’s intuitive judgments seem to be disconnected from research studies demonstrating that Fed musings have directly impacted global and emerging markets. Global implications may be beyond his perceived mandate of America first.

The Fed has now coined a new policy term – “Symmetrical Inflation”. It is supposed to explain the dichotomy between rising inflation, which the committee may feel quite comfortable with, and the lack of consumer tolerance for the same. The minutes repeat the words “modestly rising”, when speaking to inflationary trends, but no specific threshold has been defined above the oft-mentioned target of 2%. At what point is the new limit to be reached? 2.1% or is it 2.5% or more? The Fed members, whether they like it or not, are walking a cautious path between inflation, growth, interest rates on debt, productivity, and retaining reserves for the next financial downturn.

One follower of Fed jargon summed it up in this fashion: “”I think the Fed is going to be looking for every excuse under the book not to raise interest rates aggressively, no matter how high inflation gets. But of course, they’re not going to be that transparent. That’s the last thing they’d want to do is let the markets know that they’re that impotent when it comes to inflation fighting. But certainly, their language leaves a lot of room for opinion.” Acceptable inflation is when wages also increase, but increases are lacking. Disposable income is the true driver of growth, but material gains have faltered.

There is also a keen eye on the yield curve. If it rises too quickly, debt servicing will strangle the economy. If it flattens, then recession worries will mount. Everyone believes the current plan for rate hikes will have to be modified perhaps, stopping at 2.5%: “I don’t even think we can afford the interest rates that exist today. Of course, it’s going to take some time for the markets to come to that conclusion, but given the amount of debt that exists, both on a government level, on a corporate level, and then of course also on an individual level, I think they have already raised interest rates to the point where it’s going to be very problematic for the economy.”

The group’s opinion of the Trump stimulus tax plan is that it, too, has fallen flat. The cuts were sold on the premise that additional funds would be invested in wages and capital expenditures, thereby ensuring a growing economy both now and into the near-term future. Atlanta Fed President Raphael Bostic noted that, “Capex has not increased in response to the Trump fiscal stimulus, and labor markets are still tightening.” His fear is that productivity, our savior in the past, will soon succumb and fall to dangerous levels.

The internal debates go on, with no intelligent insights rushing to the forefront: “So perverse has the Fed’s “agonizing” become that previously predictably easy to categorize speakers have second guessed themselves so much as to completely U-turn on their initial positions.” Doubts are creeping in, so to speak, about every prior decision and accepted target. Chairman Powell’s reaction has been to diminish the importance of Fed guidance, more so as the so-called “neutral rate” is approached. Traders may greet this new environment as paradise, where uncertainty and volatility reign.

What will it mean for the Dollar and our bond markets? Current observers are not that taken by optimism: “I think the next time the Fed has to go to that well, it’s going to be dry. The next time they try to stimulate the economy with rate cuts and quantitative easing is going to be the last because they are going to end up destroying the dollar and destroying the bond market in the process.”

What has been the long-term trend of the U.S. Dollar?

It is no mystery that the U.S. Dollar has been on a long and slowly declining ride from that fateful day in the seventies, when floating currencies were deemed to be the solution going forward. The chart below says it all:

The above quarterly chart of the USD depicts the path of the index over the past thirty-three-year period. It appears to be trapped within two declining diagonals. If you break the chart down, you will find that the USD has alternated between seven-year rallies and nine-years bouts of decline. Are we caught in another nine-year downward spiral? By extending the lower diagonal and laying a ruler upon the slope of the recent decline, the intersection could be out in 2024 at a value of 70. Is that scenario really possible? As long as the Fed prints money to cover our expanding national debt, the potential is there.

What about commodities and other currencies?

If pressure is mounting behind the scenes that will drive the U.S. Dollar to record new lows, why would other currencies benefit? The new long-term script crafted by bankers and investment analysts presumes that other economies and their central banking policy makers will adapt to what could be described as a “newer normal”. Since the USD has been the international trading currency due to the stability of the United States, policy makers in the US have been able to get away with massive debt loads by issuing new treasury bills on a daily basis. Other countries have not had this luxury.

The simple truth is that returns in the U.S. no longer command an inflow of currency. Stimulus plans, like Trump’s tax cuts, can only push funds overseas, where more reasonable returns are obtainable. Investing in higher wages and more capex cannot occur without the potential for higher returns. Armed with this basic tenet, investors are gradually looking toward commodities and their respective currency “twins” to be the next secular bull market to pursue. In other words, this train is about to leave the station:

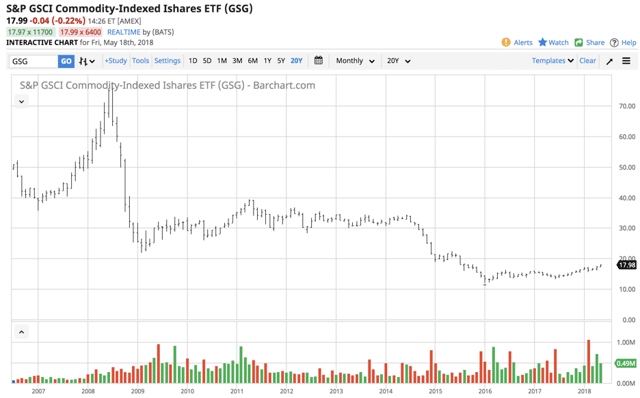

The diagram above depicts the pricing history for a typical commodities index fund. If we had only shown one for oil, the volatility may have been greater, as it fluctuated back and forth about this mean, but oil markets are somewhat controlled by both human and market constraints, as governments negotiate back and forth. Yes, oil is pulling up all commodities indices, but the consensus is that it is signaling higher demand for commodities in all categories.

According to one expert, Andrew Hecht, “There are many signs that commodities prices will continue to move higher in the next leg to the upside of a secular bull market that started in late 2015 and that is excellent news for the economies of those nations around the world that depend on commodities exports for revenues. As commodities prices move to the upside, significant producing countries like Australia, Canada, and Brazil see the values of their currencies rise, and their price charts are looking a lot like those in the commodities markets these days.”

Concluding Remarks

If the members of the Fed are “agonizing” over every decision, both past and present, then investors must naturally “agonize” at an even higher level. Uncertainty leads to volatility, which could ignite a re-distribution of capital on an international basis.

It is beginning to sound like a “Perfect Storm” for currency traders! Be prepared!

Are you ready to trade?

Sign up with Your capital is at risk

Your capital is at risk

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk