A mixed start to the trading week reflects markets still “churning” as investors rotate out of and into different asset groups. Many of the moves look like investors taking out insurance policies against the risk of next week’s news unsettling the markets.

Asian Trading Stymied by China News

In overnight trading, Chinese markets trailed a steady rise in other Asian stocks. That was mainly due to a hawkish announcement by the People’s Bank of China that it didn’t see the need for further government stimulus.

China, the manufacturing base for much of the world’s technology, has suffered from events in the US dragging down the consumer-facing Nasdaq names such as Apple. Last week’s rise in US Treasury bond yields cast a shadow over the Nasdaq that only just managed to avoid posting a technical correction.

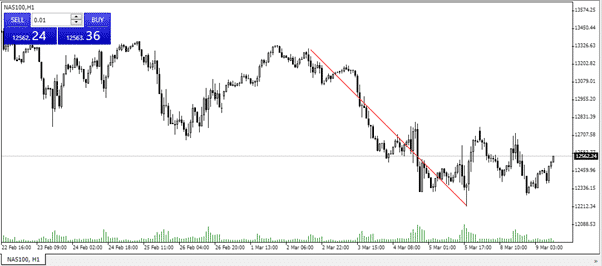

NAS100 – hourly price chart – avoids correction

Source: Tickmill

The Nasdaq 100 price slump from 13331 on Monday evening to 12211 half-way through Friday’s session was an 8.3% fall. Friday’s late rally off the back of positive US jobs numbers meant closing prices did just enough to avoid closing 10% down from their peak. Therefore, they avoided being categorised as a 10% “correction”.

US Data Points to Inflationary Pressure

The Nasdaq’s dead-cat bounce is a reminder that the risk remains for further upward movement in bond yields. Inflation has the markets spooked, and US Treasury Secretary Janet Yellen’s comments that she expects the impending stimulus package to bring “very strong” US growth has fuelled those concerns.

The Fed meets next week, on the 16-17th March and all eyes will be on the FOMC. That could result in sideways markets for the next few days, with Wall Street holding off on any major decisions until they’ve had a chance to dissect the comments of Fed Chair, Jerome Powell.

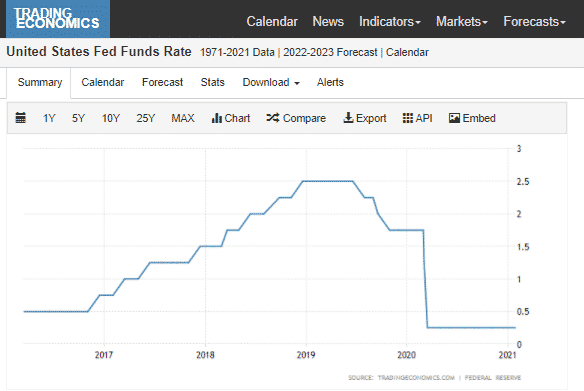

Source: Trading Economics

With US interest rates at record low levels, the only way is up. A rate hike may be some months off, but any comments suggesting they may be tabled sooner rather than later could derail the multi-month price recovery in risk-on assets.

The Nasdaq’s almost-correction has priced in some of the risk of the Fed taking a hawkish tone; however, growth stocks are particularly susceptible to inflation concerns.

European Data

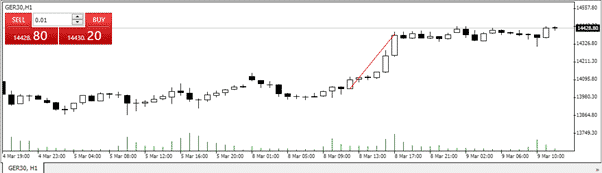

German data released on Monday saw the country post a sharp jump in its trade surplus. It was largely down to a 4.7% decline in imports rather than an increase in exports, but it was enough to take the DAX index higher.

The index, which started the week trading in the region of 13980, held onto its gains and has opened Tuesday’s session at the 14428 level.

NAS100 – hourly price chart

Source: Tickmill

More data is due out of Europe this week. None as significant as the US Fed’s announcement of next week, but European stock prices are reacting to local news. Look out for the eurozone employment change and Q4 GDP readings. The analyst estimates to beat, or miss are:

- November’s forecast of a 4.2% GDP final figure rate for 2021

- The European Commission predicts 2022 GDP in the euro area to reach 3.8%

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk