The Devil is in the detail. This familiar phrase seems most appropriate at this stage, as uncertainty grips our financial markets. Without the details of President Trump’s tax plan proposals, global markets have suddenly stalled, like deer in the headlights. Trump-phoria has continued for nearly an eternity, but analysts are beginning to ask specific questions, and investors are wondering if they might become the “greater fool” left holding the bag. Being held hostage is no fun, but, perhaps, details are on the way.

Trump will address Congress on Tuesday evening, and his aides claim that he will reveal details of his “tax plan outline” at that time, although a few tantalizing “leaks” have surfaced in today’s media. What is a “tax plan outline”, you query? Not sure that I have ever heard it referred to in such a way, but then nothing about the past few months has resembled anything in the not too distant past. Are we living in different times? Have all the rules that governed the past been suddenly put on temporary hold? More forex news

Stocks, commodities, and the foreign exchange markets look like homes on the range, with tight ranging behavior the name of the game. Glimpses and hints about pro-growth actions to be taken have buffeted this market well beyond the limits of sanity. Even the major bankers in the room have said to stay the course or miss out on the last few drops of gain to be squeezed from this overly dry dishrag. The time for quips and suggestions is over. It is time for the “Big Reveal”. What will Trump and his Congress actually do?

What tidbits of knowledge did Treasury Secretary Mnuchin share recently?

If the details are not easily forthcoming from the source, then try the next best thing – ask something close to the President for his input. CNBC did just that by interviewing Steven Mnuchin, the new Treasury Secretary in Trump’s Cabinet. The interview was held four days ago, and transcripts are readily available on the Internet for anyone that wants to parse his every word.

Mnuchin is 54 years young, Yale educated, and is also an alumni of Goldman Sachs, having worked there for 17 years and having risen to the position of Chief Information Officer. Since departing Goldman in 2002, he has managed a number of hedge funds and must have done quite well. His net worth is estimated to be in the $500 million range. Mnuchin was also Trump’s campaign finance chairman, a position that obviously won him favor and catapulted him onto the national scene.

Here are a few salient points from his interview with CNBC’s “Squawk Box”:

- What is happening with tax reform? “Let me first say that our economic agenda, the number one issue is growth and the first, most important thing that will impact growth is a tax plan. So we are committed to pass tax reform. It will be significant. It’s going to be focused on middle income tax cuts, simplification, and making business tax competitive with the rest of the world.”

- You think we can get back to 3% GDP – How do we do that? “I think it’s very achievable. If you look at long-term growth, we have underperformed where we need to be. We believe we can be competitive and get back to sustainable growth at 3% or more. There’s going to be a lot of things to impact it. I think the first issue, as I mentioned, is going to be tax reform. I think the other issue is going to be regulatory reform.”

- Do you think we will see 3% plus GDP by next year? “I think it’s going to take time to get there. So I think it would be, you know, more towards the end – seeing growth towards the end of next year. I think by the time we pass tax reform, you see the impact on the economy, you see the impact of regulation, it’s definitely going to take into next year to see an engine of growth.”

- Is it too early to reveal any details? “I would say it’s too early to announce. We’re working behind the scenes very carefully. We’re running a lot of numbers. We’re taking into account a lot of issues. As I said, you know, you’re going to see something in the near future. We’re committed to get this passed by August. Again, I can’t comment on the specifics of when we roll this out. This won’t really impact the economy until next year when you begin to see changes in behavior. And it will take a couple of years to get growth.”

Secretary Mnuchin may be hedging his bets on growth and specific details, but he is saying the right things at this stage in the process. He was non-committal on the notion of border adjustment taxes, since there has been pushback from corporate leaders, but a major piece of funding the budget has targeted this revenue source. At the end of the day, we have a service-driven economy. For it to grow, consumers need more money to spend, and very little has been said about increasing demand, other than from non-specific tax cuts. Adding to supply is not the answer. Creating demand is the way to go.

Trump also came out today announcing that he will request another $54 billion to expand the military. If you combine this request with more infrastructure spending and tax cuts, there appears to be an enormous deficit that must be made up from somewhere, but where? Trump’s only response was that, “We will have to learn to do more with less.” Look for delays and more push back.

How has the U.S. Dollar Index reacted to this calm before the storm?

The USD Index has been hovering between 90 and 100 since early 2016, but the determination of the Fed to follow through with its plans for interest rate normalization and the anticipation of the market that real hikes would materialize have pushed the greenback to higher levels. The concern, of course, it that it could go higher and put a dent in the economic modeling that Secretary Mnuchin is so proud about. If Trump’s growth policies are to succeed, a weaker Dollar is a prerequisite.

The Elliott Wave analysis depicted in the above chart is forecasting another strong up-tick over the next six months. If you buy into the forecasted bounce, perhaps, due to rate hikes and Trump stimulus programs, then we might see something north of 106 on the scale. Previous highs were just below 104, but an up trend is always defined as a series of higher lows and higher highs, as denoted here on this chart. This type of analysis is what supports the “most crowded trade” on Wall Street – the long-Dollar trade. You can also see and upward slope for both indicators, as well, more evidence, if you will.

What is happening on the commodities front?

Prices for commodities have been range bound for quite some time, showing small signs of recovery after a long 5-year period of drought. Prices, however, are inversely tied to the fate of the U.S. Dollar, such that any forecasted gains or losses going forward must be viewed in the prevailing context of the USD. The mainstays that attract investor attention continue to be Gold, Oil, and Copper, although each has a personality driven by a variety of fundamentals.

Gold has been on a roller coaster ride for the past year, but has maintained a tight range between $1,130 and $1,360. It presently sits at $1,253, roughly the mean for the period. It has recovered of late due to political uncertainty in Europe, but as one pundit put it, “There are bullish and bearish factors pulling Gold in two directions at this time. However, the prospects of rising inflation trump all other factors.”

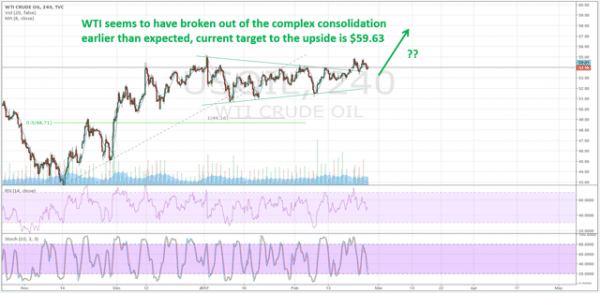

Oil has also grabbed the headlines for much of the past year. OPEC production agreements have allowed demand to catch up with supply, leading some analysts to believe that the path is set for higher prices. The chart below offers credence for this type of thinking:

There is, however, a fly in this ointment – the U.S. shale industry. Oil exports are already showing signs of growth in the U.S., all due to the ongoing recovery of shale producers. Add to that mix Trump’s desire to pump more oil, and the reasoning of this analyst becomes compelling: “The price of oil won’t enjoy the boom cycle it has in the past. There will be a ceiling on it because of the booming U.S. shale industry, and the successful and ongoing elimination of costs on the production side. That, and the increase in productivity will keep the price of oil from soaring as it has in the past.”

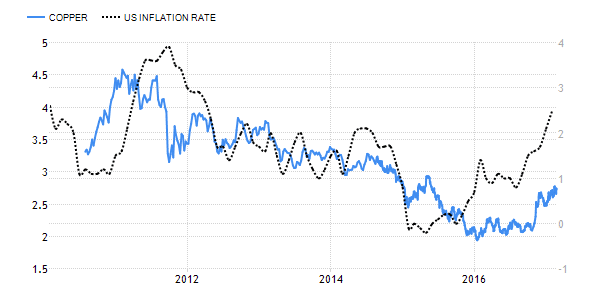

Lastly, Copper, the bellwether of industrial activity:

Copper prices bottomed out in 2016 and appear to be following inflation’s lead. A plot of prices versus Industrial Production, whether in the U.S. or China, would have yielded a similar correlation as displayed above. Is it time to be bullish in the metals sector? It could be, and these trends may not be dependent upon immediate tax cuts either.

Are we living in different times where the economy will keep expanding?

There have been two major market corrections after the millennium crossover. Metrics were stretched to the breaking point in both instances, but wisdom purveyors at the time frequently stated that, “These times are different.” In 2000 and 2008, excess debt inflated the bubbles of the period. The debt today has been transferred to government balance sheets.

The primary problem with too much debt is that it can steal demand away from the future. To a degree, we are already experiencing this lack of demand today. There is a balance that must be maintained in order for the economy to expand again, but it is a delicate balance that requires finesse, not exposure to abrupt changes. Can we trust the powers that be to do the right things at the right time in a coordinated fashion?

Concluding Remarks

Regardless of where you look, whether it is equities, commodities, or foreign exchange, our financial markets are playing a waiting game. Our community of analysts is adamant that details of Trump’s tax plan need to be revealed in order for investors to remain confident in what lies ahead. President Trump will address Congress today, which could become a quintessential moment if tax reform details are revealed. The debate will then ensue, but things should become very interesting from that point forward.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk