Recent moves in the forex markets confirm it’s the time of the month when all eyes turn to the US Federal Reserve, which is due to give its next update on interest rate policy on Wednesday, 27th July.

A pre-announcement break out of the current upward trend of the greenback might be relatively unlikely. Sideways trading might be the more likely scenario. But there are plenty of technical analysis patterns developing that could result in Wednesday’s rate news acting as the starting gun for the next move.

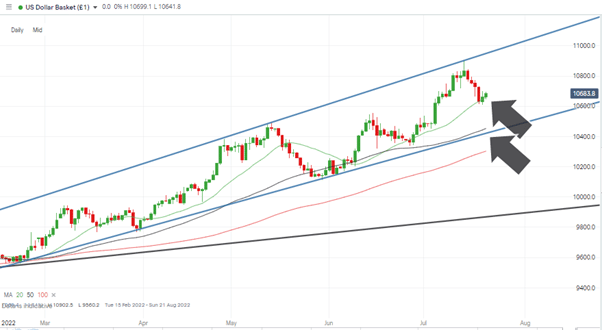

US Dollar Basket Index

The US dollar index values the greenback against a basket of other major forex pairs. Over the last week, it has been falling away from the upper trendline of the crucial price channel that dates back to February 2022.

US Dollar Basket Index – Daily Price Chart – 2021 – 2022 – Trendline Support & Price Channel

Source: IG

Comparing the long-term and more recent trendlines raises the question of whether the US Dollar Basket Index is over-extended, at least on a short-term basis. Political uncertainty resulted in a dash to the safe-haven properties of the US dollar through the first half of 2022. Demand for USD was supported by the Fed’s willingness to hike interest rates by 75 basis points at its June meeting, while other central banks have stuck with their slow and steady approach to rate rises. These strong fundamentals have offered significant support for the US Dollar Basket Index, but the air is getting thin at current price levels.

The index’s price currently sits in the middle of the (blue) price channel, leaving room for it to soften further before that all-important supporting trendline is tested. On the other hand, the fall in value from the highs of 14th July 2022 is already 2.5%, so some consolidation has already occurred. But a break of the 20 SMA on the Daily Price Chart (106.59) would open the door to price sliding to the supporting trendline in the region of 104.26 and the 50 SMA at 104.53. Both metrics have a track record of offering significant support, and their close proximity would suggest any downward move would be limited.

US Dollar Basket Index – Daily Price Chart – 2021 – 2022 – SMA’s

Source: IG

EURUSD

Despite the dollar softening over recent days, any decision to bet against it and favour the euro, for example, would still appear premature. Concerns about the Nord Stream 1 gas pipeline have stepped out of the financial news stream and into the mainstream media. European Commission president Ursula von der Leyen on Wednesday raised the stakes when she said in a statement that “Russia is blackmailing us.” Speaking in Brussels, she continued, “Russia is using energy as a weapon and therefore, in any event, whether it is a partial major cut-off of Russian gas or total cut-off … Europe needs to be ready.”

The question for anyone wanting to short the USD Basket too aggressively at this stage is whether they consider Europe “to be ready” yet. That question looks set to run for some time, and the Fed’s next meeting is much more ‘here and now’ in nature. According to the CME Group Fed Tracker tool, markets are pricing in another US rate hike of at least 75 basis points as 100% likely.

If you have been the victim of a scam, suspect fraudulent behaviour, or want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk