The start of the year saw the markets firmly embrace risk-on assets including equities and energy commodities. Monday’s pullback raises the question of whether this is a buying opportunity or the start of a correction. Price moves in early trading on Tuesday have been non-committal but trading volumes could offer a clue.

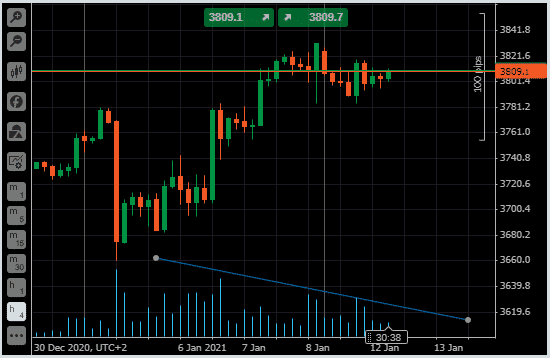

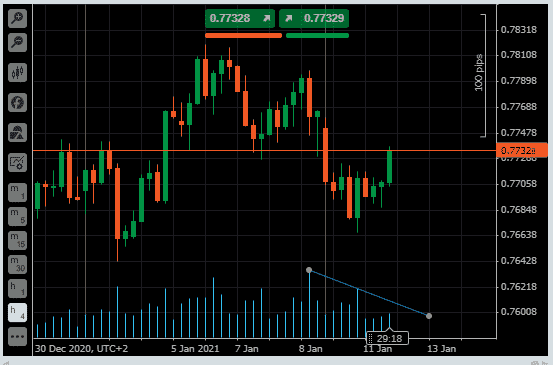

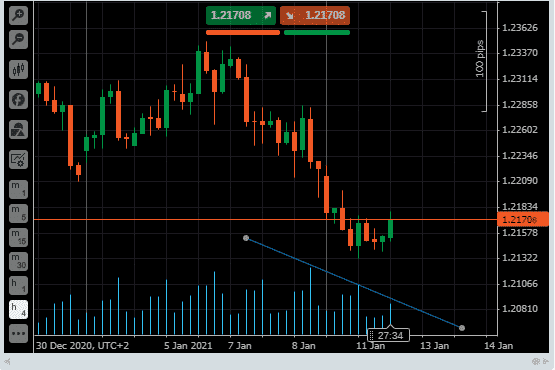

With three different markets there is a clear pattern of some risk being taken off the book. The 4-Hour price charts for US 500 equity index, AUDUSD and EURUSD all show some degree of pullback in the last two trading sessions.

US500 Index – 4H Chart

Source: Pepperstone

AUDUSD – 4H Price chart

Source: Pepperstone

EURUSD – 4H Price chart

Source: Pepperstone

In terms of understanding the move, the drop in trading volumes is at least equally important as the price changes.

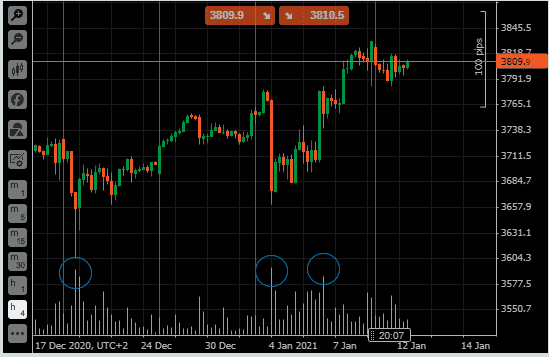

Taking the US 500 Index market as an example, the periods associated with the bullish price surges were all accompanied by a spike in volume.

US500 Index – 4H Chart

Source: Pepperstone

There is also a need to factor in market sentiment. The bullish tone which marked the start of 2021 should itself be raising some red flags. Market commentary might not have quite reached ‘complacency’ levels, however, a consensus appeared to be building that the light at the end of the Covid-19 tunnel can be seen. As experienced traders will tell you, the moment that everyone thinks everything is going to be fine is the moment to be most alert.

The Forex Traders analysts in a note on Monday pointed to the path of least resistance for risk-on markets being upwards. That view is supported by the price slide not being associated with an increase in volume. Price reflects some investors having second thoughts, but there is no sign of panic.

FOMC on the Horizon

The key confirmation of Tuesday’s price slide being an opportunity to buy the dips will be a price move backed up by an uptick in volume. When, or if, this happens looks more likely to be due to thoughts regarding the upcoming meeting of the US Federal Reserve FOMC.

On Monday, the news desk at broker XM picked up on comments from Fed staff which help explain the fall in prices and volumes.

“Fed remarks about a potential scaling back of the QE program eclipsed everything else in a rather quiet session on Monday… First it was the [Atlanta Fed President Raphael] Bostic, who said the central bank is not locked into a paradigm and could change its stance if the economy recovers faster.”

Source: XM

For the bulls, the Fed turning off the liquidity taps is a risk only equalled by a new strain of the Covid-19 infection being resistant to current vaccines.

“[Dallas Fed President Robert] Kaplan reinforced this message, saying that hopefully enough progress will be made this year in the recovery to begin discussions about a QE taper”

Source: XM

There were no such commentaries during the first week of January and risk prices rallied. Now that the Fed’s staff are behind their desks, they’ve confirmed their ability to puncture bullish euphoria. It might be that markets will wait until the meeting which takes place in the last week of January before making any notable price moves.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk