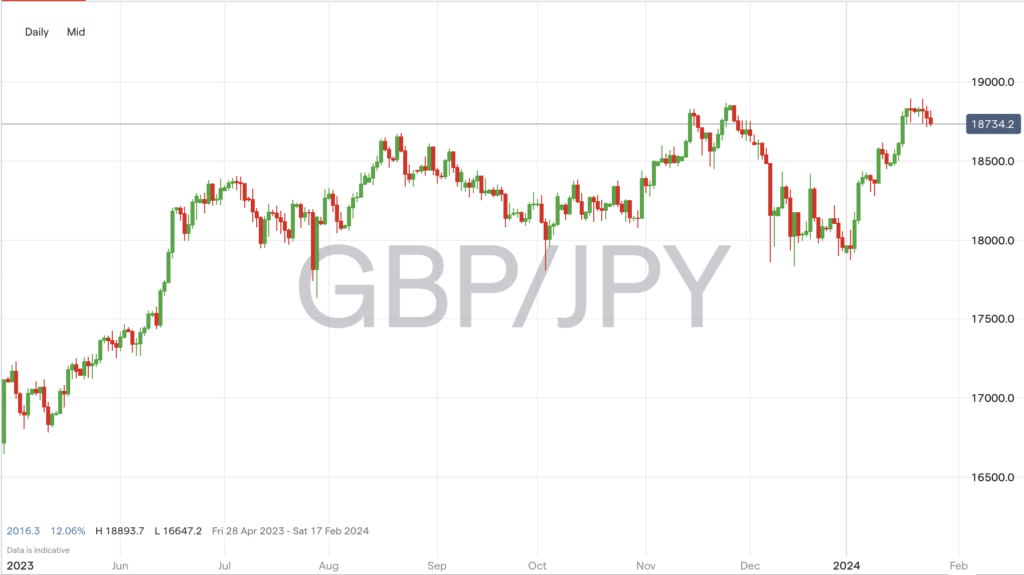

The GBPJPY exchange rate has experienced a notable journey in January 2024. It began the month at a low of 179.17 on January 2, 2024, but surged to a high of 188.476 on January 19, 2024. This was the highest level since August 2015. This rise was largely due to a bullish bounce, as noted in technical analyses, which suggested that if the pair broke the pivot point at 188.538, it could rise to a first resistance level at 190.154, aligning with the 61.8% Fibonacci projection level.

This significant uptick in the GBPJPY rate can be attributed to better-than-expected UK PMIs. This indicated a pickup in growth momentum in the UK’s private sector. The British Pound showed firm demand across the European markets, bolstered by these positive economic indicators.

However, challenges persist. The GBPJPY pair faces resistance in the 188.00-189.00 area. Technical indicators signal skepticism among investors, with overbought signals present. Should the pair fail to overcome these barriers, it might seek support near the 186.00 zone, or between its 50- and 20-day simple moving averages at 184.33 and 183.50, respectively.

Source: IG Markets

Further influencing the pair is the disinflation trend in Japan, posing a headache for the hawkish Bank of Japan (BOJ). Despite core inflation remaining above the BOJ target, slower global growth might turn disinflation into outright deflation. This situation complicates the BOJ’s decision on whether to begin normalising monetary policy by abandoning negative interest rates. The BOJ hopes wage negotiations concluding at the end of the fiscal year in March will help foster inflationary forces.

In summary, while the GBPJPY exchange rate has seen a bullish rise in January 2024, reaching its highest level in over eight years, it faces significant resistance and investor skepticism. The pair’s future movements will be closely tied to both UK economic performance and monetary policy decisions by the Bank of Japan.

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk