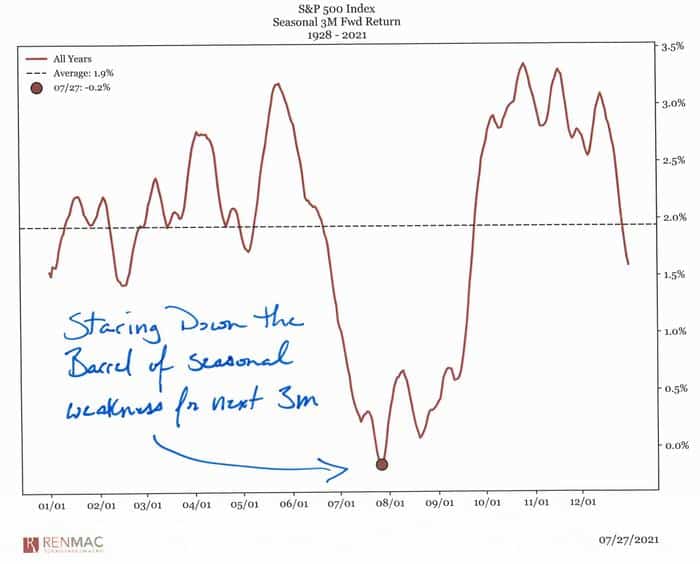

The market has levelled out this week with the S&P 500 hovering about the 4,400 mark. Investors are concerned for a number of reasons, and that uncertainty has contributed to this latest and expected ranging behaviour at the end of this month. The Fed concluded its deliberations today, suggesting a moderate tapering schedule in the years ahead, but the wait is on for next week’s Non-Farm Payroll Report to indicate if more delays are in store due to surging COVID-19 breakouts. Earnings are also top of mind, but the chart of the week goes to MarketWatch.com:

This rather academically inspired analysis takes historical three-month forward returns on the S&P 500 index and plots the results by week for each of the 12 months. As noted on the chart, the author claims that we are looking down the barrel of weakness for the next three months. This seasonality, however, is not a new discovery. It is the basis of the market adage of ‘Sell in May and go away, and come on back on St. Leger Day’ – a reference to the upper crust in London departing for the country during the summer, only to return in mid-September to attend a horse race. Statistics from 2013 forward, however, do not support this questionable strategy.

Nevertheless, there is some truth to the fact that investment analysts and traders do take extended holidays during August, returning to their desks later in the month or, bear with me, by mid-September on St. Leger Day. Studies also demonstrate that when these folks are away from their desks, they have time to think and rethink their present investment strategies. The result is that major shifts often occur in the market after this fabled holiday period is concluded.

What to expect in the weeks ahead

It may be early in the earnings season, but so far, the news has been favourable. Boeing shares jumped after it announced a return to the black, booking its first profit since 2019. Advanced Micro Devices also rose as its guidance now points to better days ahead. There is general concern that a shortage in semiconductor chips could dampen economic growth. Starbucks stumbled a bit in China, but to date, 90% of reports have been exceeding expectations.

At the Fed’s briefing on Wednesday afternoon, it highlighted a strengthening economy, but it is taking a wait-and-see attitude toward when to cut back its $120m monthly buyback of Treasuries and mortgage bonds due to COVID-19 concerns. If inflation rises beyond 2%, it will use its tools to dampen it.

Concluding remarks

August is about to begin and could witness a weakening, if historical data from many years back holds sway in today’s market ecosphere. The Fed is acting in line with expectations, and after just a few weeks, earnings have been for the most part very favourable. Investors, however, are always looking for something to worry about, and if it is not earnings or the Fed, then what? Will a pullback in China be the next big item? Maybe it’s time to attend a horse race and forget about the market until later.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk