Countless articles have been written about the last decade’s gradual recovery from the worst recession since the Great Depression and the inability of central bankers, economists, and government officials to get things rolling once more down the road to greater prosperity for all. If you happen to have resided in a developing country, you might wonder what these concerns are about, since globalization has benefited many populations across the developing world. Advanced economies, however, have been stuck in low year for what seems to be an eternity. Discussions for why this situation persists tend to be circular in nature, always returning to where is inflation?

It was more than a year ago that we addressed this same quandary, but not that much has changed: “Economists and central bankers alike cannot seem to find the catalyst that will ignite inflation. For the past eight years, countless stimulus packages and quantitative easing programs have hit the ground running, each designed to push the global growth engine into a higher gear, thereby creating as a consequence – now wait for it – inflation. But inflation is nowhere to be found. In fact, commodities have actually deflated, which leaves everyone asking the same question, and that is ‘Why?’”

The traditional monetarists within the central banking community generally believe that expanding the money supply will ultimately lead to inflationary pressure on prices. They cite countless examples in the historical record to support their claim: “Monetarists assert that the empirical study of monetary history shows that inflation has always been a monetary phenomenon. The quantity theory of money, simply stated, says that any change in the amount of money in a system will change the price level.”

The fly in the ointment, so to speak, is that such arguments have failed over the past decade. Central banks have flooded the market with liquidity, printing money like it was going out of style. The expectation was that hyperinflation would take hold soon enough, but the unfortunate outcome was that cheap money led to an over abundance in supply across every product line. Commodity prices went into a downdraft. The overall slack in the system has taken years to dissipate, and may take many more. Demand-pull, one of three accepted types of inflation, has deliberately been held in abeyance.

Economists today prefer a low and steady rate of inflation. This preference has gained support since it is believed that the labor market can then adjust more quickly to avoid a severe recessionary downturn. It is also a long-held belief that inflation and labor unemployment rates are intrinsically tied together in what is known as the Phillips Curve. According to this model, as unemployment declines, it puts pressure on wages and prices, but such has not been the case for ten years. Daniel Tarullo, a former Fed governor, has publicly stated that, “Monetary policy will need to confront the likelihood that we may be in for an indefinite period in which no Phillips Curve or other model will be a workable guide to policy.” In other words, the Fed has no inflation compass.

It is not surprising then that many economists and government policy gurus were rejoicing upon the release of today’s jobs report. Even though net-new jobs came in with a negative figure of 33,000, the first time in nearly a decade, the cause for celebration was due to an unexpected hike in hourly wages. One headline story read, “The U.S. lost 33,000 jobs in September, versus a 90,000 jobs increase expected by Reuters. Even with the surprise jobs number, the closely watched hourly wages figure jumped higher, suggesting a long-anticipated revival of inflation.” Hour wages grew at an annual clip of 2.9%, and the labor participation rate jumped to 63.1%, its highest level since 2014.

The Fed, however, remains confused. Per one reporter: “The elephant in the room at developed central bank monetary policy setting meetings has been the absence of inflation. At the Fed, it is now officially a “mystery”, although as yet no missing person’s report has been filed yet in relation to its absence. Evidently, the perception is that no crime has been committed, and there are no suspicious circumstances. There is no crime and no smoking gun. This “mystery” has no explanation, so it is being discounted by the Fed until either its absence can be understood or more hopefully, it will return.”

Even Janet Yellen said as much during a recent press conference when questioned about the inflation “mystery”. Her specific response was that, “I will not say that the committee clearly understands what the causes are of that, but we continue to expect that the ongoing strength of the economy will warrant gradual increases.” By “gradual increases, Janet is referring to the Fed’s plan to gradually normalize both interest rates and its bloated balance sheet.

“Why Does U.S. Price Inflation Remain Relatively Subdued?”

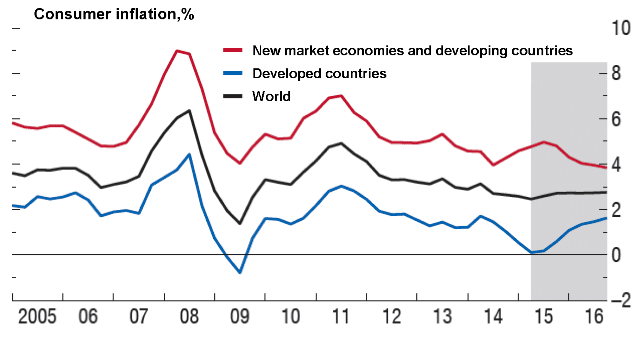

Over the past decade, the focus of the general populace on every word uttered by a central banker has transformed these intellectual geeks into nothing short of rock-star status. The lack of follow through on their inflation predictions, however, may threaten their exalted super-star reputations, if something does not happen quickly to revive the public’s adoration. Their path to stardom began back in the 70’s and 80’s when rampant inflation was the evil enemy at hand. Subduing this monster contributed to their early successes. As globalization and technological advances continued the downward trend of the past three decades, central bankers may have taken more credit for the outcomes than was warranted. The trend downward has continued since 2005, as well:

Global inflation, as measured by a weighting system developed by the IMF, has been stable for the period depicted above, while barely ticking up in 2017 to a 3.7% level, Such is not the case in developed countries, where the group struggles to reach a 2% targeted range. Back in 1999, emerging markets and developing countries were experiencing 13% inflation, but over time, this sector has become more resilient and manageable, posting a 4% figure by the end of 2016.

What is holding the developed sector back, especially in the United States? The number of hypotheses put forth to answer this query varies across the lot. The first idea is more a complaint. The Consumer Price Index does not fairly present what is really going on behind the scenes with inflation: “Big-ticket expenses such as rent, healthcare, and higher education – expenses that run into the thousands or tens of thousands of dollars annually – are severely underweighted or miss-reported. While rents have soared, the CPI uses an arcane (and misleading) measure of housing costs: owners’ equivalent rent.

Healthcare is 18% of GDP but only 8.5% of CPI. To those exposed to actual costs of healthcare, 8.5% of the CPI is a joke. The same can be said of higher education: households paying tuition and other college costs are exposed to horrendously high rates of inflation.”

We have also already mentioned globalization and technological advances, which have both managed to lower prices in critical areas. Hidden within these is the notion that international trade as a rule produces lower prices, which in turn forces domestic suppliers to compete at lower price levels. Another argument points to the miss-allocation of resources to non-wealth producing activities, the result of cheap money and abundant credit from the banking establishment. One need only observe what happened in the oil and gas industry for confirmation of this theory.

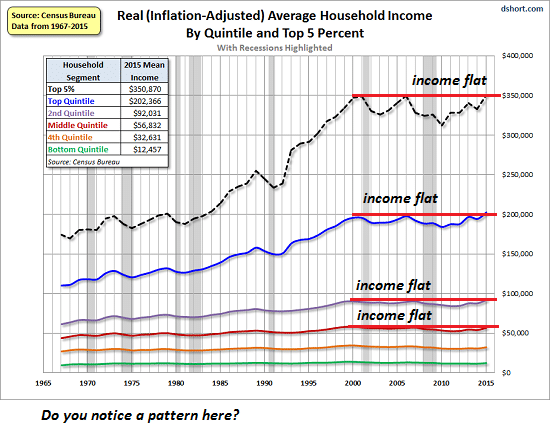

It is a known fact that an abundance of liquidity has definitely contributed to the supply glut on a global basis in just about every category of production, but commodities have been severely impacted. It may take years to climb out of a few of these so-called pits before demand dynamics take over once again. Why is demand lagging so badly? It does not take a massive research project to determine why demand is lacking. One only needs to look at income demographics over the past few decades to see the problem. Wealth is continuing to concentrate at the upper echelon levels.

How bad is this shift in wealth demographics? The following chart is self-evident:

From 1980 forward, the pattern of shifting tides favoring the wealthy is unmistakable. Per one analyst: “The supposed benefits of high inflation are undercut if wages don’t rise as fast as prices. As many observers have noted, wages for the bottom 90% have not kept pace with higher costs. For the bottom 90%, rising rents, higher property taxes, higher health insurance premiums, higher healthcare co-pays and deductibles, soaring college tuition and so on, have squeezed household budgets while household income has stagnated.” Wages have stagnated, while wealth inequality has soared.

From 2000 forward, income has basically remained flat for everyone, the one significant reason why demand is so subdued. The widening gap, however, has lit the fires of populism across the globe, which seemed to have been checked for the moment in Europe, but not for the U.S. and the UK. The progenitors of change, nevertheless, have their hands full in both regions. It took decades for the problem to arise, and it will take similarly long periods of time to correct the issues at hand, if ever.

Will inflation pick up in the near term?

A majority of experts, the same ones that have been wrong before, are already saying the fuse has been lit, so to speak. Bond markets are already signally inflation. Many of these proponents of “inflation is coming” point once more to the Phillips Curve: “We’re at an inflection point where any further declines in the employment rate should be putting upward pressure on wages. The inflation outlook is not worrisome per se, but certainly the risk of deflation has receded.” Today’s Non-Farm Payroll Report must have been music to this person’s ears.

Other observers are concerned that when equities drop, there will be a flood of money from those assets that will be poured into the economy. The result could be dire: “One part of the “inflation will stay low indefinitely” story is there’s an abundance of everything: grain, oil, natural gas, copper, bat guano – you name it, the world is awash in the stuff. Few seem to ponder the possibility that this surplus of everything might be temporary, a brief run of extraordinary luck rather than a permanent abundance. Few seem to ponder what global shortages in key commodities might do to prices.”

Concluding Remarks

Inflation can be both good and bad for economies, but the inability to model today’s dynamic is troublesome. Our new “Normal” is anything but normal.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk