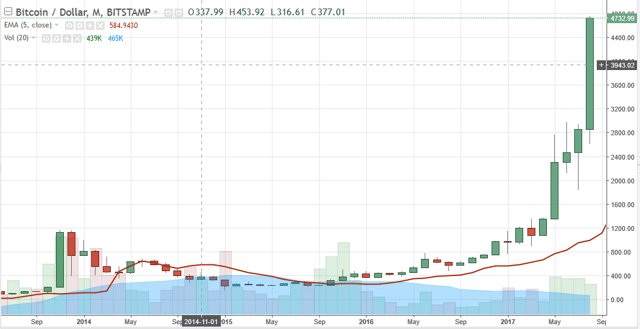

Everyone loves a great investment, especially one that outperforms all others and then some. Would you believe that crypto-currencies are the rage of this market? People are crawling over one another to invest, not knowing the risks or what even a Bitcoin or an Ethereum is, but they do not want to miss out on the fun. Sound familiar? Does it sound like an asset bubble in the making or has it already been made? If you had purchased Bitcoins for $400 at the end of 2016, your value today would exceed $4,700. What? Yes, a ten-bagger, as it is called, in only the space of eight short months!

See all trading news.

The rush is now on, or are lemmings flying off a cliff? The crypto-currency space has gone through boom and bust cycles before, but nothing has ever approached the current euphoria. Analysts are scratching their heads, as are bankers, regulators, criminals, and the public at large that can only wonder why Bitcoin so popular. Traditional investing rules do not apply here. Markets are controlled by a band of brokers and what are called “miners”, the ones with the power and technology to generate new issues of the heavily demanded digital assets. Blockchain technology, another buzzword that has yet to enter our traditional dictionaries, is supporting the scheme and purportedly drives the current madness, but how can anyone test this hypothesis or project its true value?

And so the beat goes on. Investors may wait a lifetime to experience the asymptotic rise in value depicted in the above chart. This chart, however, may be a bit misleading since it is only the experience of one broker in the network. Therein lies part of the mystique in that there is no central trading floor, no way to deliberately short the market, and what futures market there happens to be is very thinly traded. It is not uncommon to see daily swings in value of 10% or more, but that measure can also vary dramatically by broker.

As luck would have it, there is one organization, Coindesk.com, which has made an effort to bring order to the chaos. It assimilates data from brokers around the globe to publish, as accurate as they can be, top-down charts on a variety of investment and market criteria. It also publishes data for Bitcoin rivals, like Ethereum (Ether for short), and a plethora of articles about blockchain technology and related industry news. Here are a few bits of information about these two crypto-currencies of late:

Per Coindesk: Value 12/31/16 Value Current Market Cap

Bitcoin $968 $4,318 $70.7 Billion

Ether $8 $306 $27.6 Billion

Bitcoin’s present market cap is over two and a half times its nearest rival, Ethereum, but there are several more contenders waiting in the wings to gain advantage. It took years for Bitcoin to get past initial hurdles in its path, but once it earned its place in the sun, competitors arose from the bushes instantly to compete for market share. The press now calls it “Crypto-Currency War”, as the battle for loyal customers rages on. There are numerous market entries, another being Ripple, showcased in the picture below, but other less known entities include Litecoin, Dash, and Monero. Industry followers claim the total number of crypto-currencies existing in the world today exceeds 700+.

Many of these “Bitcoin Wannabes” are riding the wave created by Bitcoin, which hit the market in 2009. If Bitcoin trips and falls, it is doubtful if any of the other contenders could ever mount a similar charge, but the race goes on. The risks posed by regulators and other government authorities, primarily tax collection agencies, are enormous and will not disappear anytime soon, but outsiders claim the “bubble” valuation phenomenon is reminiscent of the “Tulip Craze” in the 1600’s, as well as the Internet frenzy of recent memory, labeled then as irrationally exuberant.

Ethereum’s path to riches seems to be paved with more gold, considering its rise from a lowly $8 to $306, but it has pulled back some 20% from recent highs. Bitcoin’s pullback was a mere 13%. A change in Chinese regulations has been attributed as the cause for sour times, it being the latest culprit in a long line of failed attempts to bring down what has been termed a playground for money laundering and tax evasion. The criminal element has fastened onto crypto-currencies with a flourish to hide and disguise illicit money flows, as well as to facilitate every type of fraud scheme known to man that thrives where regulatory oversight is lacking.

Will this Bitcoin asset bubble burst in the near term or should you throw caution to the wind and buy on the dip? For those investors that have incredible gains on paper, you might remember that you have no gain until you sell your position and bank your profits. For those wishing to get into the market while the iron is still hot, perhaps, a quick review of the facts at hand will cool your enthusiasm and allow for a more prudent assessment of what the risk/reward potential might truly exist at this point in time.

How did Bitcoin and others get to where they are today?

Anytime one attempts to understand this new phenomenon or find a very simplistic explanation that mere mortals can understand, one is confronted with a litany of IT-speak that only confuses the mind. Here is one attempt that seemed to convey the meaning adequately: “Bitcoin is a completely digital form of currency and uses cryptography, which controls the creation and transfer of this currency. There is no centralized exchange for any transaction to occur with this currency. Any number of Bitcoins can be sent to anyone living anywhere in the world without the intervention of any traditional financial institutions such as banks.”

Anonymity prevails in the way that addresses are handled by the system: “Any user that wants to use Bitcoins needs to have only a Bitcoin address and a reliable Internet connection. The user has to remain online for as long as the transaction needs to be processed. Every transaction that takes place is recorded in a public ledger called the blockchain. However, any user can receive Bitcoins even when they are offline to their Bitcoin address.” Bitcoins can be quickly redirected to obscure the audit trail, as well. Therein lies the characteristic that worries tax collectors, bankers, and regulators alike.

Whenever the opposition backs down, valuations soar. When fraudsters hack into the system, and they have for millions, confidence in the special sauce, i.e., blockchain technology, plummets precipitously. In recent months, however, according to Morgan Stanley and a host of other investment houses, the growing momentum for the appeal among banks and consulting houses for blockchain technology, the hidden asset behind the entire shebang, is actually driving the rapid appreciation of Bitcoin values. When “Miners” limit supplies of crypto-currencies, then demand and volatility prevail.

What are the arguments for full speed ahead on the Bitcoin Bull?

One thing that Bitcoin and its cast of competitors have is broad-based support from high-tech zealots that view crypto-currencies as revolutionary, evolutionary, and disruptive, their way of fighting back at the system. Support such as this has sustained these digital alternatives in hard times, but real demand must supplant artificial control mechanisms at some point, if higher price valuations are to be in the cards. Here are two opinions that suggest where pent-up demand may exist to provide additional boosts in value:

- “Bitcoin has seen a tremendous run this year, recently functioning as a sort of safe-haven in securities crises, a little like gold, but with apparently (much) better returns. Recent events show that investors are increasingly using Bitcoin as a hedging tool against geo-politics and market uncertainties. In the next 10 years, Bitcoin will gain immense popularity as a hedging tool. A 10% divestiture of money from gold to Bitcoin could take Bitcoin’s price to $50,000.”

- “There are unconfirmed reports that a large number of fund managers are planning to launch hedge funds with crypto currencies. There are several exchange-traded products that loosely track its value: BTCS Inc. (OTCQB:BTCS), The Bitcoin Investment Trust (OTCQX:GBTC), and others. But most of these are over the counter, thinly traded or both.” Regulatory scrutiny will increase as issues of volatility and scalability escalate.

What arguments support a contention that Bitcoin is a bubble ready to burst?

The counter arguments, as you might expect, are several in number:

- Yale economics professor and Nobel Prize winner, Robert Shiller, has been recognized for his seminal work on asset bubbles. When asked, “What are the best examples now of irrational exuberance or speculative bubbles?’, his response was, “The best example right now is Bitcoin, and I think that has to do with the motivating quality of the Bitcoin story.”

- “Bitcoin is more commodity than currency. As such, an attempt to value it can begin with its cost of production, determined to be $495.” Market forces tend to dissipate purchase premiums over time.

- China has passed new regulations that ban the use of digital currencies when funding new enterprises, a direct hit on Ethereum and others.

- “Bitcoin undermines the power of monetary policy. Governments will not allow a currency they don’t control to become prominent in their economies and undermine their monetary control. The sky-high price of Bitcoin has not factored in the possibility of mass governmental rejection. When this is announced on a country-by-country basis, expect Bitcoin’s price to drop toward its cost of production of around US$500.”

- “Six of the world’s largest banks led by UBS and some others that have signed on are teaming up to create and accept a utility settlement coin – a new cryptocurrency. It is supposed to be used for clearing and settling transactions over blockchain technology.”

These arguments are not new, and crypto-currencies have succeeded in the past to overcome such obstacles, but what now?

Concluding Remarks

Bitcoin and Ethereum are the investment rages of today for a variety or reasons that ebb and flow at a whim. If you want to jump upon this over-hyped gravy train, then be sure to maintain your skepticism at every turn, and stay vigilant. One skeptic gave this simple, but wise, advice: “As in the offline world, if it looks too good to be true, it is most likely a scam. When dealing with Bitcoins, it is best to treat the currency as carefully as cash in the everyday world. If you lose it, it is very unlikely that you will ever get it back.”

Wise words for the uninitiated – Buyers be wary!

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk