President Donald Trump was finally able to get a major piece of legislation through Congress, but opinions are mixed as to if it will really have its publicized impact. According to Trump: “We are really going to start to rock.” According to Janet Yellen, the outgoing Fed Chairperson: “It’s not a gigantic increase in growth.” And lastly, one Democratic Representative, Lloyd Doggett, described it as, “This monstrosity is a bill that only Donald Trump and Republicans, who have accomplished next to nothing in this Congress, could love. It will not grow our economy.”

Read more forex articles and news

Is the new bill a gift to the Middle Class, as Trump would have us believe, or is this act just one more trickle-down bait-and-switch that benefits the super wealthy at the expense of the masses? Politics and spin doctoring are in full swing at the moment, deliberately disguising whatever the true outcome might be, and, as with all tax reform packages, there are phase-ins and loopholes that may take years to play out.

The insidious part of the plan, as revealed by GOP insiders, is that it punishes Democratic states by levying new tax burdens on property owners in those locales. Corporations benefit to a large degree, as well, but most experts agree that, “Corporate tax cuts are likely to be spent on buybacks, dividends, and debt repayment rather than investment.”

An ecstatic Trump told reporters, “It’ll be fantastic for the middle-income people and for jobs, most of all. And I will say that because of what we’ve done with regulation and other things our economy is doing fantastically well, but it has another big step to go and it can’t take that step unless we do the tax bill. I think we could go to 4, 5 or even 6 percent, ultimately.” Congress is expected to pass the tax bill this week, since last-minute adjustments and tax gimmicks have assuaged the last bits of opposition.

This type of overly optimistic retort has accompanied every single piece of major Republican tax reform over the past four decades. Unfortunately, the great claim of “Trickle-down Economics” has never come to pass. The wealthy class has less tax burden, while the middle class suffers, and Federal deficits balloon to new heights. For many observers, this tax reform joke is just déjà vu all over again.

What are the primary drivers in the new Tax Plan that will “rock” the economy?

The last occasion when the U.S. economy topped 5% GDP growth was in 1984. Most economists agree that, under today’s mitigating circumstances due to central bank policies on a global level, achieving consistent growth dynamics in the 4 to 5 percent range would be supremely challenging. A brief summary by one reporter of the key highlights of this proposed legislation follows:

- “Under the bill, today’s 35 percent rate on corporations would fall to 21 percent, the crown jewel of the measure for many Republicans. Trump and GOP leaders had set 20 percent as their goal but added a point to free money for other tax cuts that won over wavering lawmakers in final talks.

- The bill would repeal an important part of President Barack Obama’s Affordable Care Act — the requirement that all Americans have health insurance or face a penalty — as the GOP looks to unravel a law it failed to repeal and replace this past summer.

- The bill would drop today’s 39.6 percent top rate on individuals to 37 percent. The standard deduction — used by around two-thirds of households — would be nearly doubled, to $24,000 for married couples.

- The $1,000-per-child tax deduction would grow to $2,000, with up to $1,400 available in IRS refunds for families who owe little or no taxes.

- The deduction that millions use in connection with state and local income, property and sales taxes would be capped at $10,000. That’s especially important to residents of high-tax states such as New York, New Jersey and California, traditional Democratic strongholds.

- The bill would allow homeowners to deduct interest only on the first $750,000 of a new mortgage, down from the current limit of $1 million.

- People who inherit fortunes would get a big break. The bill would double the exemption, meaning the estate tax would apply only to the portion of an estate over $22 million for married couples.”

How did the opposition react to this hoopla? Chuck Schumer of New York, the Senate Minority Leader, recoiled when reporters asked for his opinion of the proceedings, remarking that, “Under this bill, the working class, middle class and upper middle class get skewered while the rich and wealthy corporations make out like bandits. It is just the opposite of what America needs, and Republicans will rue the day they pass this.”

Who are the winners and losers in this proposed tax reform plan?

Legislators have decried this entire process for being conducted in private without the normal reviews by the budget office to determine estimates of financial impacts and exactly who the winners and losers under this bill might be. In order to ensure its passage, there have also been numerous last minute changes, often written into the margins of the bill, which have yet to see everyone’s light of day.

Recently, a team from The New York Times was able to obtain a copy of the proposed legislation for analysis. Their top-level conclusion: “Real estate developers and technology companies could see big tax cuts, while low-income households and people buying health insurance could lose out.” A brief recap of their analysis is below:

WINNERS

- President Trump, his family, and other real estate developers;

- Big Corporations;

- Multimillionaires;

- Private Equity Managers;

- Private Schools and the People that can Afford Them;

- The Liquor Business;

- Architects and Engineers;

- Tax Accountants and Lawyers.

LOSERS

- People Buying Health Insurance;

- Individual Taxpayers in the Future;

- The Elderly;

- Low Income Families;

- Owners of High End Homes;

- People in High Property Tax, High Income States;

- Puerto Rico;

- The Internal Revenue Service.

The last one may be a bit puzzling to the casual reader, but, as NY Times reporters noted, “The tax collection agency has been under funded and understaffed for years. Now, it will have a raft of new tax rules to deal with that will require upgrading its software, printing new manuals and explaining to confused taxpayers how things work.”

Why doesn’t Trickle-Down Economics work as proclaimed?

Tax cuts for the wealthy began in earnest in the sixties, but reached their crowning moments in the decades to come. The siren song of Trickle-Down Economics began as far back as the eighties, when President Ronald Reagan and his budget director coined the phrase for public consumption. Nothing has changed, as one analyst opined: “The bill embodies a long-standing Republican philosophy that a substantial tax break for businesses will trigger economic growth and job creation for Americans in a trickle-down economy. Skeptical Democrats are likely to oppose the legislation unanimously.”

For several generations, Republicans have espoused the enormous benefits of rewarding the wealthy and corporations with tax cuts, swearing that these newfound savings would be re-invested in the economy, thereby generating enormous job growth amongst the masses, increases in disposable income, and prosperity for all. This litany of carefully chosen words, as logical and appealing as it may sound, has never fulfilled its promises. To the contrary, there is no evidence that Trickle-Down Economics works.

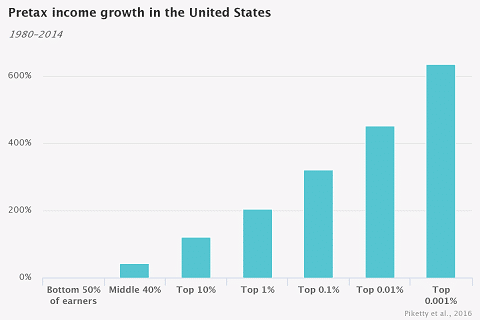

Republicans scoff at these notions, as do their wealthy donors that fill the GOP coffers in anticipation of more favorable tax legislation. This latest round of blatant prestidigitation basically ignores the overwhelming preponderance of negative data, as borne out by a few of the diagrams that follow. The first exhibit depicts income growth demographics from 1980 forward:

The chart above presents the final result of years of favoring the wealthy. Prosperity is nowhere to be seen at the lower levels. For those of us that prefer to see trends over time, the next diagram is quite revealing:

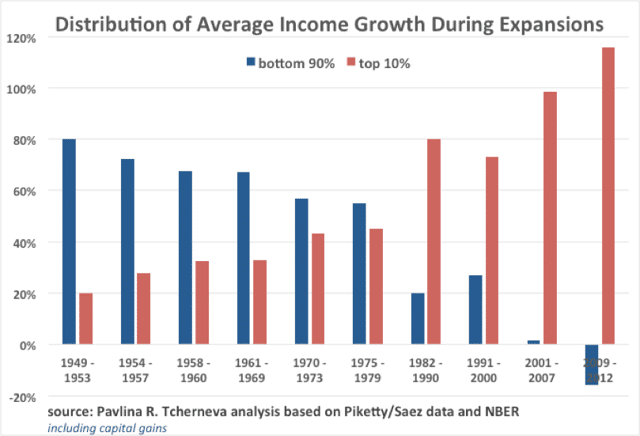

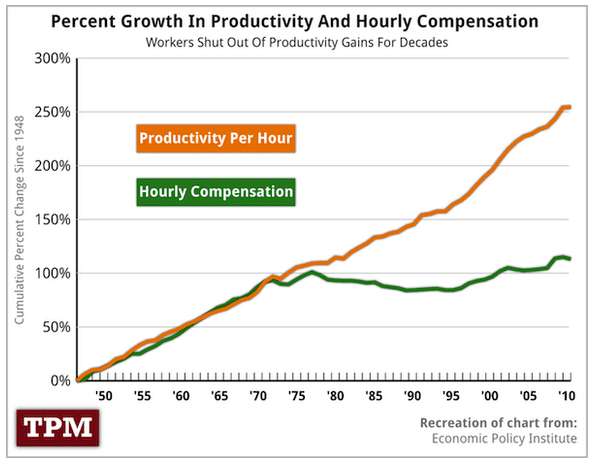

Make no mistake about it – there has been a long-term trend over decades to concentrate wealth and income in the upper reaches of society. As one investigator puts it: “Here, you see that the spoils of economic growth have been accumulating progressively towards the top while the bottom 90%(!), which accumulated as much as 80% of the gains from economic growth in the early 1950s, are basically stagnant. As have been medium wages, stunning in the face of rising productivity:”

Hourly compensation has traditionally tracked in tandem with any realized productivity gains, but there was a large disconnect that occurred in the eighties during the Reagan years. Economists have attempted to explain these results by pointing to the outsourcing and off-shoring phenomena that have accompanied this same period of time, but these techniques have also been enabled by the technologies of our times.

After further study and analysis, economists now understand that technology, after assaulting labor intensive, capital intensive, and technology intensive industries from the seventies forward, had now shifted its focus to service industries. The jury is now in. New technology has actually been destroying jobs more quickly than it generated new ones, and the new ones take more training and time to develop, as well. As for the United States, the sad commentary is that, “What’s perhaps surprising is that the U.S. is doubling down on some of the policies that have led to this disappointment.”

And what about deficits? Republicans have staunchly objected to rising corporate debt and the operating deficits that bring them about, but where have they been during this round of wealth giveaways? Senator Bob Corker of Tennessee, a deficit hawk, blithely stepped out of the way by announcing that, “I realize this is a bet on our country’s enterprising spirit, and that is a bet I am willing to make.”

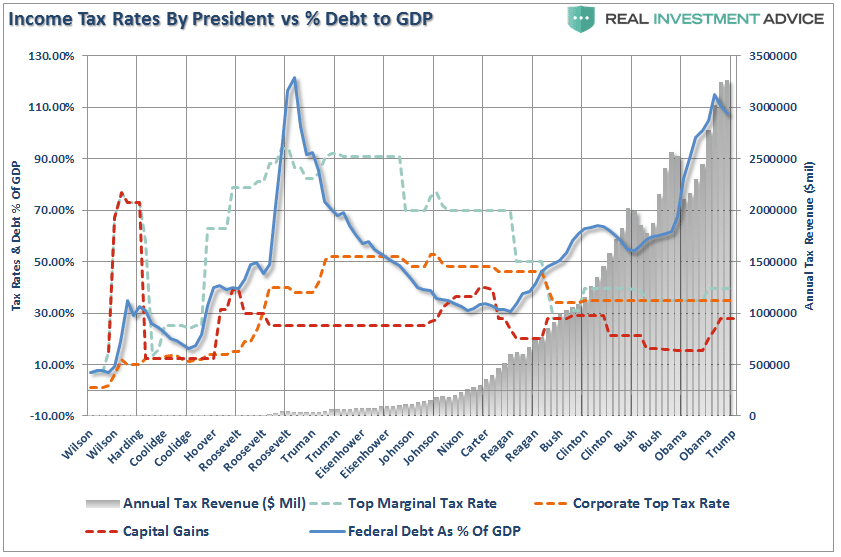

Unfortunately, the correlation depicted below is a haunting reminder that tax reform has not been deficit-friendly in the past:

Yes, tax revenues may have increased, but they did not keep pace with government spending, especially in the area of defense. Federal Debt as a percentage of GDP now resembles that of some third-world banana republic. Something has got to give.

Concluding Remarks

Trump steadfastly believes the U.S. economy will rock, but there is no evidence that his trickle-down policies will lead to anything more than it has in past administrations. In the past, stimulus programs generally followed periods of recession or high interest rates, neither of which is present this time around.

Will the U.S. economy float all boats? Time will tell!?

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk