Thursday looks set to be a day of big announcements wrapped around small, hard to find clues as analysts try to predict where the markets are heading.

The European Central Bank (ECB) will update the markets on interest rates and Covid-support policies, and a rack of US corporations across a range of sectors will report their earnings. The news releases might not trigger immediate upticks in price volatility, but some of the details will provide key pointers to medium and long-term trends.

ECB Interest Rate Announcement 13.45 (CET)

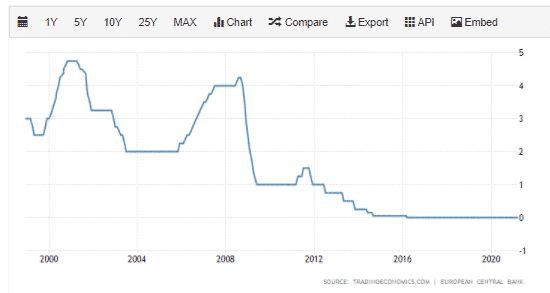

A decision of ‘No Change’ to the base ECB interest rate appears nailed on. The days of markets being ready to shoot one way or another on the back of an announcement seem a distant memory, for now at least.

Source: Trading Economics

ECB Interest Rate Press Conference 14.30 (CET)

The press conference looks likely to be the focus of analyst attention thanks to conflicting fundamentals across the eurozone region. More robust than expected economic data from some parts of the multi-faceted group of countries points towards the ECB tapering its intervention. Simultaneously, particular sectors and regions are struggling to come out of lockdown as the EU vaccination program painfully stutters into action.

The ECB’s long-running problem is how to implement a ‘one size fits all’ policy approach that caters to both thriving Berlin-based tech start-ups and struggling southern European tour operators. At the moment, that balancing act is as hard as it’s ever been.

Banking officials from the Benelux countries have been taking an increasingly hawkish stance. In the build-up to today’s announcement, Klaas Knot, the Dutch central bank chief, said:

“If the economy develops according to our baseline, we will see better inflation and growth from the second half onwards.” Expanding on the timeline for the policy change, he added:

“In that case, it would be equally clear to me that from the third quarter onwards we can begin to gradually phase out pandemic emergency purchases and end them as foreseen in March 2022.”

The argument against that happening is based mainly on the ECB wanting to sit in the slip-stream of the US Federal Reserve, which has pointed to relaxed monetary policy in the US continuing into 2022.

Behind the scenes, there appears to be an acceptance that the debate on how soon the ECB tightens its policy will pick up steam over the summer. That means analysts will be looking out for any signs from the ECB head, Christine Lagarde, that she is moving her finger anywhere near the trigger of that gun.

A Big Day for US Earnings

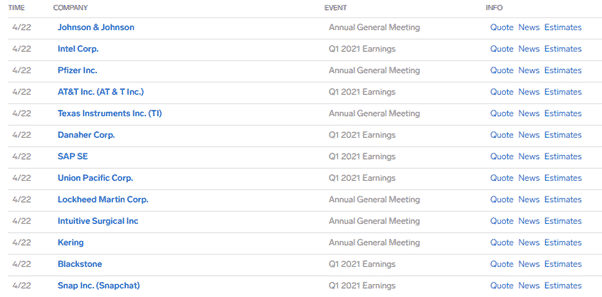

Netflix’s disappointing subscriber numbers on Tuesday took trillions off the value of global stock indices. Thursday sees big names from a wide range of sectors reporting their earnings, and this should add considerable colour to the picture.

No one knows yet if the news from J&J, Texas Instruments, Snapchat and Intel will be good or bad. But given the amount of data due to hit the market, the consensus reached by analysts is that it is likely to have a long-term impact on prices.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk