If last week’s incredible events in the US stocks GME and AMC had a hint of Star Wars rebel fighters winning the day, more recent events reflect The Empire Strikes Back.

Whether traders will make a profit with these stocks will come down to the order in which events play out over the next few days. It will also depend on them finding a way to trade the markets.

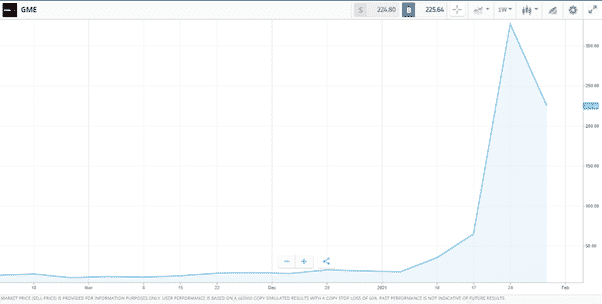

Source: eToro

Throughout January, online retail traders who spotted GME and AMC were over-shorted piled into long positions in the stocks. That drove price up to levels which were eye-watering for the big Hedge Funds who, using short-selling strategies, had bet against them.

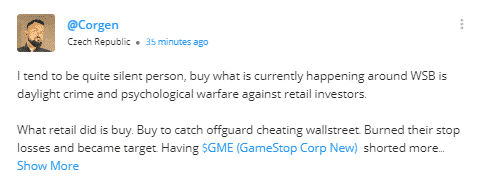

On Thursday, the situation radically changed as the little guys found they could not trade the market in the hot US stocks while the hedge funds still could.

Source: eToro

Is Your Broker Letting You Down?

The unprecedented events of last week have led to independent traders not being able to trade. Whether by accident or design, there are countless reports of traders being locked out.

Robin Hood – Robbing from the poor to give to the rich?

The US broker Robin Hood was until the end of last week the platform of choice for many independent traders of GME and AMC. Its innovative and user-friendly functionality counted for nothing as on Thursday it prohibited its clients from adding to positions in the stocks.

Basic economics covers that price moves are a function of supply and demand. By removing the buying pressure, Robin Hood was effectively inviting any clients who held GME / AMC positions to suffer losses as the price plummeted or to become forced sellers.

To put it politely this isn’t a good look for the platform which had been happy to collect brokerage fees from the army of small investors who bought into the stocks through January. Suggestions that the Wall Street establishment had put pressure on the broker were soon filling the Reddit chat rooms the small traders use. Even Elon Musk called out the move.

UK Brokers also clamp down on GME / AMC trading

June Felix, CEO of the broker IG emailed clients on Tuesday to state the platform had “made the difficult decision to temporarily suspend new trading on GameStop and AMC Entertainment”.

The undertone of the message from IG is that they are looking to protect retail clients from themselves. Trading though is inherently risky. Whether in EURUSD or Crude Oil, any position can blow up an account within seconds. By bringing in controls in this one situation, the broker may well be demonstrating good client care. There is though a secondary consequence of prohibiting trading in GMe, that is it’s letting the big hedge funds off the hook.

Brokers Which Offer Markets in GME / AMC

While IG has bailed out of the market, some brokers currently demonstrate an intention to continue supporting trading in the two hot-stocks. Things can change quickly though, and the below are likely to have their arms twisted by the financial establishment, but at the time of writing, they are holding out and offering markets in GME and AMC.

- eToro

- Admirals

- Plus 500

The above is not intended to be financial advice but is a commentary on the health of the retail broker sector. The risks associated with trading are considerable and you can lose all your money.

If you want to know more about this topic, please contact us at [email protected]

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk