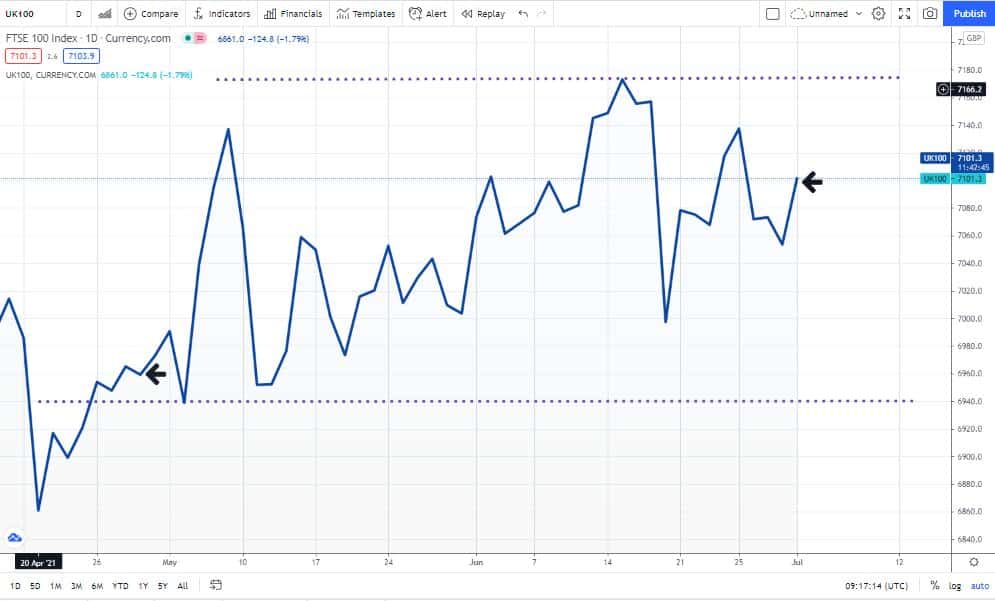

The Covid pandemic has reduced the impact of some of the traditional seasonal events in the financial markets. “Sell in May” could have worked, but only if you’d sold into the rally in the first week of the month and then only temporarily. Anyone who didn’t close out equity short positions to lock in profits could now be feeling a short squeeze coming on. The last month has been associated with upward and downward price swings, but at the end of the first half of the year, a bunch of indices were trading at, or near, all-time highs.

FTSE100 – May to June

Source: Trading View

“Buy in June”, as considered in this analysis, would have been the better bet. The critical takeaway is less that prices have risen – that is, after all, standard procedure for equity markets – but more that price volatility is remaining at high levels. That raises the question of whether to apply momentum or range-trading strategies and whether the summer holiday season will lead to sleepy markets?

Will the Financial Markets Have a Busy Summer?

There’s little doubt there is a strong appetite for the holiday season to return to normal, but global restrictions make that appear unlikely. With traders unable to get away from their screens, the markets could be on for a more eventful third quarter than might be expected.

Two drivers of volatility appear to be building momentum, and a third is just refusing to go away. Anyone able to make the right calls on how they interact over the next few months is likely to be rewarded.

Inflation & Interest Rates

This topic looks set to dominate financial decision making for the foreseeable future. Analyst reports on the subject have moved to “when not if”, and there is some debate as to whether asset prices have started pricing in the move.

GBPUSD vs FTSE100

Source: Trading View

In the above chart, GBPUSD has flatlined through 2021 on the back of data showing US inflation is picking up and that US interest rates might rise. At the same time, the FTSE 100 has risen in value, creating a divergence on a scale not seen for 12 months.

Furlough

The 1st of July marked the beginning of the end for the UK government’s furlough scheme. Government contributions to the scheme will be tapered back to zero by the end of September. With one to two million UK workers still reportedly on the programme, the summer months looks set to be the time when push comes to shove in terms of redundancies and unemployment.

The US is slightly ahead on this unwinding and offered a far smaller scale scheme than the UK. However, clues from there are that some sectors of the economy are stuck in the mud. So far, governments and central banks have erred on the side of supporting the unemployed rather than interest rate rises to cool the booming areas of the economy. Using blunt instruments to tackle fine-detail problems looks unlikely to work effectively, and any change in priorities would significantly unsettle the markets.

Brexit

Brexit is back, or did it ever go away? The sausage-wars relating to the Northern Ireland Protocol may be heading towards a truce, but it’s an uneasy one. Politicians and bureaucrats may be more willing than hedge fund managers to prioritise summer breaks in their second homes, but the UK and EU can expect continued trade disruption.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk