EagleFX is a new entrant into the increasingly competitive broker space. Fortunately, it comes with a few unique selling points that mark it out from the crowd. Founded in 2019 it offers a broker platform which looks to combine tried and tested processes with the latest trading trends.

The best example of them adopting an established top tier process is the selection of Meta Trader MT4 as their trade execution platform. EagleFX clients can benefit from using this powerful and robust platform which is something of an industry standard. Demonstrating their understanding of modern trading styles the platform offers up to 31 cryptocurrency markets. Other useful features include a support team available 24/7 that is able to support clients via live chat, email or phone.

Deposits and withdrawals of funds incur zero fees and can be for amounts as small as US$10. The broker also boasts of being able to facilitate same-day withdrawals which is something most other brokers do not. Once transferred funds are placed in the market traders can take advantage of very competitive trading spreads.

The company is registered in the Dominican Republic and is currently considering its options in terms of which regulatory body to align with. The customer support team explains: “We are currently researching which regulatory body we would like to consider for regulation. What we need to be careful of is that we don’t eliminate certain countries or citizens of the world so for that reason we are taking our time.“

See our full list of trusted brokers

Who does this broker appeal to?

EagleFX does not try to be all things to all people. As a result, it has an agile functionality backed up by powerful software tools and an approach to trading that will be particularly appealing to a certain type of trader.

The EagleFX site itself is web browser-based and of very light touch. The services provided will appeal to those looking for simple functionality, excellent customer service and punchy leverage terms.

We have yet to come across a trader who doesn’t like to see zero commissions on cash deposits and withdrawals so that part of the EagleFX offering will appeal to all. The fact that withdrawals can be made the same day will also catch the eye of some.

The actual trading takes place through Meta Trader MT4 which is an established, robust system with a market-leading range of software tools and indicators. The charting, analysis and execution functionality of MT4 is hard to match and will appeal to anyone looking to have access to pretty much all the tools out there.

Traders looking to trade forex and crypto will find EagleFX offers a range of markets that is hard to beat. There are 53 forex pairs and 31 crypto markets. Trading spreads are tight and the MT4 execution GUI is as reliable as they get.

One feature which might appeal to those who are more active in cryptocurrencies is that EagleFX provides cold storage for crypto deposits.

Account types

Traders who are new to EagleFX will take comfort from the availability of a free to use Demo account. It has the same functionality as the Live account which allows traders to fully test their strategies before they put capital into the markets. Unlike some other brokers, there is no time limit on the Demo account; a plus point for EagleFX.

The EagleFX offering is very much one that involves simple functionality. Accordingly, there is one type of Live account.

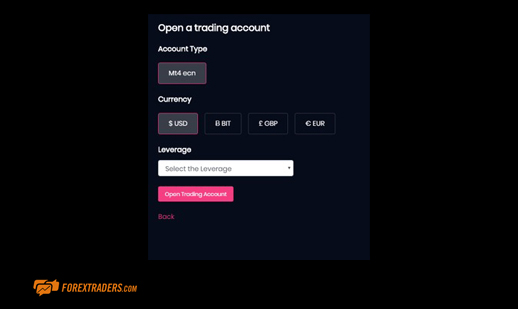

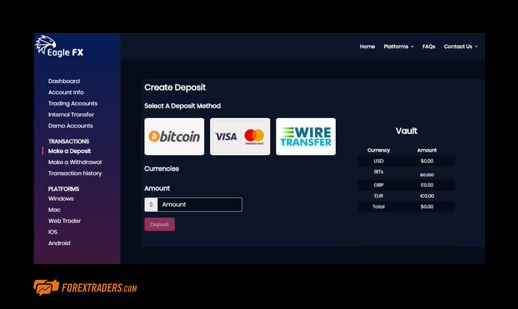

Deposits can be made in USD, GBP, EUR or Bitcoin BITs and are held in what EagleFX refer to as a “Vault” account. Funds are moved from the “Vault” account to the “Trading” account to collateralize trading activity. All trading accounts are USD denominated.

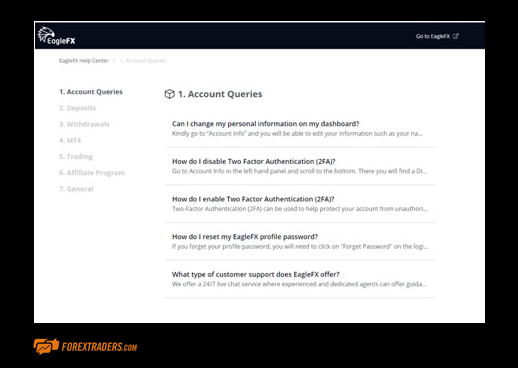

The Account Queries section of the FAQs section includes a concise break down of the options available to account holders who can adjust their profile and preferences very easily. Updates to additional services such as Two Factor Authentication (2FA) or personal details are processed instantly.

Islamic Trading accounts are available and are set up by contacting the EagleFX support desk. Swap-free accounts do not incur rollover charges but administrative charges do apply.

See our full list of trusted brokers

Markets and territories

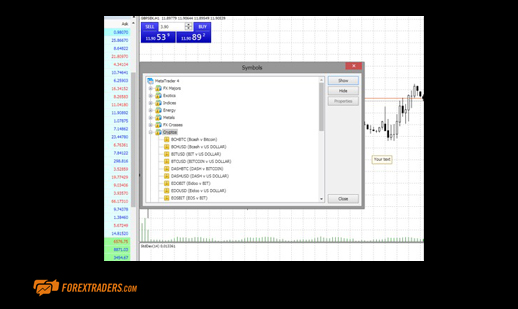

EagleFX offer access to 53 forex markets, 31 cryptocurrency markets, 11 equity indices and 7 commodities markets. The spread of markets is global. Forex markets available include a whole range of Major, Minor and Exotic currency pairs and FX crosses go down to the level of pairs such as AUDCHF, EURPLN and NOKSEK.

Crypto markets include major names such as BTCUSD but also Bitcoin Altcoin pairs such as ETHBIT. The range of global equity indices is limited but includes all the larger names including SPX500, GER30, UK100, AUS200 and NAS100. The limited range of commodities includes markets in oil, gold and natural gas.

MT4 can be set to operate in one of 41 languages ranging (alphabetically) from Arabic to Vietnamese

Customer support

During this review, the testing of the customer support team found the staff were able to address all queries promptly and accurately. In 84% of cases, our issue was addressed in the first instance.

Live Chat response times were rapid and compared favourably to other brokers in the sector. Our testers report that once engaged with one of the support staff the impression gained was that the member of the EagleFX team was dedicated to answering their query. Consequently, issues were resolved relatively quickly and problem solving didn’t prove too much of a distraction from the business of trading.

The telephone call back system is a neat idea.

We did, however, find call back response times were slower than those we experienced when using live chat. Using call back it was a matter of minutes rather than seconds before we were communicating with the EagleFX team.

Not only is the standard of customer service high, but a particularly attractive feature of the EagleFX offering is that it is available 24/7. This squares off an anomaly in the broker space where brokers have typically limited customer support from Monday to Friday, when the majority of markets are open. Traders and analysts looking to develop strategies during the quieter weekend period will find it particularly valuable to have customer support to hand to help them try and test new ideas. Most other brokers in the space provide 24/5 support at best. As crypto markets trade on a 24/7 basis and analysts exert themselves 24/7 it’s helpful to have expert support available at those times as well. On the downside. The Live Chat window can get in the way of other areas of the site. Scrolling doesn’t always solve the problem and minimizing the chat slows down the speed of resolution. It would also be helpful to have a switchboard/help desk phone number available. While the Call Back service delivers a degree of convenience there are sometimes delays between requests being logged and calls being made. That can be frustrating.

See our full list of trusted brokers

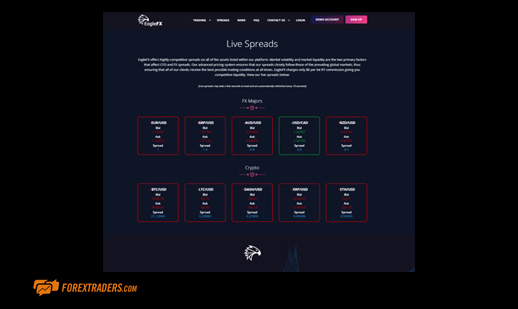

Instruments and spreads

One of the main selling points of EagleFX is its competitive execution spreads. The spreads are variable which means traders tend to get better rates during periods of low volatility but might experience spreads gapping at times of market stress. As is often the way with brokers that offer tight spreads, EagleFX is very willing to share information on its pricing. They even provide a Live Spreads area on the website which updates every 10 seconds and details some of the user-friendly small print.

The minimum trade size is 0.01 Lots and the maximum trade size is 1,000 Lots. Another point in EagleFX’s favour is that it allows trading strategies such as ‘scalping’ which some other brokers do not.

ECN

All accounts back into MT4 and offer Electronic Communication Network (ECN) trading.

This essentially involves EagleFX forming a ‘bridge’ between individual account holders and larger liquidity providers who have improved levels of access into the forex markets. The site advertises that liquidity providers include Barclays and Deutsche Bank, however, our review was unable to substantiate that.

The Margin rules for EagleFX are:

– Margin Call at a 100% Margin Level

– Stop Out at a 70% Margin Level

Fees and commissions

Financing Fees

Overnight financing fees are applied on open swap positions. The pricing schedule varies across instruments so requires some degree of due diligence to be carried out prior to trading. The EagleFX site doesn’t actually list the rates charged but instead advises that users should contact their support team for the information. Our reviewers note that if this is a trade-off to keep the site’s Spartan aesthetic, it’s, in this case, unwelcome and they’d rather have the information in all its granular detail shared more transparently.

Trading commissions

The commission charged by EagleFX is 6 USD per lot per trade. If the traded lot size is smaller, then this rate is adjusted because the commission is calculated per lot. For example, if you placed a trade with 0.1 lots, it would charge 0.6 cents.

Cash transfers

EagleFX claims to charge zero fees on capital movements into or out of accounts held there.

Adopting a fee-free policy on deposits and withdrawals would be an attractive proposition to most traders as overhead costs are an unpopular drag on trading performance. As the broker is relatively new on the scene (founded in 2019) we might suggest the proposition may not have been tested thoroughly. By this we mean the trading community has not yet shared any negative experiences. It just needs to be flagged up that the absence of comment challenging the proposal might actually be a false negative

See our full list of trusted brokers

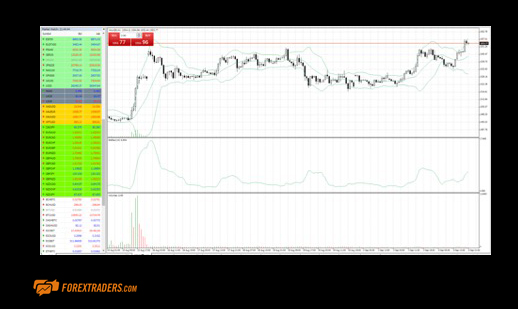

Platform review in-depth

The MT4 platform has been around since 2000. Whilst there continue to be refinements it lives according to the adage that “if it ain’t broke, don’t fix it”.

It’s available in a downloadable format which is compliant with Windows, Mac, iOS and Android. There is also a web-trader version available through web browsers

The popularity of the service and the multitude of awards it has won are down to more than it just being readily available.

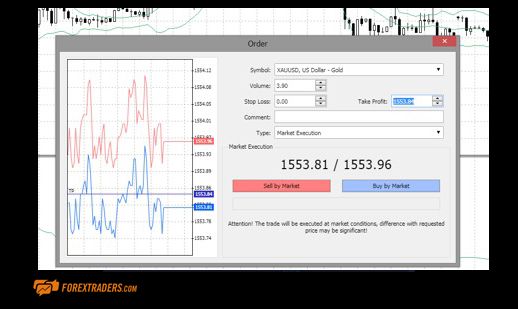

First off, trade execution is intuitive, smooth and reliable. Traders can adjust the system to their preference and operate using ‘one-click’ trading. Order building optionality allows for ‘market’, ‘pending’ and ‘stop’ orders and trailing stop losses and take profit instructions are also available.

Given the range of powerful services available it’s worth mentioning that the dashboard maintains a crisp and clear aesthetic and navigating from market to market or screen to screen is simple and easy. This combination of agility and power makes it possible for traders to get into a perfect situation from which to trade the markets

Mobile trading

The MT4 mobile trading app is free to download, is available in iOS and Android format for Tablet and Smartphones and supports both Demo and Live account formats. Like the desktop version Meta Trader mobile app is all about supporting traders. It gives them the tools to analyse the markets and to seamlessly execute trades. MT4 for Android and iOS Apps is supported by 30 technical ‘indicators’ and 24 analytical ‘objects’ such as lines, channels, geometric shapes, as well as Gann and Fibonacci levels. To ensure all this information can be used effectively the screen can be set to Landscape as well as Portrait format.

See our full list of trusted brokers

Social trading

EagleFX does not offer social trading. Being a new company it is possible this is on their ‘to do’ list but it is not available at present. The provision of a Meta Trader account means users are provided with access to resources from that community. Although this is not a specific EagleFX community, Eagle users accessing the Meta Trader community will actually benefit from being part of a larger group. MT4 is, after all, the most popular retail broking platform in the world so the thoughts shared among its many users are a considerable resource to draw on.

Copy trading

EagleFX does not currently offer copy trading. Being a new company it is possible this is on their ‘to do’ list but for current users, it is not an option.

Crypto Currency

EagleFX users have access to 31 crypto markets. That is a considerable amount, particularly as the number offered by some brokers is in single figures.

As well as straightforward markets such as Bitcoin in USD and Ethereum in USD the crypto markets offered by EagleFX include Bitcoin Altcoin pairs such as ETHBTC.

Charting and tools

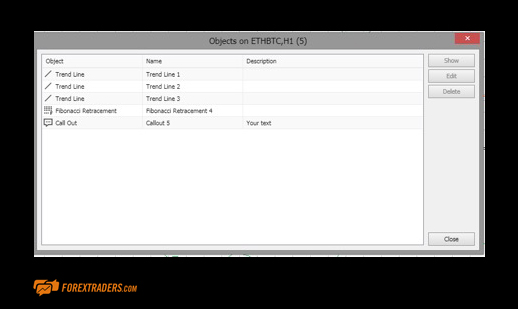

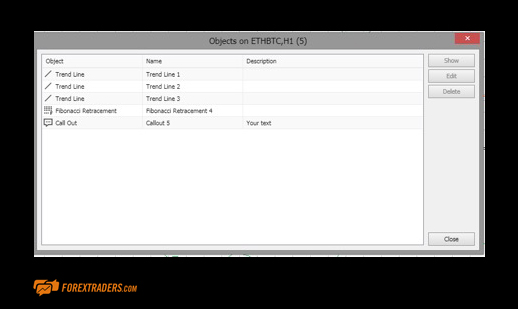

The powerful analytical software is a joy to use. Each symbol can be displayed in 9 timeframes, allowing traders to view the price dynamics in detail and as they choose. There are 30 technical indicators and 24 graphic objects included which means that users can take advantage of an extensive and comprehensive analysis of price movement.

The appearance and properties of each chart can be set up on an individual basis. The platform has the functionality to allow all the following items on a chart to be individually colour-coded: background, foreground, grid, bar up, bar down, bull candle, bear candle, line graph, volumes, ask lines and stop levels.

The popularity of the service and the multitude of awards it has won are down to more than it just being readily available.

Any ‘objects’ and/or ‘indicators’ which need to be removed can be easily selected and deleted making it easier for analysts to chop and change their approach without losing the areas of their work they value most.

See our full list of trusted brokers

Education

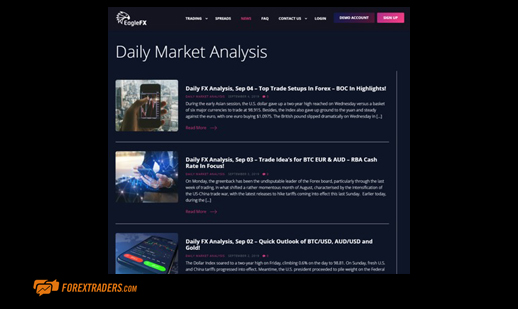

The ‘News’ area of the EagleFX site provides daily news articles which report on recent market events from an analytical viewpoint.

This section represents the site’s research and education offering. EagleFX offers a more hands-on style of learning than some other brokers. Clients won’t find a long list of bespoke research notes or tutorial videos but they will find technical analysis notes relating to specific trading ideas relevant to the market events of the time.

Alternative research and learning tools come as part of the Meta Trader package. The Traders Forum on the MQL5 site includes services relating to Calendar, CodeBase, Articles, Freelance, Market, Signals, VPS and the members’ forum.

Trader protections by territory

As mentioned earlier in this review the company, which is registered in the Dominican Republic, is not regulated or authorized by any financial body. That will obviously be an issue for some and the firm’s customer support team explained the situation as follows:

“We are currently researching which regulatory body we would like to consider for regulation. What we need to be careful of is that we don’t eliminate certain countries or citizens of the world so for that reason we are taking our time. “ There is also no information available on which bank or organization holds account holder funds. There is also no ‘Negative Balance Protection’ which goes against the current trend for more and more brokers offering NBP. The best advice in the market is that traders should apply their own rigorous due diligence policy when considering which broker to use. The testing should cover all areas of the service. Checking any broker’s risk-disclosure policy is always a good starting place for prospective clients. Founded in 2019 EagleFX offer a comprehensive and up to date disclosure page.

EagleFX does include some security features which other brokers don’t. The cold-storage of crypto assets ensures a firewall sits between client assets and the internet. Same day withdrawals which incur no fees means that traders can liquidate their accounts more quickly than with most other brokers. Operational risk is managed through the use of a two factor log in (2FL) available to all account holders and data exchanged between the client terminal and the MT4 servers is encrypted. Additionally, the MT4 platform also supports the use of digital signatures.

See our full list of trusted brokers

How to open an account

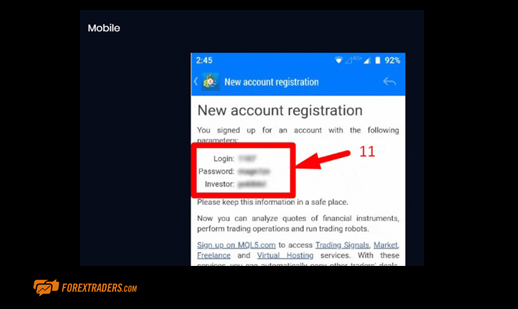

The registration process relating to a demo account is very straightforward and involves little more than providing email details. In terms of helping traders get down to business EagleFX appear to have done its homework and worked out just what helps users get onboard the MT4 platform. The EagleFX site hosts a well laid out section which uses a series of illustrations, step by step instructions and even videos which explain how to access the different versions of the MT4 trading platform. The Meta Trader platform may be the most widely used retail platform in the world, but even experienced traders can find they need to be reminded of the different aspects of the onboarding process. EagleFX’s decision to hand-hold traders through the process is a welcome development.

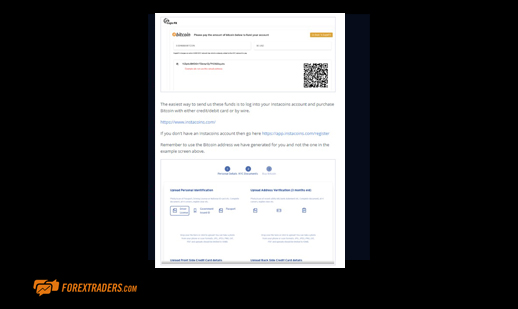

There is one type of Live trading account on offer. It can be funded using USD, EUR, GBP or Bitcoin BITs and transfers can be made using Bitcoin, credit card and wire transfer. These are paid into an account area described as the Vault and from there they are transferred into the Trading Account. EagleFX does not share information on which banks are used to hold client funds.

Leverage rates are set to the preference of the account holder. The minimum rate is 25:1 and the maximum rate 500:1 which would satisfy even the most aggressive trader. As higher leverage rates can mean greater losses as well as greater profits the ability to trade in small sizes is from a risk management perspective a step forward. The minimum amount required to open an account is US$10.

Setting up a live trading account is almost as simple as setting up a Demo account. As EagleFX is unregulated there are none of the Know Your Client documentation requests that are associated with some of the more established and mainstream brokers. Each potential user will have their own interpretation of the pros and cons of this ease of set up and should be factoring in checks of such things when carrying out their due diligence.

The bottom line

EagleFX has carved out a niche by offering its clients certain innovative services. The same day, free of charge withdrawals service removes a feature of the online broking world that has irked traders for some time. Trading and customer services are available 24/7 and during our testing they were found to tick the required boxes. Then there are the trading execution costs where EagleFX proves that tight spreads never go out of fashion. The regulatory situation will be a concern for many and potential clients would be encouraged to look into this in further detail. Then again, potential clients would be recommended to look into the whole service as well because for some it will be an ideal fit.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk