| Pros | Cons |

|---|---|

| Proprietary 24Option trading platform | US customers not currently accepted |

| Multi-lingual customer support |

Trader’s Viewpoint

First founded in 2010, 24Option are an award-winning online broker based out of Limassol, Cyprus. 24Option offers a full-service trading package that includes binary options broker as well as forex, CFDs, stocks, and indices trading. Their focus is mainly on the European market, and it has two main offices in London and Cyprus.

Although 24Option originally got their start as one of the first online options traders, it has now significantly diversified their trading offering. This includes CFDs on stocks, commodities, and indices across a range of regions and markets. Currency trading is also provided in the major currency pairs, although there is not a huge amount of support for exotic currency pairs. It provides no-commission trading and the spreads on offer are generally very competitive.

Trading is delivered through a proprietary trading platform which offers all-inclusive trading from one centralised location. This includes forex, CFD, commodity, and binary options trading all from one convenient location.

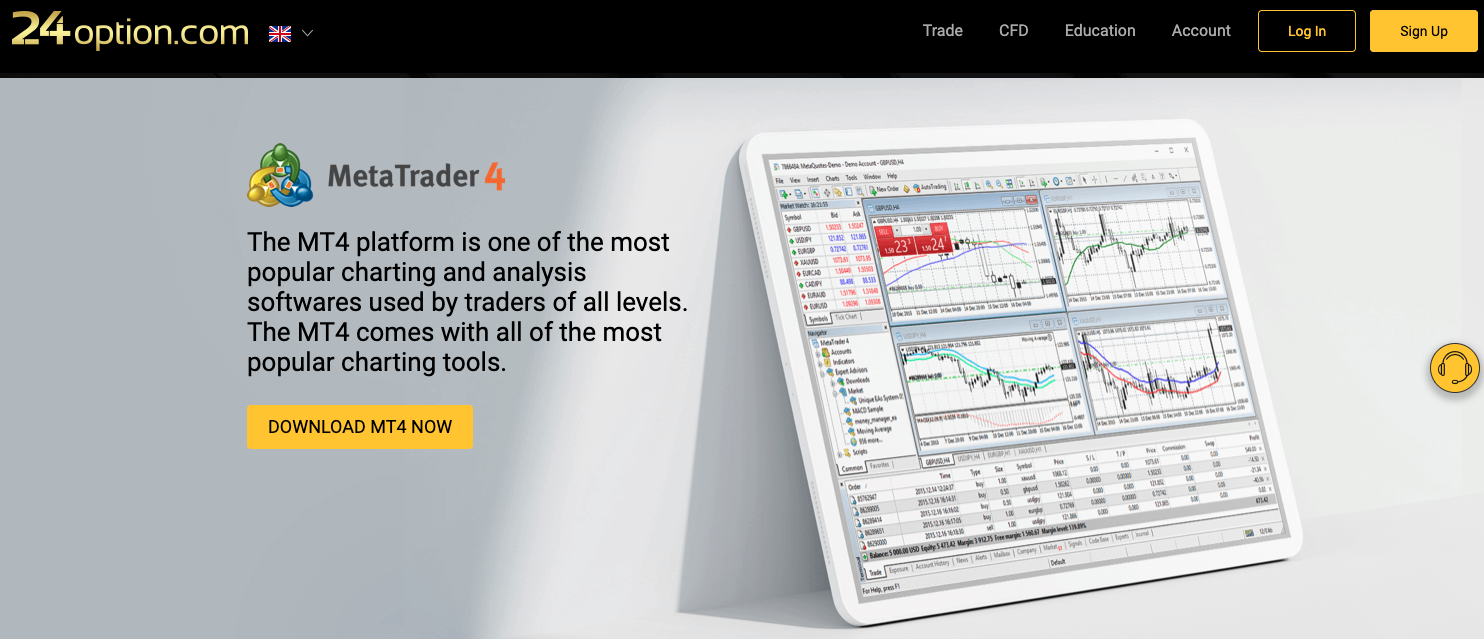

Additionally, 24Option also provides access to the MetaTrader 4 platform for those of you looking for something more familiar. Mobile trading is also supported both through the MetaTrader 4 mobile app, as well as through the dedicated 24Option mobile app. Both Android and iOS devices are supported.

As with many other platforms, 24Option has a number of different account types on offer to suit various trading needs. This includes Basic, Silver, Gold, Platinum, and Diamond account types. The Diamond account offers a truly premium trading experience with a dedicated live chat line as well as the most competitive trading rates of all the account types.

However, it has the highest minimum account balance and requires a certain level of trading activity each month. For new users, the Basic account type has a low minimum account deposit and should cover most of your basic trading needs. It should be noted, however, that only the Platinum and Diamond account types will benefit from fee-free withdrawals, all other account types will be charged a fee depending on the withdrawal method used.

Customer support is available on a 24/7 basis through live chat and email, with telephone assistance offered in twelve different languages. In addition, the trading platform has been translated into twenty-two different languages, making 24Option one of the most global brokers around. There is also a well-resourced FAQ section to the website which should help you address most common issues you could possibly run into.

If you are looking for a well-rounded trading platform that has enough features to keep both new and intermediate traders happy, you could do a lot worse than checking out 24Option. The trading conditions are generally pretty favourable, with tight spreads and quick execution speeds on offer. Although the withdrawal fees might put the basic account users off, if you opt for a Platinum account, the trading on offer is very competitive.

Founded in 2010 and based in Limassol, Cyprus, award winning online broker 24Option has been at the forefront of the binary options market for some time. The company is a full service binary options broker that recently expanded their services to include trading in forex, CFDs, commodities, stocks and indexes.

24Option is owned by Rodeler Limited, which is regulated in Cyprus by the Cyprus Securities and Exchange Commission or CySEC under the CIF License number 207/13. Rodeler also owns the Grandoption, QuickOption and 24FX brands.

Being regulated by CySEC, the company offers its services on a cross border basis to EU member states, which permits the provision of its services in their jurisdictions. Because of the EU regulatory obligations, customer funds are kept in segregated bank accounts.

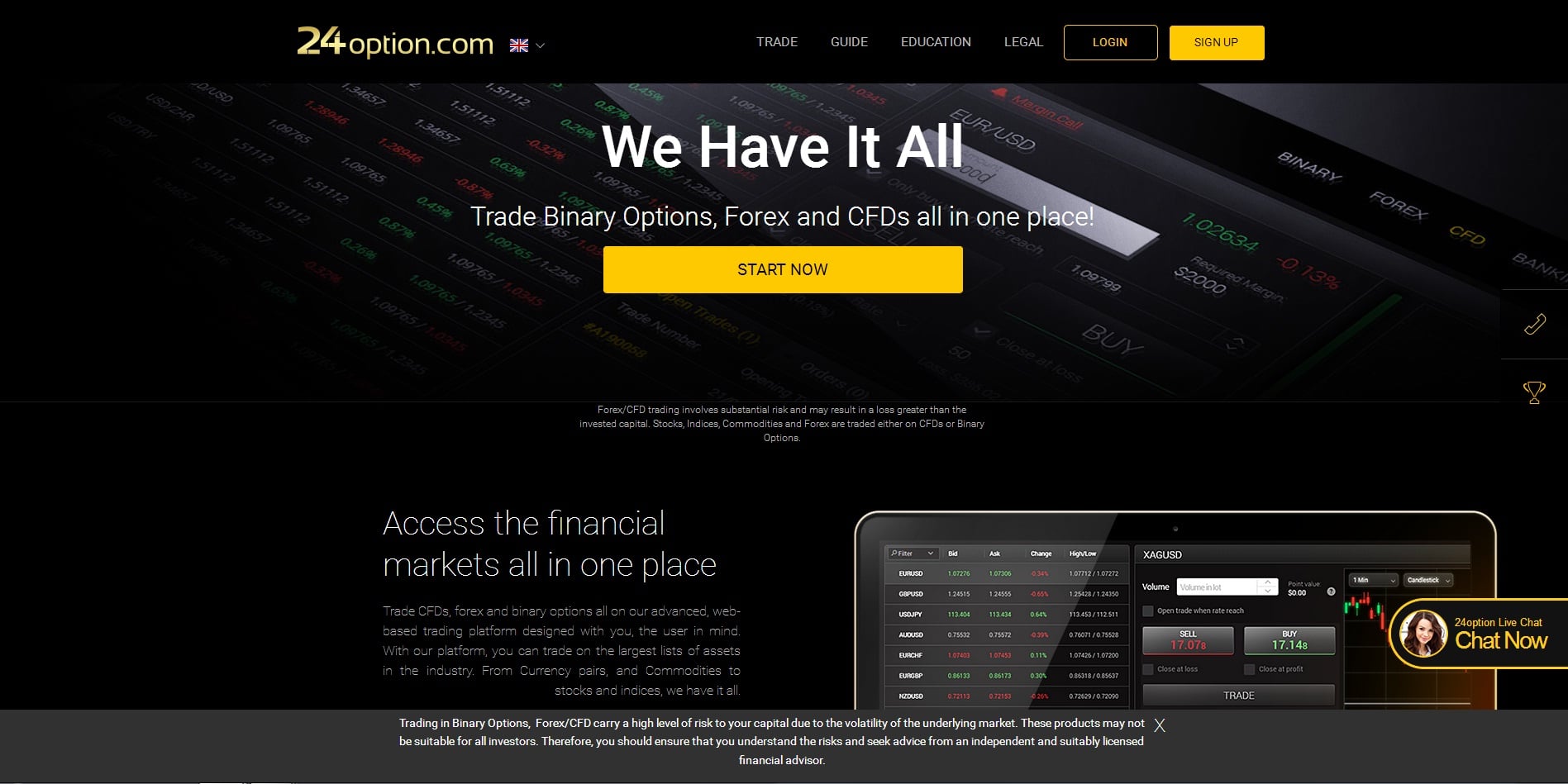

The company has two principle offices, with its UK office situated in London, and its Cyprus headquarters located at #39 Kolonakiou Street, Ayios Athanasios Limassol, CY-4103. The company’s official website can be found at www.24option.com. A screenshot of its homepage can be seen below:

24Option is not currently active in the United States and does not presently accept customers based there or allow USD accounts.

Features at 24Option

Originally one of the world’s first binary options brokers, 24Option offers traders a wide range of underlying assets designed to accommodate most traders. The asset list for CFDs includes stock indexes from the world’s largest economies, such as those on the Dow Jones Industrial Average, NASDAQ, DAX, FTSE, MICEX and TADAWUL.

The firm also offers derivative trading with U.S. technology stocks as the underlying asset, including popular stocks like Apple, Facebook and Google, in addition to the largest banks in Europe and Russia such as Barclays, Deutsche Bank and Sberbank.

With respect to forex, 24Option offers up to 200:1 leverage for currency trades; although restrictions do apply on some currency pairs. 24Option offers an execution service in all major and minor currency pairs, including most currencies versus the EUR, USD, JPY, GBP, AUD and CHF. Exotic pairings are also offered, with the ability to trade via 24Option’s proprietary platform, as well as MetaTrader4 and mobile devices with the Apple iOS and Android operating systems.

24Option does not charge commissions on trades, but, like many other forex brokers, they compensate themselves through the dealer spread. The company offers competitive dealing spreads that depend on the type of customer account opened.

Supported Platforms

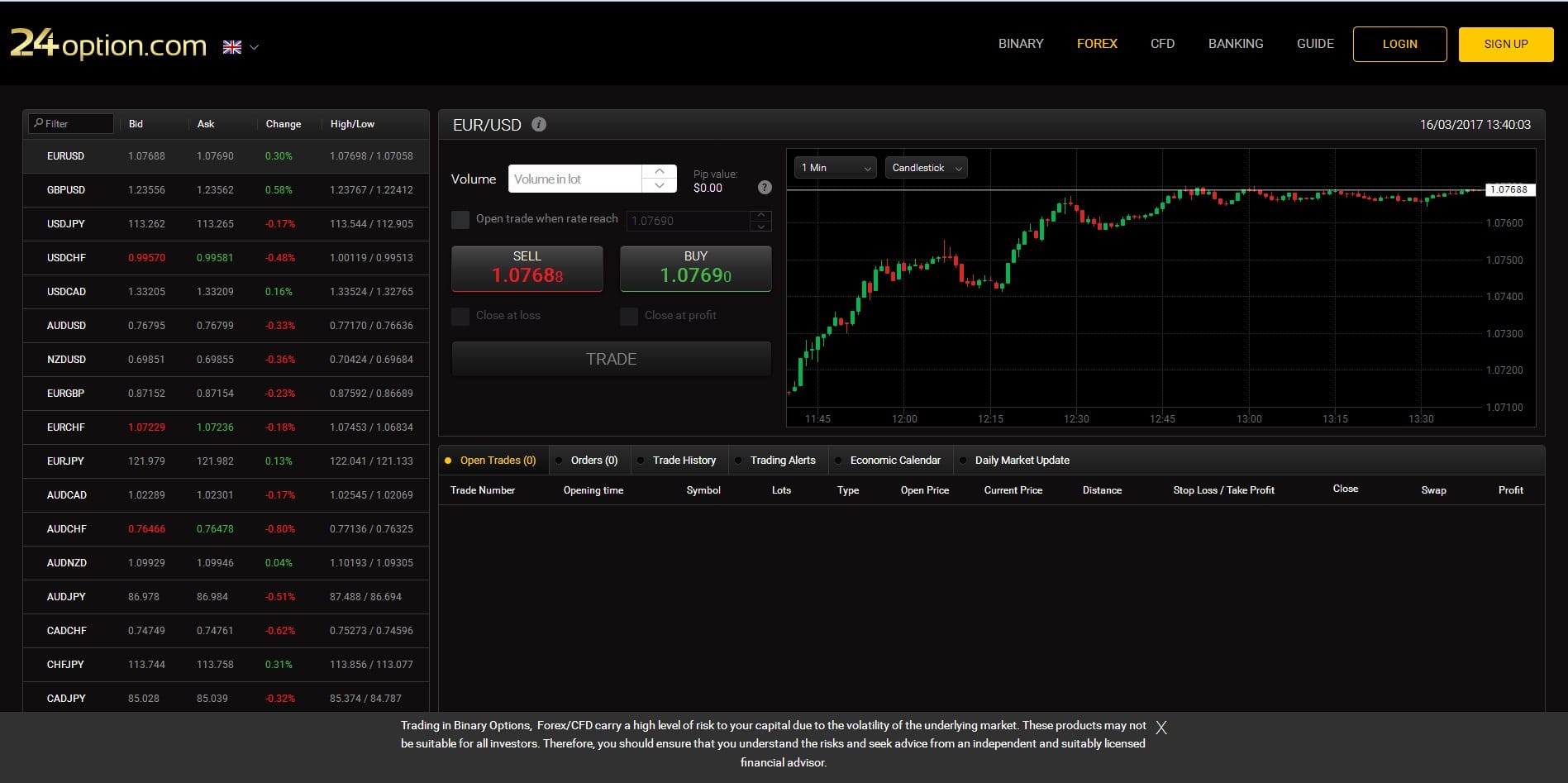

In December of 2016, 24Option introduced its all-inclusive proprietary trading platform to clients. The new platform allows traders to trade forex, CFDs, commodities and binary options, all from a single platform. The new platform includes many features not previously available on the company’s previous web-based platform. A screenshot of the company’s proprietary trading platform can be seen below:

In addition to its own proprietary trading platform, traders using 24Option have the choice of using the MetaTrader4 trading platform, which has become the standard for online forex trading.

Traders with smart mobile devices running the Apple iOS and Android operating systems can also use the 24Option Mobile Trading app that can be downloaded from either Apple’s App Store or Google Play.

Deposits and Withdrawals

24Option offers traders five different account types, which are assessed and upgraded according to an account manager’s evaluation. They are as follows:

- Basic – this account type requires a minimum deposit of EUR/GBP 250 With this type of account, exotic currency pair spreads are as low as seven pips, for major pairs, as low as three pips and minor pairs as low as four pips. The Basic account comes with access to MT4 and the company’s Web client platforms, one-click trading, a mobile app for iOS or Android and access to 24/7 customer service.

- Silver – this type of account requires an initial deposit of EUR/GBP 2,000. The account includes all of the features of the Basic account, with the addition of a Personal Trading Coach and Trading Alerts.

- Gold – the minimum deposit for the Gold account is EUR/GBP 25,000. The Gold account includes all of features offered in the Silver account, in addition to giving the trader SMS and email alerts. Also, Gold account holders receive an extra two percent return on every trade they make.

- Platinum – the minimum deposit for a Platinum account is EUR/GBP 50,000. This account includes all of the features above, in addition to access to a research website and a Live Training Session. In addition, Platinum account holders receive an extra four percent return on every trade they make.

- Diamond – a representative on the company’s live chat line informed me that the Diamond account does not have a specified minimum, but must be set up with an account manager. The Diamond account includes all of the features listed in the other account types and, in addition, includes tickets to Juventus FC soccer matches in Europe and a customizable trading platform.

To open a live account with 24Option, a EUR/GBP 250 minimum is required, with a minimum trade size of EUR/GBP 24. Initial deposits to fund a 24Option live account can be made via credit cards including Visa, MasterCard and Discover cards, as well as using the Skrill (formerly Moneybookers) electronic payment service and bank wire transfers. The company also accepts UKash, Neteller, Qiwi, Sofort, WebMoney and PaySafe, to name just a few, but they DO NOT accept PayPal payments.

The minimum deposit for a credit card is EUR/GBP 250 . Deposits can be made in the following currencies: British Pound, Japanese Yen, and Euro. For electronic payments, a minimum of €250, £250, ¥50,000, RUB 10,000, and for bank wire transfers, £1,000, €1,000 and ¥100,000.

The broker also has a maximum deposit amount: a daily limit of 10,000 Euros and Sterling or 100,000 Yen for credit cards, and a monthly limit of 40,000 Euros or Sterling and 4,000,000 Yen.

As with most regulated brokers, withdrawals must first be verified by sending the broker a copy of a government issued identification such as a passport or driver’s license, proof of residence in the form of a utility bill and a copy of both sides of their credit card if that is where the withdrawal is being made. This verification process is repeated every time a new payment method is used.

With the exception of Platinum and Diamond accounts, which are not charged for withdrawals, 24Option charges fees for withdrawals from its Basic, Silver and Gold accounts as follows: for credit and debit cards they charge 3.5 percent, for Skrill (formerly known as Moneybookers) they charge two percent, for Neteller the charge is 3.5 percent, and fees for wire transfers the fees are €25, £20 or ¥3,000 depending on the currency.

The Gold account is entitled to one free withdrawal per month. Withdrawal requests are processed during normal Cyprus business hours Monday through Thursday between 9:00 am and 4:00 pm and between 9:00 am and 1:30 pm on Friday.

Customer Support

The customer service department at 24Option offers 24/7 live chat and email support, in addition to telephone assistance in 12 different countries. Their proprietary trading platform has been translated into 22 languages. Nevertheless, their live chat feature, which was used to obtain further information for this review that did not appear on their website, was not attended to very promptly.

In addition to its customer service department, 24Option features an educational program where clients can access a wide range of educational materials, such as daily market news and updates, live webinars, interactive eBooks. Their Trading Central feature allows traders to access third party market analysis and historical data.

24Option – Conclusion

24Option is a popular online regulated broker specializing in binary options, forex, CFDs and commodities. The broker features a wide variety of tradable assets and a recently developed state of the art trading platform. The company’s customer service has telephone support in 12 countries, as well as live chat, and its trading platform has been translated into 22 languages.

The broker also offers its traders promotional incentives, such as a two to four percent return on all transactions made from a Gold, Diamond or Platinum account. The customer service personnel seem courteous and professional, although rather slow to pick up the live chat, and the broker’s trading platform is easy to use and has an intuitive interface. In addition, 24Option has an extensive educational program for novice traders.

Nevertheless, the company does not extend its services to traders based in the United States, they do not accept PayPal for account transactions, and they apparently require a minimum deposit of EUR/GBP 250 before traders can access a demo account to try out their services. Finally, while 24Option was cited and fined by CySEC for non-compliance with some important regulations in early 2016, they have probably had enough time to rectify those issues.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk