Stock Indices on the Slide

Global stock indices were treading water early on Monday, with Europe and Asian markets hovering near the security of big numbers.

- Nikkei 225 – 28,972

- Hong Kong Hang Seng – 28,864

- FTSE 100 – 6788

- CAC 40 – 5981

The uncertainty is playing on investors’ nerves and following last week’s down-week, the path of least resistance looks to be to the downside.

The EU appears to be moving towards doubling down on political manoeuvres regarding the Covid-19 vaccination roll-out. Weekend reports that the trading bloc is planning to limit exports of doses of the AstraZeneca vaccine produced in EU locations could add three months to the programme’s timeline in the UK.

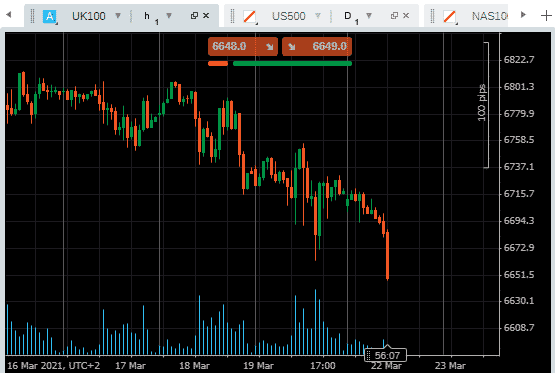

The Brussels road-block might be avoided, but the risk of a return to normality being delayed by months dragged the FTSE 100 down 0.42% from Friday’s close.

Watch out for the increasing importance of the prime minister of the Netherlands, Mark Rutte. He looks like the leader who is most likely to broker a deal that avoids delays. He has until Thursday to work his magic as that is the date currently penned in for EU leaders to hold a virtual summit on the topic.

FTSE 100 – 30m Candles

Source: Pepperstone

Turkish Lira Down 12%

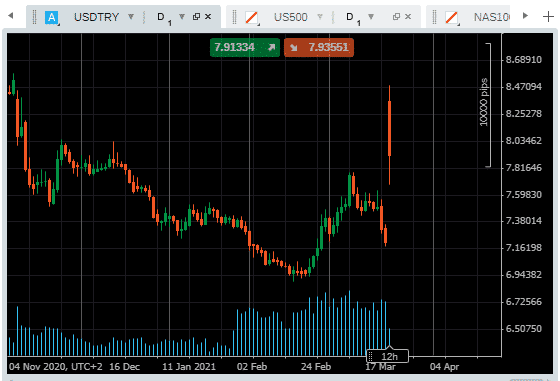

The Turkish lira lost significant ground against the US dollar. Having traded at 7.5 last week, on Monday morning, it is printing prices above 8.1162.

The price plunge followed news that Turkey’s President Recep Tayyip Erdogan had replaced the head of the country’s central bank. The departing head of the bank, Naci Agbal, lost his job after hiking interest rates last week to head off inflation. He had only been in the post for five months and had won favour with international investors who are increasingly concerned about the situation in Istanbul. Turkey’s base-level interest rate of 18% is the highest of any big economy. Still, it doesn’t look likely to hit 20% as the bank’s incoming chief is known for supporting relaxed monetary policy.

USDTRY – Daily Price Chart

Source: Pepperstone

Soon after European exchanges opened, USDTRY was trading back under 8.0. It might not be a run on the bank, but it does highlight the market as a target for speculators. Trading volumes have significantly picked up over the last two weeks.

Turkey’s Monetary Policy – Re-writing the text-books

Any traders who decide to enter the Turkish currency market will need to brush up on a few peculiar local anomalies.

- The president, Tayyip Erdogan, holds more sway over monetary policy than leaders of other major economies. The sacking of Agbal is the third dismissal since mid-2019.

- Sahap Kavciolu, who is taking up the position at the bank, shares Erdogan’s ‘alternative’ view of monetary policy that interest rate rises “indirectly cause inflation to rise”.

- The government has demonstrated a passion for stimulating the economy via loose monetary policy. The next Turkish parliamentary election is not due to take place until June 2023.

Online brokers such as Pepperstone offer spreads in USDTRY lower than 0.2%, which aren’t as wide as might be expected in such a volatile market. Lira has overall lost half of its value since 2018.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk