| Markets.com Pros | Markets.com Cons |

|---|---|

| Over 2,200 markets to trade | Some minor glitches in site functionality |

| Choice of two market leading platforms | Limited range of crypto markets |

| Low commission and tight spreads | |

| Extensive range of support tools |

Traders’ Viewpoint

- Markets.com is a longstanding and well-regarded multi-asset broker that was founded in 1999. Its parent company is Safecap, a subsidiary of a UK listed FTSE 250 company Playtech PLC. The regulatory framework is of a high standard falling under the protection of the Financial Conduct Authority (FCA) in the UK, as well as in Cyprus, Australia, South Africa and the British Virgin Islands.

- There are over 2000 markets to choose from and two trading platforms via the MetaTrader platform for forex and the WebTrader platform for the trading of ETFs. markets.com offer a strong global broking experience. All the basic markets are offered, and all come with competitive pricing. It’s possible to trade major, minor and exotic forex pairs and Indices on a Cash or Futures basis. The list of commodities on offer includes some names other brokers don’t, such as rice, soybean and palladium. There are also markets in bonds, crypto, equities and ETFs.

- Markets.com, in terms of fees, is in line with peers but not a market leader. The majors like GBPUSD and EURUSD forex pairs can be traded at a spread as low as 3 pips, and the diversity of investment opportunity allows for more than an ‘execution-only’ trading offering. It is worth noting that there are no hidden fees, and importantly deposits over USD2500 will see any third party fees refunded to clients by markets.com.

Two leading platforms, WebTrader and Metatrader, are incorporated into markets.com. This is similar to peers. Web trader allows new and experienced traders to move between demo to live trading, whilst MetaTrader remains the benchmark with forex and supports self-trading, copy trading and automated trading of algorithmic models. Both platforms are available in mobile apps for either Android or iOS devices.

The educational aspect of markets.com is a very strong plus point. The collection of tools available form a high quality, concise suite of services. There are also educational tools leaning towards fundamental analysis include Financial News and Financial Commentary. There is also a Knowledge Centre area on the site that hosts a very wide and diverse library of resources, including video tutorials. Customer support is in line with peers offering a 24/5 live chat, with better than average response times.

Markets.com offers a high quality, comprehensive and in many areas market leading trading package. There are over 2000 markets available to trade and pricing is competitive. Client regulatory protection is high, especially when you add in tools like Negative Balance Protection and Guaranteed Stop Losses that are associated with day-to-day trading. The education tools are very comprehensive, and the straight forward account opening process is very transparent with deposits being able to be made in up to nine different currencies with other options available on request. Trading in Crypto markets, via Webtrader, is relatively limited outside the majors; however, one differentiated feature is the ability to trade a basket of digital currencies.

About Markets.com

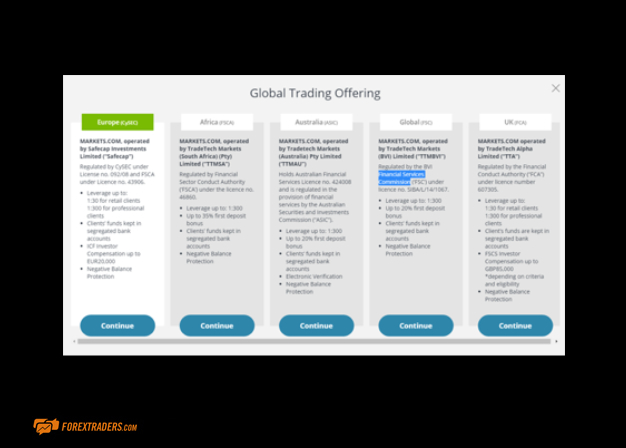

Markets.com is a well-regarded multi-asset broker with a reputation for providing its clients with a top-tier trading experience. The firm was founded in 1999, and its parent company is Safecap, a subsidiary of Playtech PLC which is traded on the London Stock Exchange’s Main Market. This means account holders can take some comfort from trading through a firm which is a constituent of the FTSE 250 Index. The regulatory framework is of an equally high standard. Catering to a global client base, the firm holds licenses with five different regulators. Depending on their domicile clients will fall under the protection of one of, Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority of South Africa (FSCA) or Financial Services Commission (FSC) of the British Virgin Islands.

Who does Markets.com appeal to?

Markets.com offer traders a one-stop-shop broking experience. There are two trading platforms to choose from meaning the trading styles covered range from systematic trading of forex on the MetaTrader platforms through to trading ETFs on the WebTrader platform. Both platforms are designed to help traders execute effectively in the market, and low trading costs are also thrown in.

With over 2,000 markets to choose from the firm has most bases covered and there is also a range of resources on offer which are designed to provide traders with the opportunity to enhance their skill-set.

The firm offers a lot but manages to keep the many tools on offer close to hand without them getting in the way of actual trading. The site has an appealing aesthetic the trading platform is streamlined, and the user experience is tailored towards helping traders get into the markets.

The firm has a transparent approach to reporting and information such as trading Ts&Cs can be easily accessed and is well laid out. The client’s interests are further protected by the firm’s decision to run their service under the regulatory umbrella of five highly regarded bodies, CySec, FCA, FSCA, ASIC and FSC.

Trading is provided using CFD instruments though UK based traders have the additional option of trading using spread bets. The possible tax efficiencies associated with that type of trading may appeal to some.

Account types

Being a broker with a global outlook means Markets.com offer a wide range of accounts. This allows them to construct the accounts on offer to take advantage of local regulations and means the accounts on offer reflect where in the world an account holder is based.

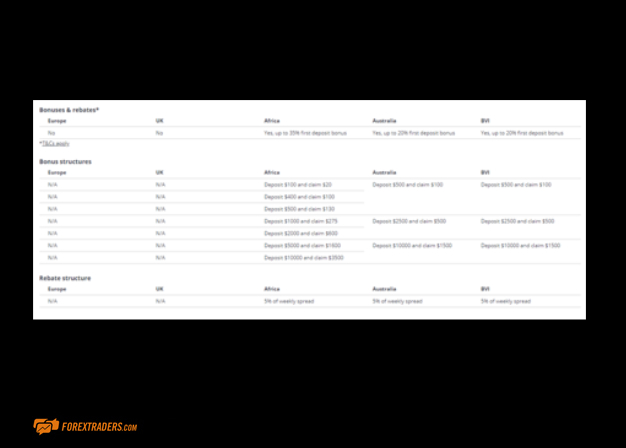

Account holders in countries which fall under the remit of the African, Australian or BVI regulator can, for example, receive bonuses and rebates up to 35% of the size of their first deposit. They can also benefit from a rebate of up to 5% of their weekly spread.

Considering the range of accounts on offer, the broker does well to provide a clear and exact description of what is on offer. The full details are laid out here (https://www.markets.com/global-trading-offering/)

All the accounts have access to the 2,000 – plus instruments. All trade-in CFD formats though UK clients have the option of trading using spread bets and there are four account types: Classic, Premium, Professional, GSL (France).

The MarketsX service is billed as a VIP style account. The broker claims spreads are tighter, that there are no fees and upgrading to it is free of charge. The minimum deposit for this account is £ 250 which is the same as for the entry-level Classic account and whilst clients would have to carry out their own due diligence it appears at face value to be a no-brainer to upgrade from Classic to MarketsX. Our reviewers tried and failed to get a clear understanding of why both the Classic and MarketsX accounts are offered. Even after discussing with the super-helpful support team, it wasn’t entirely clear where the Classic account sat in the overall scheme of things.

Markets and territories

Markets.com offer a truly global broking experience. Being set up to take clients from most corners of the world means they also need to offer trading in ‘local’ markets. This benefits all traders. Exotic forex pairs include EURRUB and USDILS.

Instruments and spreads

All the basic markets are offered, and all come with competitive pricing. It’s possible to trade major, minor and exotic forex pairs and Indices on a Cash or Futures basis. The list of commodities on offer includes some names other brokers don’t, such as rice, soybean and palladium. There are also markets in bonds, crypto, equities and ETFs.

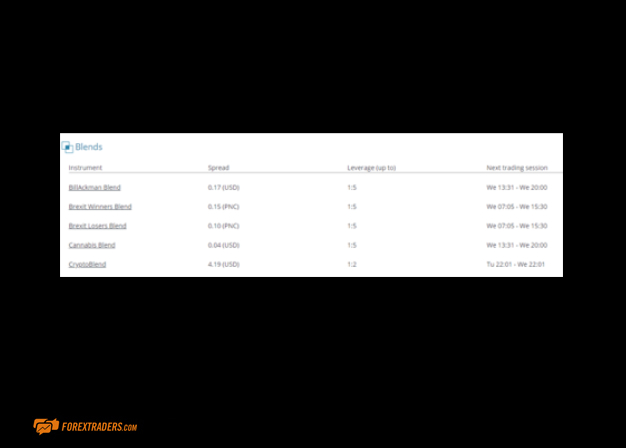

There are over 2,000 markets to trade and having such a large number means Markets.com is able to offer some more esoteric markets. The ‘Blends’ section of the site offers clients the opportunity to trade a basket of instruments which have an underlying characteristic. These ETF/Index style products mitigate single stock risk whilst allowing traders to take positions in some of the more cutting edge markets such as ‘Brexit Winners’ or ‘Cannabis stocks’.

Another interesting range of markets is the IPOs section. Providing these kinds of innovative markets will benefit traders looking to run more complex strategies or diversify risk over different asset groups.

The full list of markets is well laid out in one place and is available here: https://www.markets.com/cfds/

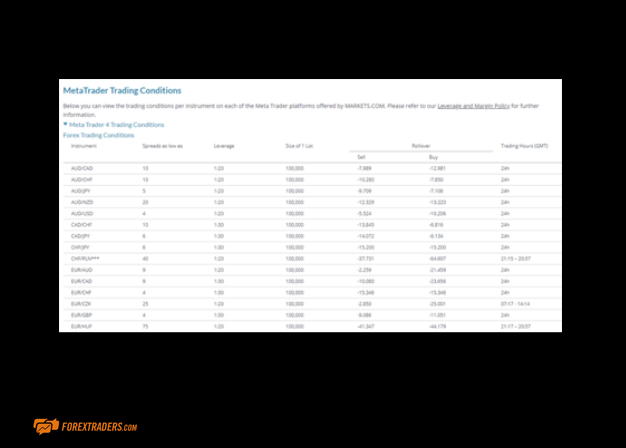

Brokers who are confident that their pricing is competitive tend to be transparent about what they offer. Markets.com fall into this group and willingly provide a clear breakdown of trading terms (here https://www.markets.com/metatrader-trading-conditions/)

The break down is done to a granular basis making it easy to pick up all the information needed to include cost details into strategy analysis. GBPUSD and EURUSD forex pairs can be traded at a spread as low as 3 pips on MetaTrader and the WebTrader platform quotes a EURUSD spread as low as 1.9 pips. Some brokers that effectively offer an ‘execution-only’ service can offer spreads on EURUSD as tight as 1 pip. How this stacks up for individual strategies will depend on such things as trading frequency. In terms of pricing, Markets.com is in line with its peer group though by no means a market leader.

Fees and commissions

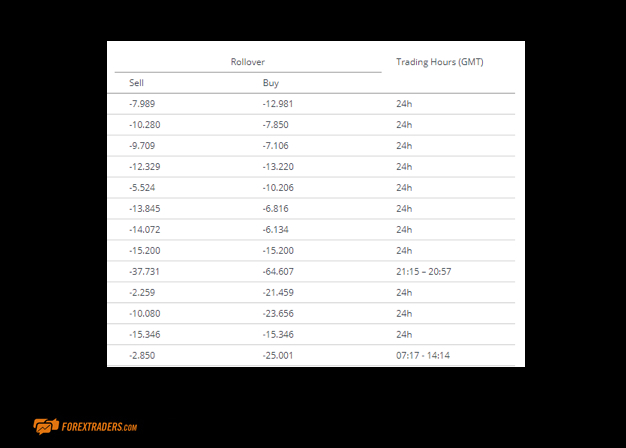

Reflecting the different approach taken by the respective regulators’ leverage terms vary across accounts. Most of the forex pairs on MetaTrader come with 1:20 or 1:30 margining. Commodities come with 1:10 leverage, and a nice-to-have feature of the site is the clear laying out of roll-over terms and market hours.

Markets.com state that there are no hidden fees and explain that the company is mainly compensated for its services through trading spreads and daily financing charges.

There are no fees applied by Markets.com for adding funds to an account. The market standard disclaimer that “a third party may apply charges” and a neat feature of the Markets.com service is that deposits of a size above $2,500 will see any such fees refunded to clients by the broker.

Platform review

Markets.com offers the choice of two leading platforms, Web Trader and the MetaTrader (MT4 and MT5) platforms.

Developed by MetaQuotes Software Corporation and released in 2005 MT4 is still the benchmark which other trading platforms judge themselves by.

It supports self-trading and automated trading of algorithmic models. Analysts can test personal trading scripts and take advantage of back-testing functionality.

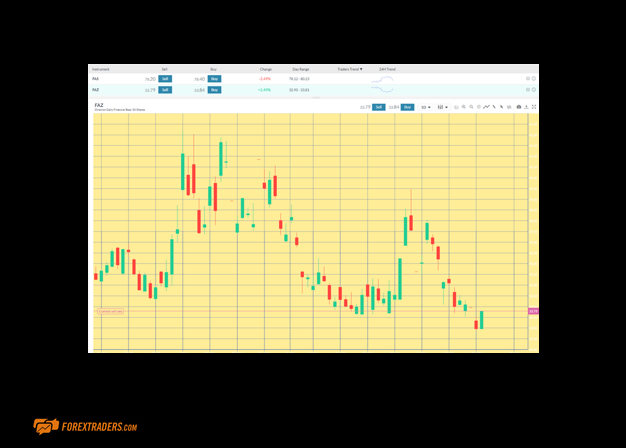

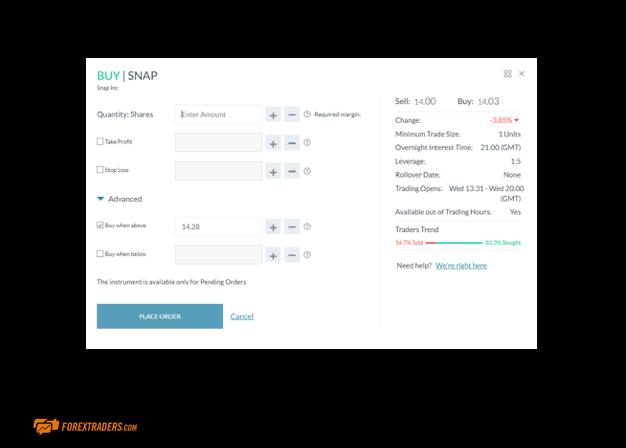

The Web Trader platform has an attractive interface which comes with highly intuitive functionality.

One neat feature that comes with the WebTrader platform is the ability to toggle from Demo to Live trading. Having the option to switch to a virtual environment to test ideas easily is a real plus.

The Web Trader platform is available in 15 languages including English, Arabic, Danish, Czech, Dutch, Finnish, German, French, Spanish, Italian, Greek, Norwegian, Polish, Swedish and Russian. The mobile Web Trader platform additionally covers even more languages, including Hungarian.

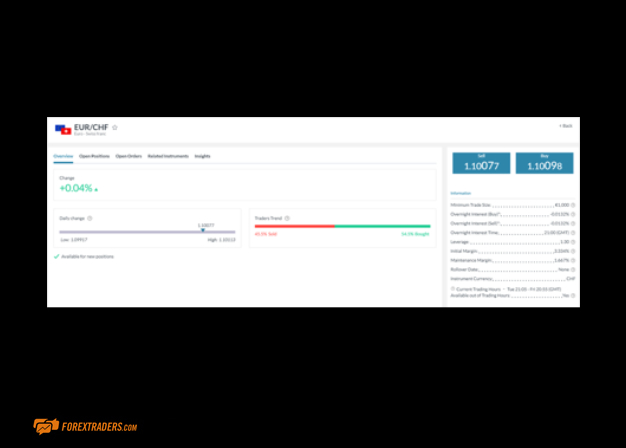

The execution interface is an ideal portal for accessing the markets. The addition of the Trader’s Trend in the sidebar offers traders an in-view last-minute sanity check as they are executing trades.

Mobile trading

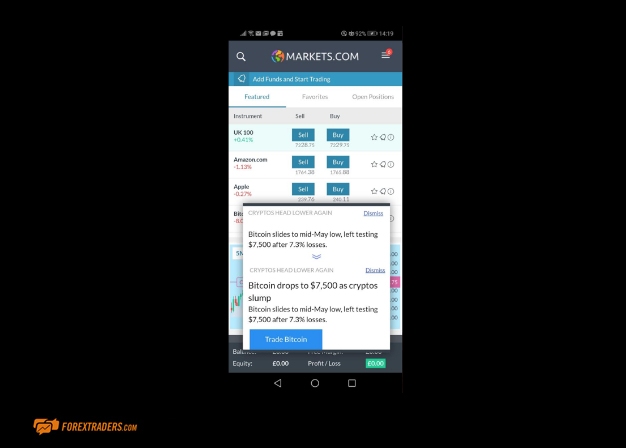

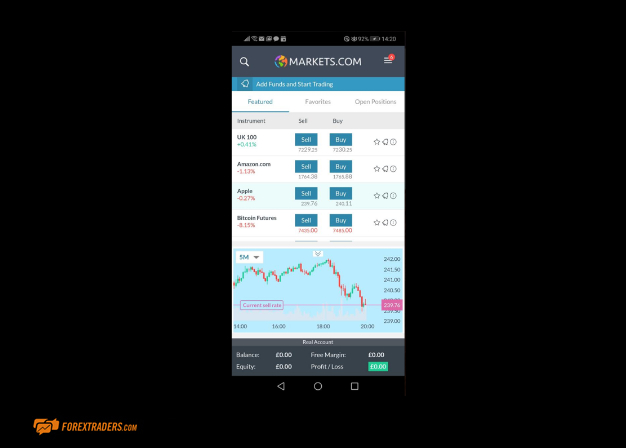

The MT4, MT5 and Web Trader platforms are available in mobile apps for both Android and iOS devices. The functionality of the desktop service is carried over into the handheld format meaning traders can benefit from consistency of service.

There are a range of research tools made available with a few not making the cross-over to the smaller screen, but both apps are all about delivering a mobile trading experience and meet that target.

Social trading and copy trading

The MetaTrader Expert Advisors function and MQL5 community chat rooms provide access to the copy and social trading environments but Markets.com do not offer any in-house social or copy trading services.

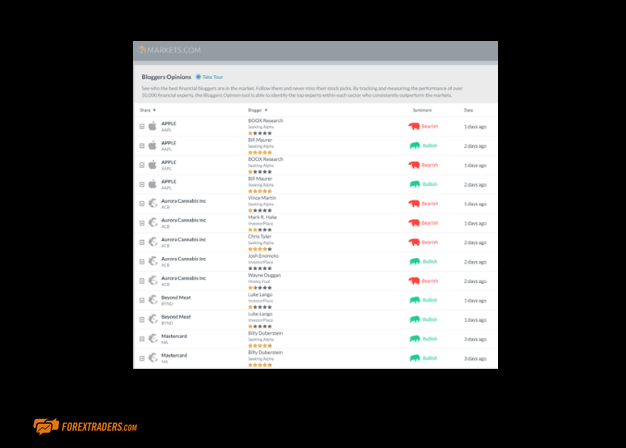

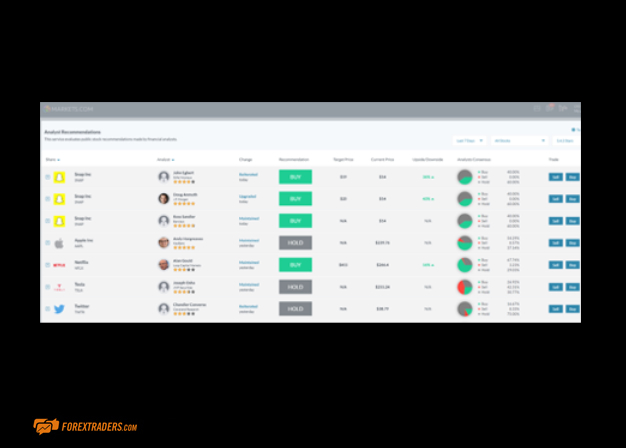

The Bloggers Opinions area of the site and the more formal Analyst Recommendations pages provide an opportunity to consider new ideas but in a less interactive way than social trading in its purest form.

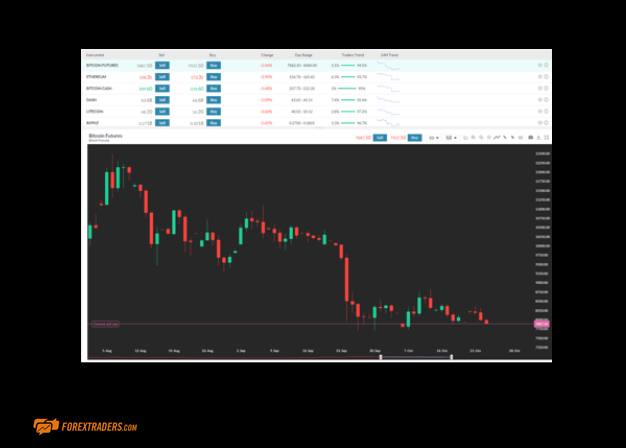

Crypto

There is a relatively limited range of Crypto markets in the WebTrader portal, but Bitcoin and the major Alt-Coins are all represented.

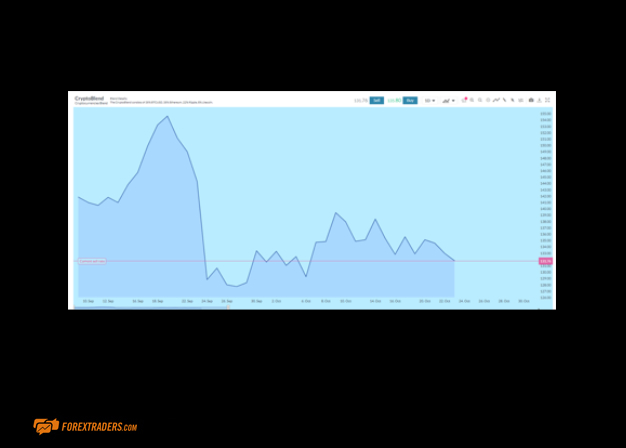

One feature which stands out is the CryptoBlend. This basket of digital currencies is made up of 35% BTCUSD, 35% Ethereum, 22% Ripple and 8% Litecoin. With volatility levels being so high in the crypto markets, this instrument manages some of the risk associated with holding a position in only one name.

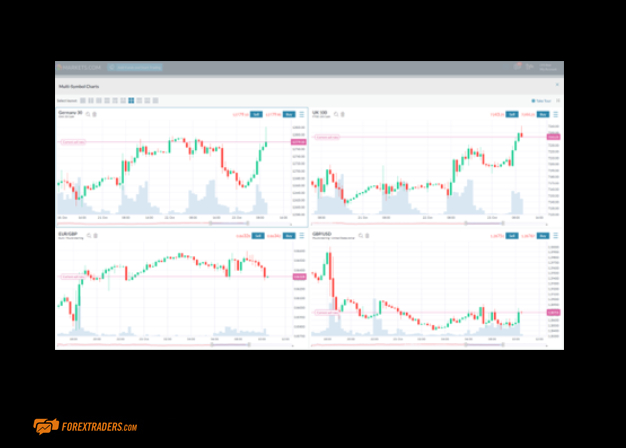

Charting and tools

The MT service is the most popular retail platform in the world, and the provision of the MetaTrader platform means Markets.com clients have access to a market leading experience. MT4 and MT5 are both particularly strong in terms of charting and indicators. Analysis is further aided by the provision of forensic grade annotation.

The WebTrader package is quite different. It’s still possible to draw down a range of software tools, but it has a very different aesthetic.

Personal preference will determine which of the two styles of service are used and it’s of benefit to clients of Market.com that they have two great packages to choose from.

Education

One of the major plus points of the Markets.com site is the resources on hand to support traders navigate the markets.

The real selling point is how the different tools form a complete package. Together they form a high quality, concise suite of services.

The range of analyst reports, for example, might not be as great as found at the biggest brokers but the reports which are available work really well and more importantly work in tandem with the rest of the offering.

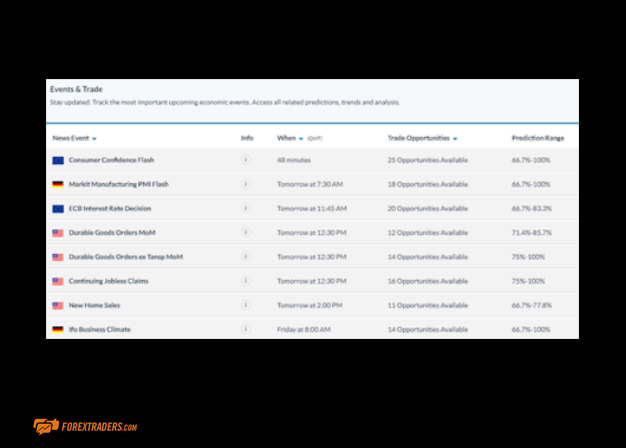

Tools leaning towards Fundamental Analysis include Financial News and Financial Commentary. The former is a great aid for those looking to manage positions through major market announcements, and the Commentary feature provides an edited selection of rolling news items.

There are also analyst recommendations and a table sharing data on recent Hedge Fund trading patterns.

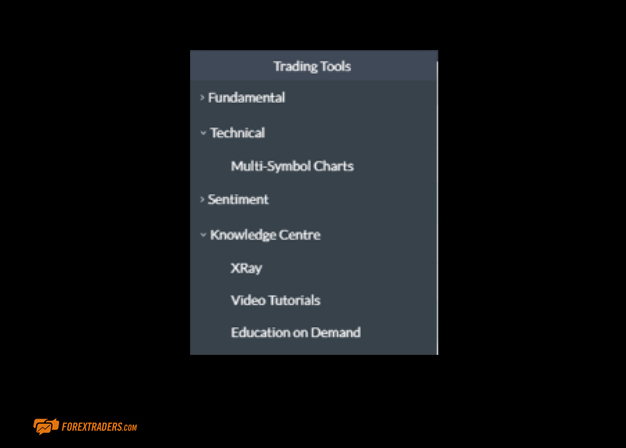

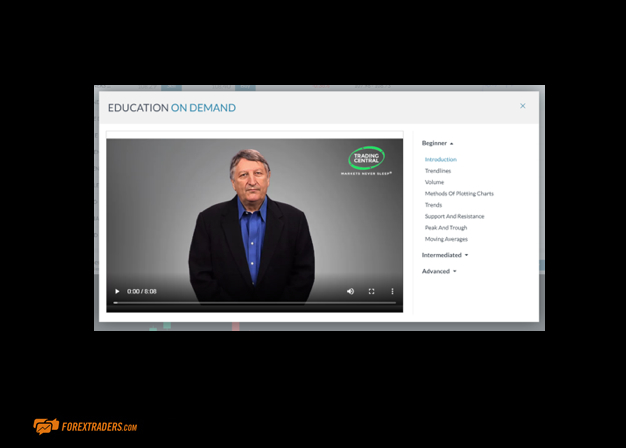

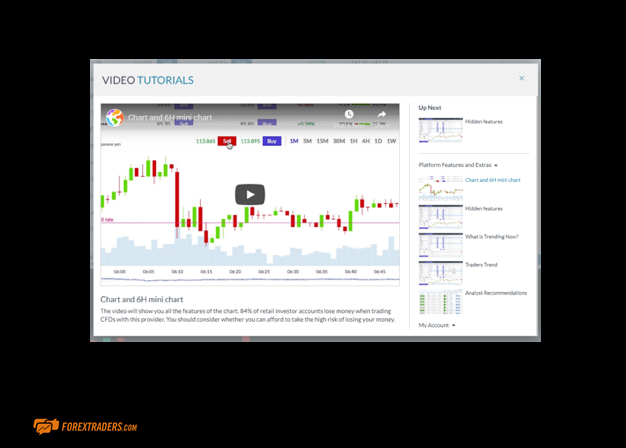

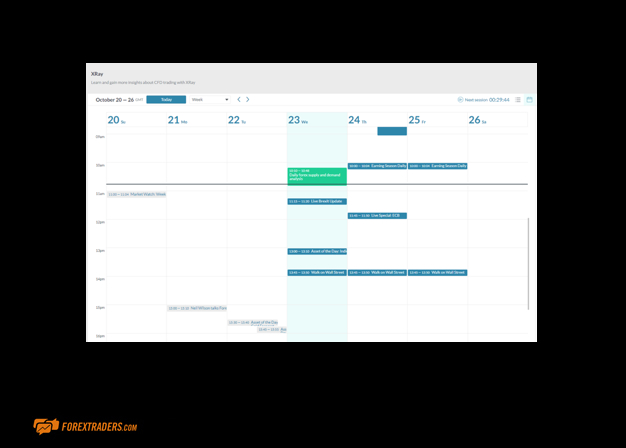

The Knowledge Centre area of the site hosts a comprehensive library of resources intended to be considered off-line. There are Trading Central videos to be found in the ‘Education on Demand’ area. The Video Tutorials hold content appropriate for both beginners and more experienced traders and the XRay function includes informative media on topics such as ‘Live Trading Rooms with Trading Signal’ and ‘Asset of the Day’.

Trader protections by territory

The five regulators who oversee the firms’ operations are highly regarded. Applying for and securing licenses from these bodies sends out a clear message that Markets.com takes compliance and client protection seriously. An additional back-up is that the parent company is a listed company and so has to comply with the reporting regulations of the London Stock Exchange.

ECN trading is not available. During our testing, we didn’t find this to be an issue, and Markets.com are a big enough broker to be able to access sufficient market flow. The other benefit of not being hooked up to ECN is that clients are protected by Negative Balance Protection, which means they can’t lose more than their initial capital outlay.

Guaranteed Stop Losses are available. Whilst these come with extra costs, they are not offered by all brokers and can be particularly useful for managing ‘gap risk’ at times of increased market volatility.

MARKETS.COM is operated by Safecap Investments Limited (‘Safecap’), which is a regulated investment services firm authorized in the conduct of its activities by the Cyprus Securities and Exchange Commission (CySEC) under license no. 092/08, and is also authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Services Provider under license no. 43906

MARKETS.COM, operated by TradeTech Markets (South Africa) (Pty) Limited (“TTMSA”)

Regulated by Financial Sector Conduct Authority (‘FSCA’) under the licence no. 46860.

MARKETS.COM, operated by Tradetech Markets (Australia) Pty Limited (‘TTMAU”)

Holds Australian Financial Services Licence no. 424008 and is regulated in the provision of financial services by the Australian Securities and Investments Commission (“ASIC”).

MARKETS.COM, operated by TradeTech Markets (BVI) Limited (“TTMBVI”)

Regulated by the BVI Financial Services Commission (‘FSC’) under licence no. SIBA/L/14/1067.

MARKETS.COM operated by TradeTech Alpha Limited (“TTA”)

Regulated by the Financial Conduct Authority (“FCA”) under licence number 607305.

How to open an account

The firm’s appetite for transparency also carries over into the administrative side of things.

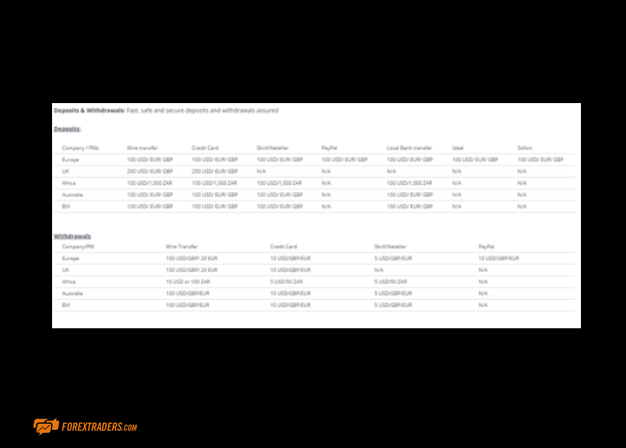

There is again a well laid out table of the terms which apply to the range of payment types in the different regions.

The clarity with which the information is presented is to be welcomed. Market.com offers a wider variety of account types than some other brokers but still manage to outshine their peers in terms of how transparently that information is presented.

Deposits can be made using USD/EUR/GBP/DKK/NOK/SEK/PLN/CZK/AED and further currency options are also available upon request. Credit/debit card payments are quoted as taking approximately 24 hours to process and wire transfers approximately 1 – 2 business days.

The free Demo account provides an opportunity for traders to familiarise themselves with the trading portal and those looking to scale up to live trading will find the broker willing to offer support through that process.

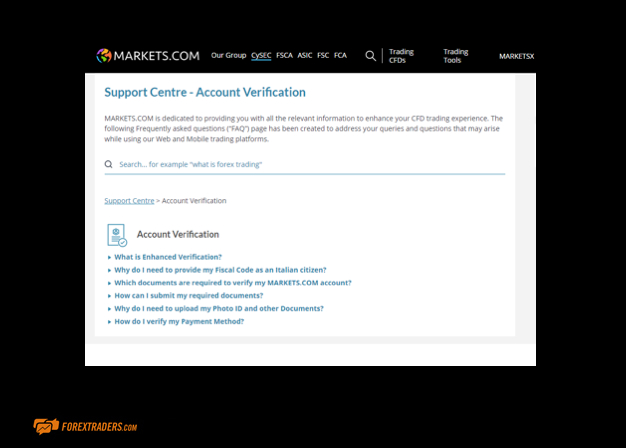

Possible snags relating to the completion of the onboarding process are addressed in the Support Centre – Account Verification page (found here: https://www.markets.com/support-center/account-verification).

The size of the initial minimum deposit is £250, which is higher than the market average. This may deter some from trying out the service, but Markets.com is set out to provide a service based on quality, not quantity. Saying that, it is disappointing that the minimum limit is not readily reported and our testers had to contact the customer support team to acquire the information.

Customer Support

Customer support is offered 24/5 via Live Chat, phone and email. During our testing the support staff came over as very client focused and knowledgeable. Response times were better than the market average and when connected there was a feeling that the support staff were dedicating 100% of their attention to resolving any issue we had.

We did hit a couple of snags which relate more to the site layout than to the quality of the support function. When discussing the role that the MarketX account plays within the suite of accounts we struggled to get a clear understanding of why anyone would stick with a Classic account and not ‘upgrade’. We also found that clicking on the ‘Contact Us’ icon on the home site and trading dashboard failed to populate the screen with the support desk phone number. The Live Chat team provided a work-around but we wouldn’t want to be trying to make a call to discuss a time-sensitive trading issue and find out that the number wasn’t readily to hand.

There were also some neat features which enhanced the experience. The Live Chat window for example doesn’t disappear when navigating across different pages.

The bottom line

Markets.com offers a high quality, comprehensive trading package. Clients have the choice of two platforms, both of which are well regarded in the trading community. The platforms have a different ‘feel’ from each other meaning traders can find a best fit which suits them and both come packed with resources designed to enhance the trading experience.

There are over 2,000 markets available to trade. Account holders can trade the popular markets knowing that the Markets.com pricing is competitive. There is also the option to bring in to their portfolio innovative instruments such as ‘blends’ and grey-market trading in IPOs.

Client protection is a recurring theme. The regulators which oversee the firms operations are of the highest calibre. In addition tools such as Negative Balance Protection and Guaranteed Stop Losses are available to help mitigate the risks associated with day to day trading.

Additional support is provided in the form of a particularly knowledgeable help desk and a range of analytical and learning tools designed to help all traders improve their skill-set.

We found a few glitches in the site functionality but these would be easy to fix and maybe reflect the broker is constantly changing its offering in an attempt to ensure their clients continue to get the best possible trading experience.

FAQs

How can I open an account with Markets.com?

A wide range of accounts are on offer, all of which take into account the advantages of local regulations wherever in the world an account holder is based. A simple online process takes only a few minutes to get up and running.

Is Markets.com a regulated broker?

Markets.com is a regulated broker. Either Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority of South Africa (FSCA) or Financial Services Commission (FSC) of the British Virgin Islands will be overseeing the regulations of operations.

What bonus terms does Markets.com offer?

Various incentives and loyalty awards are offered, including bonuses and rebates up to 35% of the size of an initial deposit and rebates of up to 5% of a weekly spread.

How do I withdraw money from Markets.com?

To withdraw money, there is a simple step by step online process that allows you to choose your preferred withdrawal method, including using a mobile app. Accounts must be fully verified before a withdrawal request is fulfilled and funds will be returned to clients with the same payment method used to deposit, with credit card deposits being prioritised.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk