Could lightning be about to strike twice? If it does, then those positioned correctly could be about to post some serious returns.

The US Jobs numbers released on Friday caused the Dow Jones Industrial Average index to lose 0.21%. That index, full of defensive and cyclical stocks, reacted badly to the news that the number of new US jobs in August was only 235,000 compared to the analysts’ forecast of +720,000. At the same time, the tech-heavy Nasdaq 100 rallied by +0.21%. The symmetry in the numbers added a neat touch to the fact that not for the first time, Covid fears manifesting themselves as payroll data were sending different sectors shooting off in opposite directions.

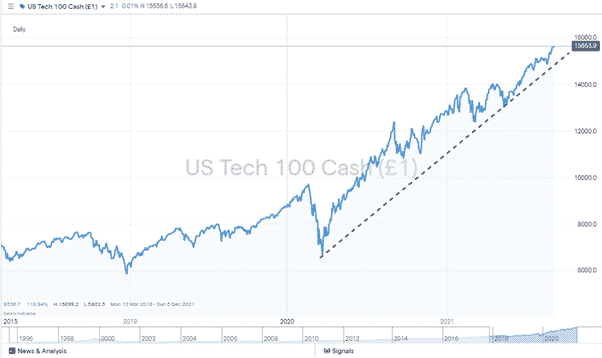

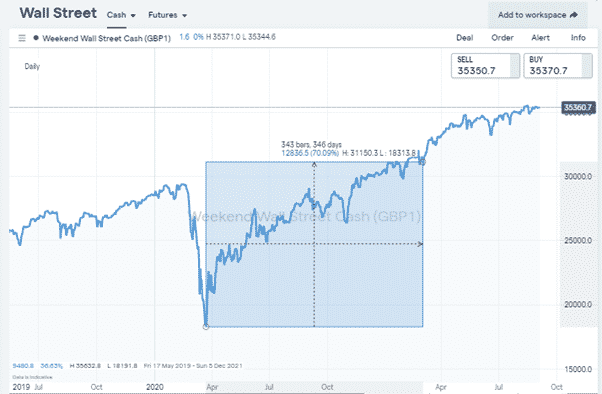

The markets have been here before. In March 2020, the battering taken by leisure, traditional retail and airlines was harder to bear because IT, home-working, and biotech stocks took off on a multi-month bull run. The Nasdaq posted a 100.55% return in the space of 12 months. Over the same period, the DJIA’s increase in value was 30 percentage points less than the Nasdaq. If any next wave of Covid infections is anywhere near a worst-case scenario, then how long could this trend last? Is it just a case of using historical price data to run the same strategy as before?

Source: IG

Source: IG

Non-farm Payrolls & Covid

The Non-farm Payrolls numbers may have been the catalyst of the market moves, that data point being one of the most important in any calendar month. But it was the look-through to the cause of the disappointing number of new jobs which brought analysts back to the familiar page headed “Covid.”

Nasdaq Relative Out-Performance – Round 2

The divergence might be momentary or far less sizeable than the one that started last year in March. However, given the historical reference between March 2020-21 and the size of the potential opportunity, it could be the big trend in the run-in to the end of the year. With the traditional flu season in the northern hemisphere due to kick in, there are plenty of reasons to be concerned about new Covid strains bringing ‘normal’ economic activity to a grinding halt.

The argument that equity valuations are beginning to look a bit “toppy” might deter those looking for a naked long position in the Nasdaq. Also, remember that even that index suffered a slump when the Covid outbreak first gripped the markets. Therefore, a market-neutral long-short strategy could be a popular strategy; a potential 30% gain over 12 months would be hard to dismiss.

No Alternative

There aren’t any hard and fast guarantees in the markets, but the NFP numbers do point to interest rates staying near zero for longer than some have been thinking. With negligible returns on cash likely for the foreseeable future, playing a potential Covid resurgence could be one of the few games in town. The Covid pandemic remains a wildcard, but it is one that traders have seen played before.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk