| Pros | Cons |

|---|---|

| Multiple trading terminals | |

| Low client trading costs | |

| 50% bonus to clients |

Trader’s Viewpoint

Based on our extensive review of CCI Traders, we’d like to share the high points, primarily aimed at assisting prospective investors in making informed decisions on whether to sign-up with the broker or look for alternatives.

Beginning with the positives, CCI Traders is a low-cost ECN broker operating since 2008, albeit under a different name. The broker’s offering includes over 100 products across FX, commodities, cryptocurrencies and indices.

The key highlight is the spread which comprises fixed or variable. The flexible spread starts from 0.01, among the lowest in the industry. Besides the bid-ask difference, there are no other costs such as commissions, overnight swap rates or fees across the entire product range, something unheard of in the CFD space.

If you’re excited already; there’s more to come. CCI Traders offers clients the choice of three account types, two of which support ECN. The minimum account opening charges start at $50 for retail clients and can go up to $500 for the premium account.

All clients signing-up with CCI Traders have the option of two trading platforms. The proprietary XOH Trader and the MetaTrader 5. Users who wish to open an ECN Mini or Premium Account can sign-up for the MT5 while others can opt for the XOH Trader. We tested the MT5 demo account and were satisfied with the order execution speed, something that we were unprepared for initially.

On the negatives, CCI Traders is not a tier-I regulated broker. The product range is not extensive and does not cover all the asset classes. Also, there isn’t anything much in terms of education for beginners, nor is the customer support top class.

For more information on CCI Traders, continue reading.

Are You Ready To Trade?

Get Started Within Minutes With The Simple Sign Up Process

About CCI Traders

CCI Traders have been known for training CCiTraders since 2008 under a different name, and founded CCI Traders in 2017. Brokerage started exactly a year ago.

CCI Traders is the trading name of CCI Trading LLC, a multi-asset CFD broker, incorporated in Saint Vincent & the Grenadines.

The broker was not a well-known name until 2019 when they registered for a license with the Financial Service Authority (FSA) in Saint Vincent & the Grenadines. They followed it up with the Financial Services Commission (FSC) regulation in the Republic of Mauritius. The CCI Traders broker, along with its legal entities provides an assortment of financial services encompassing retail trading, broking and hedging.

When it comes to CFD trading facilities, CCI Trader offers a range of 100+ products across forex, commodities, shares and indices. All the CFD instruments are accessible via web, desktop and mobile devices from two trading platforms- The proprietary XOH Trader and MetaTrader 5.

The ECN broker claims to have adequate security measures in place to protect fund deposits. These include maintaining client funds in segregated accounts in major banks across the globe, negative balance protection and an insurance cover of up to $1,000,000 against errors, fraud, negligence and hacking.

The broker claims to have signed-up thousands of clients and is the recipient of the ‘Best STP/ECN Broker’ award at the 11th edition of the African Financial Expo in 2020.

In this CCI Traders Review, we go through a comprehensive analysis of all the features of the CFD broker, including account types, range of markets, trading platforms, client protection and many more. Our unbiased review of CCI Traders should assist investors in comprehending all there is to know about the low-cost broker.

Who does CCI Traders appeal to?

Based on our extensive review of CCI Traders, we believe that the CFD broker appeals to all categories of individuals trading FX, commodities, stocks and indices. That’s because trading costs are negligible, one of the primary characteristics that clients generally look for in a CFD broker.

Once you register for a live account with CCI Traders, your trading costs are limited only to the spread, which starts at 0.1 pip for FX pairs. Besides, you don’t have to pay a commission nor swap charges for holding overnight positions.

While forex-CFD brokers generally offer only Muslim traders the option of swap-free accounts, CCI Traders extends the facility for all its customers. So, it doesn’t matter if you are a swing trader or a long-term investor, you can save thousands of dollars just by avoiding these charges. Also, investors can hold on to their positions for an extended period, without worrying about the overnight costs.

To summarise, day traders can benefit from low spreads, zero commissions, high-speed order execution and generous liquidity via the ECN route. At the same time, swing, positional and long-term investors stand to gain from the low spreads, zero commissions and swap-free trading.

Account types

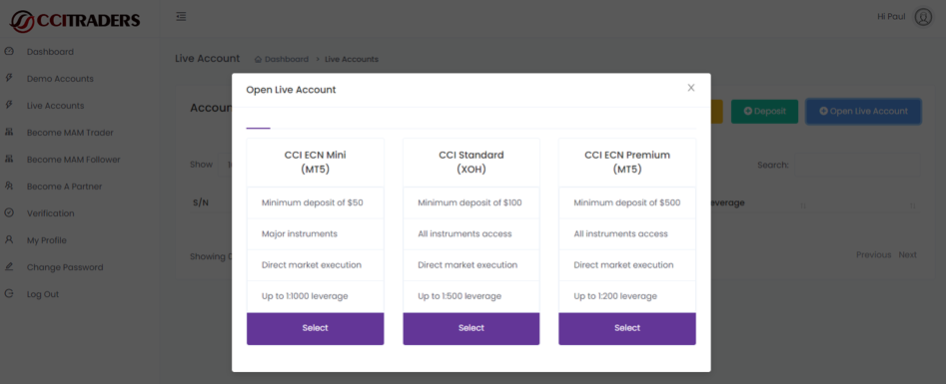

CCI Traders offers clients the choice of three account types- ECN Mini, ECN Premium, and ECN Institutional. In the CCI Traders Review, we study the account types and how you can go about opening your live account.

The primary difference in the account types is the minimum deposit, tradable instruments and the leverage. You can open a Mini Account with $50 and access all the major instruments with max leverage of 1000:1. In the case of the Premium and the Institutional Accounts, you can access the entire range of products. The minimum deposit is $100 and $500 while the max leverage 1:200.

Besides the multiple account types, you can also choose your trading category from retail, professional, institutional. The key differences here are in the minimum deposit, product range, leverage and fixed or variable spread. Regardless of the trading category, all clients come under negative balance protection, direct market execution with zero-swap charges.

Open Your CCI Traders Account

Be Trading The Markets Within Minutes

Markets and Territories

CCI Traders is a global broker operating in multiple countries via its FSA registration. While the ECN broker is accessible across all the continents, they do not provide services to residents in the US, Canada, UK, Syria, Yemen, North Korea, South Sudan.

Instruments and Spreads

CCI Traders is a multi-asset broker. In this CCI Traders Review, we take a look at the various asset classes on offer and the corresponding spread.

Beginning with the trading instruments, CCI Traders offers access to 100 financial products comprising currencies, commodities, cryptocurrencies and indices. Although the CFD broker has also mentioned share CFDs as part of its offering, we couldn’t find any on the CCI Traders live MT5 trading platform.

The following table gives a breakup of the various asset classes

| Asset class | Number of instruments |

| Forex | 68 |

| Commodities | 12 |

| Cryptocurrencies | 05 |

| Indices (CFD & CFDm) | 15 |

On the spread, CCI Traders offers the choice of fixed or variable spread depending on your trading category. In our CCI Traders forex Review, the minimum spread on FX pairs was 0.9 pips, which is reasonable considering that the broker does not charge commission or the overnight swap costs.

Fees and Commission

When it comes to fees and commission, clients would be extremely pleased to know that CCI Traders does not charge fees, commission or swaps on overnight positions. Regardless of the account type or the trading category, none of these charges applies. The only trading cost to clients is the low spread that the broker charges when you enter and exit trades.

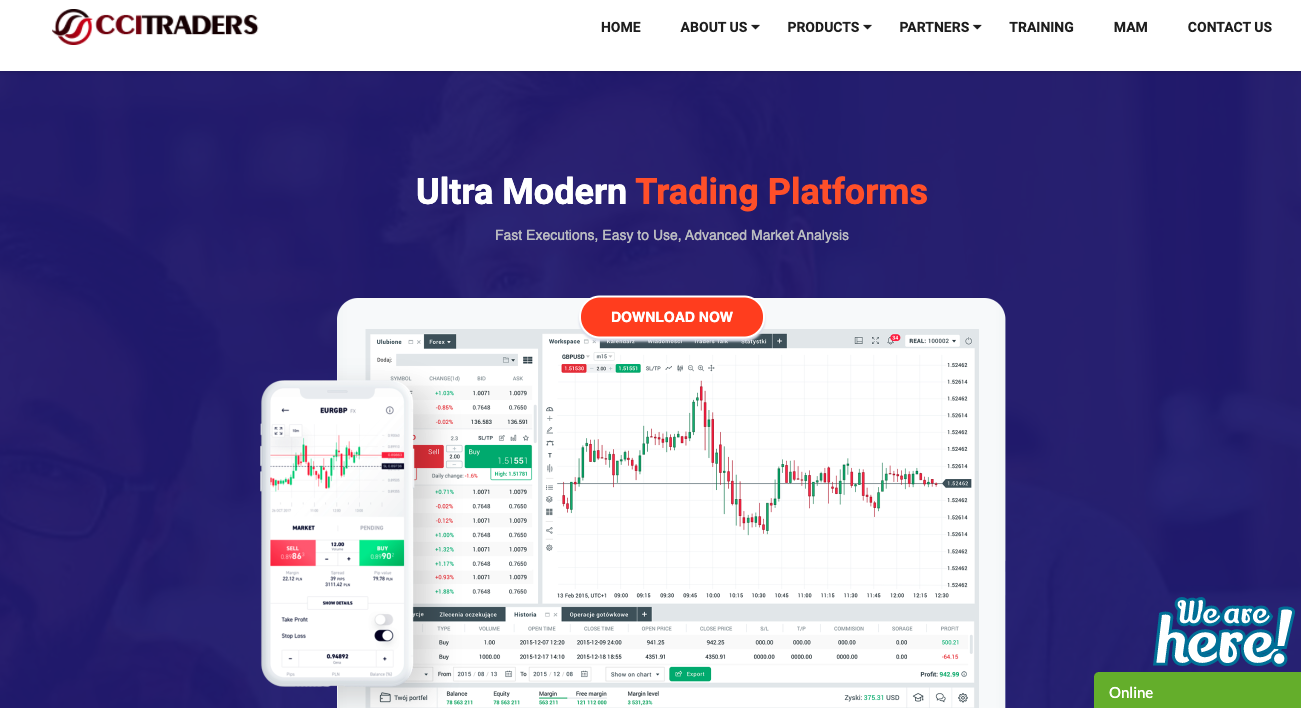

Platform Review

CCI Traders offers all its clients the choice of two trading platforms. The proprietary XOH Trader and the MetaTrader 5. The XOH is available as a web, desktop and mobile application, while the MT5 is only accessible in the downloadable desktop and mobile versions.

You can open several demo/live accounts, but due to technical issues, we were unable to access any of the broker’s patent offering. So, in this CCI Traders Review, we would only be putting out our in-depth analysis of the CCI Traders MetaTrader 5 that we experienced first-hand from a demo account.

Before we begin the CCI Traders platform review, we’d like to inform our readers that traders signing-up for the Mini ECN Account have access to only certain products. However, if you register for either of the other two account types, you can trade on all the instruments. Also, if you register for a demo account, you may not be able to access or trade on all the instruments.

Explore The CCI Traders Platform

Open Your Account

The CCI Traders MT5 offering is the basic version of the MetaQuotes software. You can access real-time price data, charts, advanced market depth and execute manual, automated trading at the click of a button.

However, if you’re expecting the broker to provide free news from third-party sources or allow clients to copy strategies of profitable traders, you’re bound to be disappointed. The most you could do is make the best use of the existing features in the MT5 that include multiple order types, or subscribe, rent or purchase analytical tools from the codebase.

We placed a few orders on the desktop application and found that the order execution speed was more or less in line with the top brokers in the industry.

However, we were limited to placing orders only in FX pairs, a distinct disadvantage. We also noticed a big difference in the spread between the demo and live accounts. While CCI Traders was quoting a minimum spread of 0.1 pip in FX, it was about 0.9 pips in the live MT5 account.

We have included more details on the analytical tools under the section, ‘Charting and tools.’

Mobile Trading

The CCI Traders MT5 mobile app supports Android and iOS devices. You can access the user-friendly app on any Android smartphone or iPhone, iPad.

In this review of CCI Traders, we tested the MT5 Android app and here is our outlook. As mentioned earlier, CCI Traders provides only the basic version of the MT5.

Beginning with the trading features, these include real-time market data, a full set of trading orders, all types of trade execution modes and access to trading history. When it comes to analysis, you can evaluate real-time interactive charts in nine-time frames and 30+ technical indicators. The other features comprise monitoring trade levels, volumes, push notifications and the option to chat with the MQL5 community of traders.

To conclude, if you’re keen to know what you get from the CCI Traders MT5 platforms, log in to metatrader5.com and access all the features of the desktop and mobile client terminals.

Social trading and copy trading

Beginners looking to copy strategies of professional and profitable traders are likely to be disappointed as CCI Traders does not permit the social and copy trading. Although the option to copy trades is available on the MT5, the broker has blocked the feature. The best you could do is subscribe to a profitable trader who would install the trading system on your MT5, which you can then use to automate your strategies. The other alternative is to download Expert Advisors from the MetaTrader codebase to automate your trading.

However, if you are an account manager and intend to replicate your strategy on the managed accounts, you can do so via the Multi-Account Manager (MAM) platform.

Crypto

Within its small product offering, CCI Traders has also included a small number of CFDs in digital currencies. The CCI Traders cryptocurrency trading comprises Bitcoin, Bitcoin Cash, Ripple, Ethereum and Litecoin. All the virtual currencies are pit against the US dollar with the minimum lot size ranging from 0.01-1.00.

Trade Cryptocurrencies With CCI Traders

Ride The Crypto Wave And See Where It Ends!

Charting and tools

In this section, we have highlighted the analytical tools and charting features as part of our review of CCI Traders. Here they are

- Access three-chart types in 21-time frames, with the option to open up to 100 charts at a time.

- There are 30 technical indicators and 24 graphical objects to carry out in-depth chart analysis.

- The platform supports advanced market depth comprising tick chart and time & sales.

- The order types include instant, market, pending with the SL/TP function.

- Price alerts with push notifications for mobile apps.

- Automated trading features with the option to download indicators, trading signals and expert advisors from the codebase.

- Access the MetaQuotes programming language.

- Get onto the online chat, exchange views and ideas with the MQL5 trading community.

Education

CCI Traders does not offer anything much in terms of providing training or educational resources to beginners. You can only find one youtube video on the forex markets.

In this one-hour video, beginners can get a brief understanding of the forex markets, the risks involved, and the ways to profit from these markets. However, the CCI Traders organises webinars once in a while. So, if you have registered with the broker, wait for the email invite, and when you receive it, sign-up to participate.

Training, education and soft/ware technological support are offered by the Mauritius entity, while brokerage is offered by the St. Vincent entity.

Trader protection by territory

CCI Traders is a global broker:

- Registered by the Financial Services Authority (FSA) of St Vincent and the Grenadines- Registration number SVG1852019.

- Authorised by Financial Services Commission (FSC) of the Republic of Mauritius- Authorisation number AU20032208; registration number AC173242.

So, there is no territory-wise protection nor rules that demand lower leverage for retail clients or compensation if the broker goes into administration, as is the case in Europe and the UK under the CySEC or FCA.

All clients receive identical trading conditions and to ensure the security of deposits, CCI Traders assures

- Negative balance protection

- Client funds are separate from the firm’s operational capital.

- Insurance cover of up to $1,000,000 from hacking, errors, fraud and embezzlement.

How to open an account?

Opening an account CCI Traders is pretty straightforward. In this CCI Traders Broker Review, we guide you through the account opening process, and you can see how easy it is to sign-up as a client.

To get started, click on OPEN LIVE ACCOUNT.

Fill out all the info and click on REGISTER.

Verify your email address by clicking CONFIRM MY EMAIL.

In the CCI Traders Client Cabinet, check if all the info is correctly entered, complete all the info under MY PROFILE, deposit funds and start trading.

Open Your Account Today

Take The First Step In Your Trading Journey

Customer support

The customer support channels at CCI Traders comprise email, telephone, and Skype. You can get in touch with the CFD broker via any of the channels.

Based on our exchange, we found the support team to be courteous, although we were not very happy with the response time.

The bottom line

Following our in-depth review of CCI Traders, we have mixed views of the ECN broker. Beginning with the positives, CCI Traders is probably one of the lowest-cost brokers in the industry, with the client trading cost limited to the spread.

The broker is not only commission-free but does not charge interest on overnight positions, making it extremely beneficial for positional traders and long-term investors. The other benefits include multiple deposit/ withdrawal methods, the choice to fund your account using Bitcoins, option to open a trading account with $50 and instant processing of deposits.

On the flip side, the biggest drawback is the security of client deposits. While the broker comes under the regulations of the Mauritius Financial Services Commission (FSC), the monetary agency is not very active when it comes to protecting clients interests.

The other downside is the product range, which mostly covers forex while ignoring the other asset classes. Besides, the broker does not offer additional third-party plugins, real-time news, VPS and does not even permit copy trading, all of which could work against CCI.

However, if trading costs are a priority to you, then CCI Traders is among the best in the industry. It doesn’t matter if you are a day trader or a long-term investor; you can save thousands of dollars by avoiding commissions and swap charges. That’s more than you can ask.

Claim Your CCI Traders Account

As Approved By Forextraders.com

FAQs

How can I open an account with CCI Traders?

The account opening process at CCI Traders is simple and straightforward. All you have to do is sign-up for a live account, complete the email verification process and submit. Next, verify your email to access the client area. Once there, complete your profile, deposit funds and start trading.

Do CCI Traders offer an Islamic Account?

CCI Traders does not explicitly offer an Islamic Account. But, all the trading accounts are swap-free, which means that you don’t have to pay overnight charges on your open positions. The account features are identical to that of an Islamic Account.

What fees do CCI Traders charge?

CCI Traders does not charge any fees. So, your deposits, withdrawals, and all the other services offered by the ECN broker are free of cost. However, the minimum deposit/withdrawal amount is $50.

How do I change leverage with CCI Traders?

CCI Traders offers three categories of leverage, depending on the client type. Here they are

- Retail Trading- Max leverage: 500:1

- Professional Trading- Max leverage: 1:200

- Institutional Trading- Max leverage: 1:200

You can increase or decrease the leverage by changing your trading category.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk