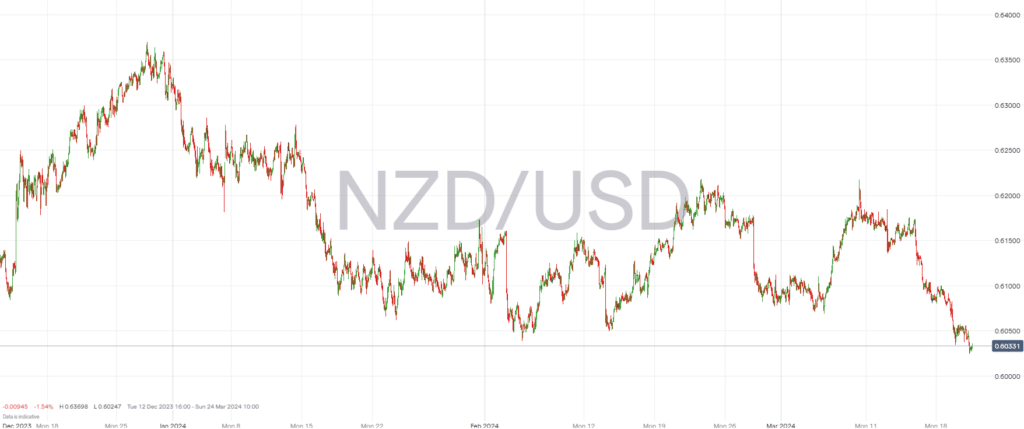

The New Zealand Dollar (NZD) is currently balanced on a delicate fulcrum against the US Dollar (USD). NZDUSD is reeling close to the lows that haven’t been seen since late 2023. The currency pair’s proximity to these levels signals a heightened sensitivity to the ongoing concerns regarding U.S. interest rates, particularly as traders grapple with the implications of the upcoming U.S. Federal Reserve decisions.

Despite no anticipated changes to the Federal Funds Rate in the imminent FOMC Statement, the financial market’s nerves are on edge. There persists a tangible nervousness stemming from the Federal Reserve’s pronouncements. While originally forecasted to deliver a dovish stance, recent indications suggest that the Fed may have to contend with more persistent inflation than previously expected—implying that prices may remain stickier for longer.

As the NZDUSD flirts with crucial support levels, traders with a bullish outlook are reminded to tread lightly. The steadfast selling pressure indicates that recovery from the oversold conditions might not be on the immediate horizon. The watchful eye is on the 0.60500 benchmark—the level below which, as breached, could set off alarms for bullish speculators and potentially usher in an era where the pair consistently trades beneath this marker. NZD being 2.08% in the red through the past 5 days is a sign that this was a marker on many radars.

The anticipation of increased market volatility is palpable, particularly post the U.S. Federal Reserve‘s monetary policy statement release. For short-term traders, preparation for swings in liquidity and pricing is imperative. Such volatility, while a boon for some, demands a strategic and responsive approach to trading.

Political acumen will also come into play as the Fed is projected to adopt a tone of caution intertwined with an air of positivity, reflecting ‘improving’ conditions. This blend of caution and optimism is a potential catalyst for uncertainty amongst financial institutions, which are already trying to navigate an intricate global economic landscape.

At present, the technical outlook for NZDUSD portrays a landscape marked by resistance and support that traders are closely monitoring. These thresholds define the immediate battlefield for the currency pair, with traders seeking to employ strategies to advantageously pivot within these targets.

Whether the NZDUSD pair can withstand the tremors from the Federal Reserve’s forthcoming policy communications remains to be seen, but what is certain is the advisement of caution in these unpredictably shifting tides of global finance.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Related Articles

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk